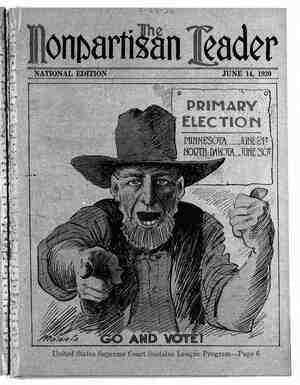

The Nonpartisan Leader Newspaper, June 14, 1920, Page 6

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

¥ ‘, i’ NORTH DAKOTA LAWS UPHE Supreme Court of the United States Approves Entire Industnal Pregram . . ~ of League by Unanimous Dec181on o Washmgton Bureau, Nonpartisan Leader. 1 MORTAL blow was dealt the special -ticians in North Dakota and elsewhere “ who are seeking to destroy the farm- ers’ ‘movement, : declsmn June 1, upheld.dhe constitutionality of the North Dakota' industrial program. The highest court in the nation, speaking through:- - Justice William ' R. Day, who was -Secretary: of state in the cabinet of President McKinley, asserted the right of the people of North Dakota, and their _ legislature and courts, to determine what measures should be taken for their own general welfare. The supreme court of the United States affirmed the' decision of the:supreme. court of North Dakota in: the ‘case of Green and others against’ Governor Frazier and other state ofi"lclals, and-it’ affirmed the decision. of ‘Judge Amidon in the federal district court in the case of Scott and others against ‘Gover- nor Frazier and other state officials. These cases involved the issue as to whether the enemies of the farmers could destroy the state’s ownbank, 1ts grain eleyator and flour mill and: its: . ‘home building enterprise, under pre- tense that as taxpayers they were being “deprived ' of ' property . without 'due process of law’. in violation of the four- teenth amendment to the federal consti- tution, due to the “private” character of the business in which the state has be- gun to engage, and to finance which they claimed they were forced to pay taxes. These sults, brought as the last hope of the anti-farmer plotters in the Min- neapolis Chamber of Commerce to save their private monopoly of the grain- buying and flour-milling industry, have held up the sale of the state bonds which the people ‘of the state authoriz- - ed last June to be sold in order that the first terminal elevator and mill might be built. Now that the supreme-court of the United States has spoken, there - remains no possxble 1égal ‘cloud upon the bonds. Mzy. Justice, Day, in a lengthy opinion - . read-to the court, reviewed in detail the - case of Green et al. vs.-Lynn J. Frazier et al., and the question as to the taxing. power of the state as restricted by the “due process” clause in the fourteenth amendment. “The taxing power of ‘the states,” he then said, “is primarily vested in their legislatures, deriving their' authority from the people.. When a state legisla- ture acts within the scope of its author- ity it is responsible to the people and: - their right to' change the agents to whom they have entrusted the ‘power.is: ’ : ordinarily deemed a sufficient check upon its abuse.. ‘When the constituted authority of the state under- ¢ takes to exert the taxing power, and the question “of the validity ‘of its action is brought before this court, every presumption in its favor is indulged and only eclear and demonstrated usurpation of power will authonze Judlclal interference with leg-: ; islative action. _ THE PEOPLE HAVE gPOKEN, : SAYS SUPREME COURT = “In the present instance, under the authonty of the .constitution and laws prevailing in North Da-- - kota, the people, the legislature, and the highest: court .in the’state have ‘declared the purpose for which ‘these: several acts were passed to be of a * public’ nature and within the taxing authority of 'With this united action of the people, legislature and:court we are not at liberty to inter- the state. fere unless it is clear beyond reasonable controversy that rights secured by the federal Constltutlon have been ‘violated:: . “What is a pubhc purpose’ has ngen rise to no little judicial consideration. Courts, as a rule, have attempted’ no: judicial® definition’ of a- ‘pubh(:ha as’ ut ve. dlstmgmshed from ‘al pnvate’ purpose; _privilege forces and their hireling poli- wken the - United Stayes supreme court, by a unanimous left each case to be determmed by its own pecuha.r ; circumstances., ‘Necessity alone is mot the test by _“'which the limits of the state’s authority in this di-' rection ‘are to be defined, but a nice statesmanship must look beyond the expendltures which are. abso- lutely needful to continue the existence of organized = government, and embrace those which may tend to make that government: subserve the general well- being of society and advance the present and pros-- ‘“pective happiness’ and - prosperity ‘of the people.’ (Cooley, Justice, in People vs. Salem, 20 Mich. 452.) “Questions of policy are not submitted to judicial determ.matlon, and the courts have no general: au- . ‘thority of supervision over the exercise of dxscretmn which under our system is reposed in the people or - other departments of goyernment. “With' the wrsdom of such legislation, and the :soundriess: of the economic policy involved, we are. not concerned. Whether it. will result. in ultlmate : g‘ood or harm 1§ is.not w1thm our rprovxnce to: 1n- : quire. legislation not to amonnt to a taking of property mthout due process of law The questmns mvolved APPROVED BY HIGHEST AUTHORITY " were glven elaborate consxderatlon in that court and it held, concerning what may in general terms ‘be. denommated the ‘banking legislation,’ that it 'was justified for the purpose of providing: ‘banking facilities' and to enable the state to carry out the “ ‘purpose of the other: acts, ‘of which the Mill and . Elevator association: act is the principal one, " It - justified the Mill and Elevator assaciation act by ( the peculiar situation in the state of North Dakota, - and particularly by the great agricultural ‘industry . of that state.” It estimated; from the facts of which. it was authorized to take judicial notice, that 90 -~ per cent of the wealth produced by the state was from agriculture; and stated that upon the pros- perity and welfare of. that industry other business the present system of transportatmn and market- " *ing this great crop prevents the realization of what ‘“are deemed just prices was: ‘elaborately stated. It -was affirmed that the annual loss from these sources ' (including the loss of: “fertility to the soil and failure - to feed:the by-products to stock within the state) i mounted to $55,000,000 to the wheat “raisers of- % orth . providing' Homes for the people, a large proportion « - : “It was believed and affirmed by the supreme court ““We: come now to. examine the grounds upon “which the supreme court of North Dakota held this __process ‘of law. = ,-—-Drawn expressly for the Leader by H. G. _Webster. ~ enterprises as are here involved, with the sanction ity of this court, in’ renforcing the observance of th judicial decision. = - ¢ and pursuits carried on in the state were largely ' two taxpayers” (Green and: others) agamst the in- i dependent; ‘that the state produces 125 ;000,000 - bushels of wheat each'year. The manner in which . ‘that the issuies involved were the same s in the . federal district court was right in dis “of North Dakota have been upheld in their rulings oS thorxty in: xhe United States. e “It answered the contentxon that the mdustnes* R » e ‘involved: were' private ‘in their nature by stating B that all of them belonged to the state of North i ' Dakota, and therefore the asctivities authorized by = i " the legislature: were to be distinguished from busi- e ness of‘a private nature havmg pnvate gam for xts o) object. b P “As to the home bmldmg act, that was sustamed i “because of the promotion of the general welfare in P Yy of whom were tenants moving from place ‘to place, of North Dakota that the opportunity-to secure and - maintain homes would promote the general welfare and ‘that the provisions of the statutes to enable " this feature of the system to become. eflectwe would % g6 redound to the general benefit. 3 P CONSTITUTION OF THE UNITED S 'STATES IS NOT VIOLA’I‘ED AR S “As we have said, the questxon for us to consxder 443 and determine is whether this system of Jegislation « 5 : is' violative of the federal ‘Constitution because it @ e gl amounts to - a: takmg of property without “due;; ; The precise question herein in-- *'volved so far as ‘we have been able to discover has never been presentéd to " this court. The nearest approach to-it . “is found ‘in ‘Jones vs. City of Portland,) 7 = *in ‘which we held that an act of thedf- : state of Maine authorizing cities and towns to establish and maintain wood, - ! coal and fuel yards for the purpose of Y S -selling these necessaries to the inhabit- .~ : ants of cities ‘and towns, did not de- ' 5 ‘prive taxpayers of due process of law e within the meaning .of the fourteenthw 5 e amendment. . In that case we reiterated the attitude of this court toward state: - legislation, and repeated what had been said before, that ‘what was or was not: " public use was a queétion concerning - - " ‘which' local authority, / legislative tand . P - judicial, had especial means of securing information to enable them to forfna = = <.l s . judgment; and particularly;” that the: . . judgment of ‘the hxghest court in ‘the . gl . state, declaring a given use to be pub= i lic in ifs nature, would be accepted by this court, unless: clearly unfounded. = _ “In that case the _previous decisions, = mdw sustaining the proposition, were ¢ited e and: approved, and. a quotation was' made from the opinion of the supreme . court -of Maine justifying the legisla=: - ture under the conditions: prevailing in =~ ‘that state. We think the principle of A that decision is apphcable here. 20 -*“This is not'a case of underts.kmg g N S aid private institutions by public taxa-: e > tion, as was the fact-in ‘Citizens’ Sav- 48 EEL) - ings and Loan. Assocmhon vs. ,Topeka e 20 Wall. 665. . : 2l . “In many mstances,sfiate and mumnx g pahtxes have in late years seen fit to enter pro;ects e to promote the public welfare which in the past- = = - ‘have been conszdered entlrely w:thm the domam of ke 0 private enterprise, ; “Under the pecu’l\ar Conidiions mustmg ; North ey Dakota; which are emphasized in the opinion‘of 'its ¢ hxghest court, if the state sees fit to enter upon such P of its constitution, its 1egxsla.ture and its people, are not prepared to say that it is within the author- fourteenth amendment, fo set asxde such ‘action'by HAffirmed.”? | ; : - 'The opinion of the court in the smt ' dustrial commission ‘was likewise delivered by Mr. ' Justice Day. It was very brief; merely Settmg forth other case, and ‘adding that Judge Amidon of the Thus hoth Judge Am:don and ‘the: supreme court highest judicial au in behalf of the people by th