The Nonpartisan Leader Newspaper, November 24, 1919, Page 9

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

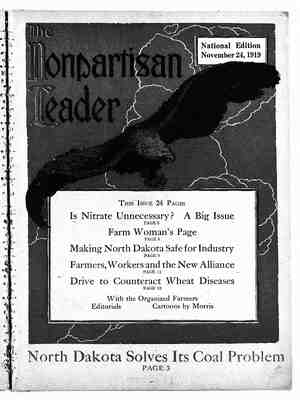

Subscribers enjoy higher page view limit, downloads, and exclusive features.

Makin' - North Dakota Safe for Industry "The Story of the Compensation Bureau and What It Is Doing for the .-, Workers in the Shops and Factories of the State BY E. B. FUSSELL HARLES A. STEARNS, a 17- year-old boy employed by the Northern Produce company at Bismareck, is the first worker of North Dakota to receive bene- fits under the workmen’s com- pensation act passed by the farmers of the North Dakota legislature for the benefit of . the workers of the state. The story of young Stearns shows how the new law will work out, not merely to benefit the work- ers, but their employers and the public as well. Stearns ran a nail into his finger on the Fourth of July. He didn’t think much of it and kept on work- ing. 'Three weeks later blood poisoning set in. Prompt medical attention saved his hand, but Stearns lost 15 days from his work. He got no pay, of course, while he was off, and there was a $15 doctor’s bill against him. Young Stearns earned only $21 a week and was all alone in the world, so the loss of wages, added to the-doc- tor’s bill, might have been a serious proposi- tion.. As it was the workmen’s compensation law allowed Stearns two- thirds pay for the time he was off and the amount of his doctor’s bill. If it had not been for -this law, young Stearns might have hes- itated about going to a doctor, on account of the expense involved. He '‘might easily have lost his hand, his arm or his life if he had,delayed. But he knew the State would take care of him, he got his medical attention and a check for $37.50 for his lost time, and $15 for his doctor’s bill from the state. = That is what happened in the Stearns case under the North Dakota com- pensation law. Suppose the law had not been in existence. The injured youth might have lost his hand. The Northern Produce company might have had a pretty dam- age suit on its hands. If Stearns had won the suit, it might have cost the Northern Produce -com- pany thousands of dol- lars, most of which would have been eaten up in court expenses and law- yers’ fees. As it was it cost the Northern Pro- duce company just 39 cents a week to insure Stearns against the re- sult of any accidents. The 39 cents that the North- ern Produce company paid each week for Stearns, along with amounts that other employers pay for the protection of their workmen, went to make up the $42.50 that went to Stearns and that will go to ' every other injured workman in the state. WORKER KILLED, WIDOW IS AWARDED PENSION Suppose, on the other hand, that Stearns had brought suit against the Northern Produce com- pany and lost it. He might have been unable, as the result of his injuries, to get another job and the taxpayers of the state of North Dakota would have had to dig down in their pockets to support Stearns for the rest of his life. One of the first death claims handled by the com- mission was that of John Werlinger. Werlinger, a man of 62, employed by the Harvey .Milling company of Harvey, N. D., was sent down in the basement of the mill to clean up. He was found later unconscious, struck in the head, by a clutch on the mill machinery and died from the wound. Werlinger left a widow. Under the North Dakota law Mrs. Werlinger will get, as long as she lives and remains unmarried; $8.40 a week, 35 per cent of the $4 a day that her husband earned during his lifetime. The state of North Dakota also will pay $100 for funeral expenses and medical and hospital fees. The $8.40 a week is not much, but it is just $8.40 more than Mrs. Werlinger would have gotten without the law, and in paying this amount to the widow, as long as she lives, the state of North Dakota is more liberal than any other state in the Union, all others ending widows’ pensions aftdr a designated period of time, without regard to wheth- er the widow ‘can then support herself or mnot. The only possibility of Mrs. Werlinger having re- ceived any aid without the compensation law would have been a long, drawn out lawsuit, which might Above—The office force of the workmen’s compensation bureau at Bismarck, N. D. Commissioner 8. S. McDonald is at the extreme left and Commissioner L. J. Wehe at the extreme right. Be- . low—Some of the North Dakota workers protected under the new law. not have been settled until after she was dead. But the North Dakota law, unlike the law in many other states, provides that the state shall pay claims without any interference by court or law- yers. More than half of the states of the Union have what are called workmen’s compensatlon laws, but under nearly all of them casualty insurance com- panies are allowéd to do business. Under this plan the employer pays the casualty company a stated amount to protect the employer against any claims from injured workmen: The casualty companies naturally keep large staffs of solicitors on the road to get business and have heavy expenses. .They also maintain expensive - legal departments and fight claims in the courts, whenever there seems to be a chance to escape payment, instead of pay- ing them. The casualty companies, remember, guarantee to protect employers against claims, not necessarily to pay them. PAGE NINE S e e e e Sl PTGl ‘Federation of Labor. The state of North Dakota, on the other hand, has wisely adopted another plan. The state acts instead of the casualty insurance company, and guarantees to protect the employer from damage suits by PAYING all just claims, instead of FIGHT- ING them. It not only insures just treatment to the injured worker, but it actually saves money to the employer. The money contributed by the employer goes direct to the injured workman, instead of be- ing spent for soliciting business, maintaining a dozen expensive offices and fighting claims in the courts, and therefore it is not necessary to require the employer to pay so much. STATE INSURANCE CUTS RISK RATES IN HALF To show the difference between state insurance and private casualty insurance, it is necessary only to cite the actual experience of two states that have tried the two varieties. New York, with pri- vate insurance, and Ohio, ~ the same rates of com- pensation to injured workmen, A statement issued by the Ohio com- mission shows that in the last year Ohio employers paid into the state fund $9,442,000. If they had been insuring with pri- vate companies and pay- ing the rates charged by the private companies in New .York, the Ohio em- ployers would have paid the year, nearly twice as much. Washington is the only other state, besides Ohio and North Dakota, to start off with compulsory sthte insurance. The cost of operation under the Washington law has been the money handled. The expense of operation of private casualty insur- ance companies runs from 35 to 50 per cent. The advantage that the North Dakota law has over the Ohio and Wash- ington laws is that in- stead of handing over to the employers all the savings that are made by state management, North Dakota, through a more liberal law, divides the savings between the in- jured workman and his employer, paying claims on a more liberal basis than any other state. The North Dakota bureau, which is admin- istering the new law, ‘consists of John N. Ha- gan, commissioner of agriculture and labor, a prac- tical farmer; L. J. Wehe, a lawyer of Devils Lake, who has consistently lined up with the organized farmers, and S. S. McDonald, president of the State The commission from the start adopted the policy of employing the best ex- perts available to do the technical work of prepar- ing rate schedules, getting out forms, etc., and was - all ready for business July 1 when the new. law went into effect. The payment of claims was held up for many | ~ weeks, however, by the tactics of Carl Kositzky, Although the law went into traitor state auditor. effect July 1, it was not until the last of October that a decision could be secured compelling Ko- sitzky to obey the law so that claims could be paid. Besides administering the workmen’s compensa- tion law, the compensation bureau administers the women’s minimum wage law and maintains investi- gators to see that other labor laws are obeyed. with state insurance, pay less than 6 per cent of’ out $16,224,000 during - workmen’s compensation |