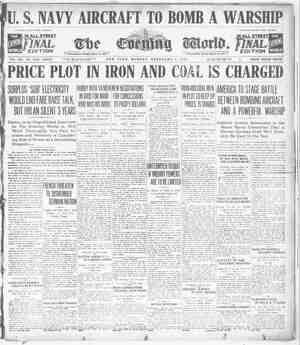

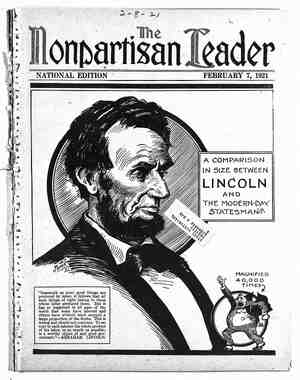

The Nonpartisan Leader Newspaper, February 7, 1921, Page 8

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

e Putting Farming on a Business Basis Producers Lack Advantages Given Other Lines of Business, Says Baruch— The following article is taken from a pamphlet, “Put- ting Farming on a Modern Business Basis,” issued by Mr. Baruch in response to a statement on this subject requested by the Kansas state board of agriculture. Mr. Baruch was a member of the council of national defense and chgirman of the war industries board during the war. BY BERNARD M. BARUCH HE world at large had net given much thought to the farmer and what he was doing for it until the great world war. Then it was learned that the farmer was one of the most vital fac- tors in the success of the war, because the world had to be fed. After the war, the high cost of living becoming acute, soon brought vividly to every one that farm- ing was a matter in which not only the farmer was interested, but that the production and distribution of his products were matters of vital and grave concern to the dweller in the city. The farmer now finds himself in the predicament of having a crop partly cut off from its usual mar- ket, former trade routes limited, and unable to finance himself unless he is willing to sell his prod- ucts at very great sacrifices, in many instances well below the cost of production. > If necessary credit is not extended so that the farmers may market their products according to consumption needs, and secure a reasonable return for their efforts, they will suffer very severely and will restrict their operations. And the consumer, who is vitally concerned in the maintenance of a normal flow of products, will suffer in the end. There are certain things which must be done, it seems to me, before a success can be made of co- operative marketing, which I desire at once to ap- prove wholeheartedly. While I do not presume to be an expert on the subject, I would like to present certain suggestions for consideration whether co- operative marketing is undertaken or not. AMPLE STORAGE WAREHOUSES THE FIRST CONSIDERATION The theory of my recommendations is that, in the marketing of his products, the producer must be placed on 2 footing of equal opportunity with the buyer. . First (and this is the cornerstone of the whole subject matter), I believe that sufficient storage warehouses for cotton, wool and tobacco, or eleva- . tors for grain, must be provided at primary points to carry the peak load in the distribution of the product. These warehouses or elevators should be Must Be Put on Equal Footing preferably under private ownership. - But if private capital is not forthcoming they should be under state ownership. But under any condition, they should be under state’or federal supervision. The question as to who should own or build these elevators and warehouses requires some thought. But that adequate warehouse and elevator facili- ties of the most modern type should be established is beyond question. The very well-being and pros- perity of the different states and all of their citizens depend -upon the proper marketing of their major products. The modern warehouse makes possible the handling of agricultural commodities at reduc- ed costs because of the saving that could be effected in insurance, financing and marketing. It also will play an immensely important part in the develop- ment of a practical plan of co-operative marketing. When the products are delivered to the ware- houses or elevators they should be properly weigh- ed, graded-and certified by licensed weighers or graders. For the lack of a better term I shall call this process a “certification” of the product. This certification should be so hedged about that under- payment, overcharging and unfair grading will be avoided. It will be the basis of sale, or in case the producer does not desire to sell, it should be, and could be, made the basis on which he could borrow money until he is ready or willing to sell. As a rule the farmer’s products move to the mar- ket when there is a great congestion both in the money market and in traffic conditions. This oper- ates to his disadvantage in the sale of them.” Ar- rangements, therefore, should be made so that he can borrow a reasonable amount properly margin- ed upon the products of his farm. This will enable him to sell when the market will take them whether he sells as an individual or through a co-operative movement. Preparations are made each summer for the movement of the crops in the fall. Yet almost every year we runinto difficulties. This year they are accentuated by world conditions and the huge promotion, speculation and hoarding which took place during 1919 and 1920. Bankers, financiers, promoters, speculators and jobbers, with their many facilities and more marketable securities or warehouse receipts, can .always obtain more and cheaper credit than the farmer. If possible a certain percentage of the credit facilities should be set aside for the movement of the crops. In other words, our banking system should be so adjusted that not less than a certain ‘ IMITATION IS THE SINCEREST FLATTERY L wara Progressives everywhere are falling in line with the League plan, John' Baer says. v : . PAGE EIGHT . L gVATORS & REHOUSES il ¢b percentage of the credit facilities are held in re- serve for the movement of crops. In a way, it is al- ready being done. But the farmer, the merchant and the manufacturer each has to bid for his share. Dealers and jobbers usually have little difficulty in securing credit to carry the very crops and prod- ucts which they have bought from the farmer, but the farmer frequently is unable to obtain the credit he needs in order to finance the marketing of his commodities in orderly fashion. In connection with the establishment 4nd opera- ‘tion of the necessary warehouse facilities, institu- tions or corporations could be established for the purpose of making loans on the warehouse receipts. They should be large enough and so officered that they would gain the confidence of the investing public. Their capital stock should be open to public subscription. They could be made co-operative; but they need not necessarily be so. They could ad- vance money to the individual, just as the banks do now for any time from 30 days up to six months or a year. They would not take the place of the present arrangement wherein the merchant, the banks and the federal reserve system finance the marketing of the crop, but would supplement it. PLENTY OF MONEY IF RIGHT MACHINERY IS PROVIDED The finance corporation would deposit in its treas- ury in trust the farmers’ notes maturing at various dates and secured by the warehouse receipts. It would then issue against the notes bearer certifi- cates, as is now done by the large corporations in the issuance of short-time notes, in denominations of $100, $500 and $1,000. There would be no bet- ter short-time investment or collateral than these obligations. The " present process, wherein the farmer gives his note to the local bank, and the bank sends it to the federal reserve bank, amounts to practically the same thing. The only difference is that the secured bearer certificates would be in negotiable form and would attract the private in- vestor. There are large sums of money, even in-the local- ity in which the production of the crop takes place, that would seek investment in small amounts if it were made easy for investors to buy these negoti- able, well-protected instruments. The finance cor- poration, being responsible for the repayment of the loans, would see to it that they are properly pro-. tected at all times. In other words, investments in bearer certificates would be protected by the re- sources of the corporation plus the farmer’s indi- vidual credit, plus the security of the warehouse re- ceipt based upon a proper certification of the amount and grade of, and insurance on, the product covered by it. For instance, a farmer might deliver to a ware- house so many bales of cotton or so many bushels of grain. He could either sell his product on the basis of the warehouse receipt, or he could use it to secure indebtedness to the merchant, who, in turn, could go to the banks as at present; or he could go to the finance corporation and borrow, let us say, at 6 per cent, or 7 per cent, or whatever the rate might be, and thus be able to pay cash for his- sup- plies. The corporation in turn would issue its own bearer certificates carrying a rate of interest wfiir.h would allow a margin sufficient to cover the neces- sary expenses of the corporation and earn enough profit to attract the necessary capital. The cor- poration would sell the bearer certificates in denom- inations of $100, $500 or $1,000 either to private investors or to the banks or financial institutions all over the country. This process, with the cor- ..poration’s capital as a revolving fund, can be con- tinued and repeated to the extent that good busi- ness and financial judgment dictate. As the certifi- cates become due, they would be forwarded back to the corporation, which would meet them. This does not.do away with the present method of finane- ing, but only makes available for the marketing of agricultural commodities a large amount of money - * in the hands of private investors, who know, or would soon know, how safe this form of investment would be. There could be nothing more secure or more-liquid than the bearer certificates based upon carefully guarded advances on farm products. The government, through the department of agri- b i (Continued on page 17) :