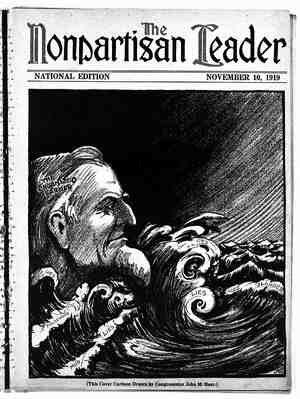

The Nonpartisan Leader Newspaper, November 10, 1919, Page 6

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

‘ , “G VY. TNonpartigsn Teader Official Magazine of the National Nonpartisan Leagne—Every Week Entered as second-class matter September 3, 1915, at the postofice at St. Paul, Minnesota, under the Act of March 3, 1879. OLIVER 8. MORRIS, Editor E. B. Fussell, A. B. Gilbert and C. W. Vonier, Associate Editors. B. 0. Foss, Art Editor. Advertising rates on application. Subscription, one year, in advance, $2.50; six months, $1.50. Please do -not make checks, drafts nor money orders payable to indi- viduals. Address all letters and make all remittances to The Nonpartisan Leader, Box 575, St. Paul, Minn. MEMBER OF AUDIT BUREAU OF CIRCULATIONS THE 8. C. BECKWITH SPECIAL AGENCY, Advertising Representatives, New York, Chicago, St. Louis, Detroit, Kansas City. Quack, fraudulent and irresponsible firms are not knowingly advertised, and we will take it as a favor if any readers will advise us promptly should they have occasion" to doubt or question the reliability of any firm whick patronizes our advertising columns. o THE SCANDINAVIAN REOPENS LL the charges of the enemies of the Nonpartisan league " concerning the Fargo bank case are now once and for all sufficiently answered. The Scandinavian American has re- opened. The bank which Langer and Hall said was “hopeélessly - insolvent” is stronger than ever. It is doing a bigger business than ever. The mouths of the big business propagandists of the country, who said the bank-wrecking attempt “forever discredited the League” and showed that the farmers’ movement had “col- lapsed,” are stopped. The editors of the kept press, who solemnly announced the League ‘“had blown up,” and added “I told you so,” have again got themselves in a silly and uncomfortable position. The day the bank opened it received an additional $45,000 in deposits, showing the faith of the people of North Dakota has increased instead of diminished as a result of the unsuccessful plot of the bank wreckers. \ > The reopening of the bank followed immediately a decision of the supreme court which ought to be read in detail by every = B e P NN PSS reader of the Leader. The court held that the action of the banking board, of which Langer and Hall constitute a majority, was “unwarranted and illegal and neither within the spirit nor letter of the legal power conferred upon such board.” This is strong language. The court finds the bank solvent and further characterizes its closing as follows: There is no other manner in which this procedure can be char- acterized than arbitrary and contrary to both the spirit and letter of the law. It both merits and receives the condemnation of this court. You didn’t see this final determination of the case played up in your newspaper, did you? You didn’t find columns of editorials written about it, did you? . But another feature of the court decision ‘is probably even - more important. It will be remembered that, after they had il- legally closed the Scandinavian American bank, Langer and Hall issued a decree ordering all banks in North Dakota to cease han- dling post-dated checks of farmers issued to pay League dues. The supreme court permanently enjoins the carrying ouf of that edict, which it brands as “illegal and unwarranted,” The court holds that post-dated checks are NEGOTIABLE INSTRUMENTS SIMILAR .TO BILLS OF EXCHANGE AT A FUTURE DATE, - AND MAY BE USED AS COLLATERAL PAPER THE SAME AS ANY OTHER NEGOTIABLE INSTRUMENTS. Thus ends the spectacular and ruthless attempt to prevent the farmers’ organization from being financed. Its failure has strength- ened the movement in all states. FALSE IMPRESSIONS : farmers’ government had to find some excuse or explanation for the fact that eastern financial houses have agreed to buy $3,000,000 worth of North Dakota state bonds. Otherwise it might look like the stories they have been spreading about the bankruptey PROPAGANDISTS hired to misrepresent the North Dakota ' of the state, and the general unstable conditions “due to a mad rugh in bolshevism,” are falge.- =~~~ —. = The first propaganda story to offset the effect throats of North Dakota farmers—and so Chicago bank % ,bidii ' Y?u ‘have their own word as to the reason in the 7 % Y, ty, the bonds was that they weren’t sold at all—that “only an option had been taken to buy them, subject to their being found legal and constitutional by the attorneys of the bond houses.” The facts are that no bonds are ever sold anywhere except with this proviso. Investment brokers who deal in public securities never agree to buy state bonds or city bonds without specifying that the deal is subject to the legality of the bond issue as ascertained by lawyers employed by the buyers. The next fake the propagandists spread was that, before the eastern investors agreed to take the bonds, the state agreed to keep on deposit with them public money to the full amount of the bond issue—$3,000,000—on which the bond houses would pay the state- WRITE A STORY". ING TO - SCARE TH ™ RUYBLIC e s Ut mummnmmunum¢®'th«%§' =< 2 per cent interest. This was to be “protection” for the bond buy- ers. This story appeared under a New York dateline. The Daily . Missoulian of Missoula, Mont., a copper trust organ, was one of the papers printing the fake, and it has doubtless made its appearance in the press throughout the country by now. According to the story, the people of the state, on account of the deal, are out $90,000 a year, the difference between the interest on the bonds, which the state must pay, and the interest on the public moneys deposited, which the state will receive. The fake yarn does not explain how North Dakota would be foolish enough to borrow $3,000,000 at 5 per cent and turn around and lend the whole amount to the same persons at.2 per cent. - Under such a deal the state would have no more ready money than it would have had if the deal had not been made. So why sell the bonds at all?' This objection to the reasonableness of the yarn has been made by several of our readers who saw the article and sent it to us. Our readers seem to have become adepts at detect- _ing newspaper fakes. The Bank of North Dakota has agreed, as a matter of fact, merely to deposit $500,000 for 90 days with the bond houses, the ‘deposit to be made out of the money received for the bonds. The deposit draws 2 per cent interest and can be entirely withdrawn on two days’ notice.: In the meantime the state can check against it. The Bank of North Dakota has large amounts, running into. - hundreds of thousands of dollars, deposited in many financial cen- ters of the country. Such deposits are customary and necessary for reserve banks in transacting their business. On such slender foun- dations are built the fake yarns of the press. THE REASON GIVEN OU do not have to take the word of the Leader as to why the farmer government in North Dakota is finding it difficult to dispose of the state bonds issued to carry out the farmers’ program. The following item appeared in the October 18 issue - of the Chicago Banker, a financial publication, reporting the sale of $3,000,000 of. the $17,000,000 in state bonds authorized by the legislature: s " William R. Compton & Co. and Halsey, Stuart & Co. have par- tially underwritten $17,000,000 of the North Dakota bonds. The bonds are to be used only as the Nonpartisan plans de- velop, for building of. grain elevators, mills, banks, starting news- papers, etec. : 4 “The internal political strife in the state probably accounts for the opposition to the bonds. : : Chicago banks are said to have turned down the offer because they did not wish to offend the Twin Cities institutions with opposing interests. : Ry Note carefully the last paragraph, which explains why -there were not more bidders for the securities. The Twin Cities insti- tutions referred to are, of course, the grain and milling combine and allied banks and newspapers. Naturally they are opposed to the state of North Dakota attempting to break their clutch on the