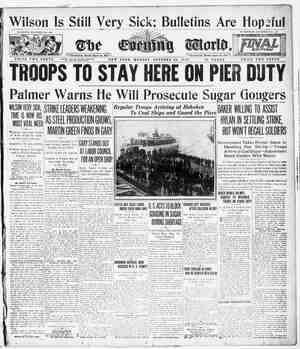

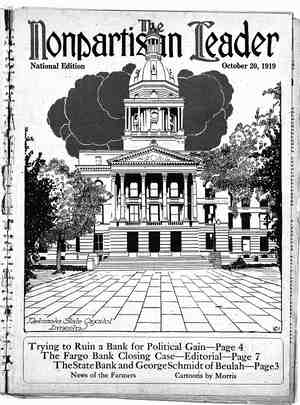

The Nonpartisan Leader Newspaper, October 20, 1919, Page 4

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

1. opo. M sscrmesradrs e 3 3 /venting their being financed by banks Would Ruin Bank for Political Gain - The Truth About the Closing of the Scandinavian-American Bank at Fargo— ~ Financial Wreck of League and State Aimed At HE great news agencies have flooded the country with the re- port that the Scandinavian- American bank at Fargo, N. D., has been closed by the state banking board; that this bank is a “Nonpartisan league bank”; that the closing was due to excessive and illegal loans to the League, to one of the League’s publication companies and to some business enterprises in which North Dakota League farmers are interested; that the bank has hundreds of thousands of dol- lars’ worth of valueless paper. Beyond a few lines of interview with the bank’s officials and persons connected with the League, buried and “played down” and mostly altered and garbled to make the bank’s officers and League of- ficials appear to be crooks and asses, nothing has appeared in the newspapers giving the other side of the question or to give the public a true under- standing of this most important event. Once again the American press has become a sewer for big interest propaganda instead of a channel of news. Once again a people’s movement has been libeled and misrepresented because news in Amer- ica is a mom;poly and controlled by the “big - fellows.” Briefly the true facts are: The Scandinavian-American bank is a farmers’ institution, doing one of the largest and most prof- itable businésses in North Dakota, chiefly with farmers and farmers’ organizations and business enterprises. The state banking board consists of three men, Attorney General William Langer, Secretary of State Hall and Governor Frazier. Langer and Hall, the majority, are two of the three League state officials who turned traitor to the movement nearly a year ago. They stumped the state in op- position to the farmer legislature’s acts carrying out the League program during the recent refer- endum campaign. Actuated with the peculiar venom of the apostate, they, attempted a few . months ago to put out of business the Consumers United Stores company, an enterprise in which League farmers in the state are heavily interested, and they tried to do it through their control of the state banking board. They failed. Hall has made open attacks on and threats against farmers’ busi- - ness enterprises, including the farmers’ Equity co- operative packing plant at Fargo. He refused to sign the capital stock bonds for the Bank of North Dakota, which was created by the farmers’ legis- lature, and had to be forced to sign by mandamus proceedings in the supreme court. ACTION PURELY POLITICAL ATTACK ON LEAGUERS As a result of the latest plot of these League turncoats and anti-League politicians, they - have closed the Fargo farmers’ bank and have had a temporary recciver appointed. It is purely' a political attack on farmers’ organi- - zations. The facts are amazing. The bank is charged with making loans on worthless security. This so- called “worthless security,” ‘millions of dollars of which has been handled without question by scores of banks during the last four years without a cent’s loss, consists of notes of pros- perous farmers issued to buy stock in farmers’ banks, stores or news- papers, and of post-dated checks is- sued to pay dues in the Nonpartisan league. If this security is worthless, it is impossible to organize or finance farmers’ organizations or business enterprises. Hall and Langer know that. This attempt to wreck the ° farmers’ bank at Fargo is therefore an attempt to put all farmers’ or- ganizations and co-operative business enterprises out of business, by pre- on the only seeurity it is possible for them to get. = That this is the purpose is shown plainly by the action of Langer and Hall immediately after closing the bank. They decreed that no North Dakota bank in future could make loans on post-dated farmers’ checks issued <or League dues. It is true that this is not big business paper, but it is probably as gilt-edge as any commercial se- curity in the country handled by banks. Dozens of farmers’ banks in North Dakota and scores of old-line banks in many states handle it and have for four years without losing a penny on it. - Ever since the Scandinavian-American bank en- tered the field as a farmers’ institution and grew big and prosperous on business with garmers'and farmers’ organizations and business enterprises, it has been marked for destruction by big business and its money trust, which have now found ready tools in Langer and Hall. * BIG BUSINESS BANKS OF FARGO GIVEN WARNING Fargo big business banks got advance notice of ° Langer and Hall’s impending action ‘and made heavy cash demands on the farmers’ bank the day before the closing. Even with this drain, which the bank had met promptly, the bank’s reserve at the hour of closing was in excess of that required by law. It was meeting all obligations and doing an immense and profitable business.- To put over the conspiracy, Langer and Hall sent ~ State Bank Examiner Lofthus to Florida on a wild-goose chase and, under the pretext of examin- ing another bank at Fargo, got the banking depart- ment to issue a letter giving the attorney general . power to look into ALL Fargo banking institutions. This authority was used merely to make a hasty examination of the farmers’ bank. A report was hurriedly got up by the attorney general, alleging farmers’ checks, notes and other paper are worth- less, and this report was suddenly presented to the banking board. . Governor Frazier, third member of the board, demanded that the state banking de- partment be heard from before action was tak- en. He requested time for discussion and sug- gested the summoning of the state bank guar- antee commission. He said haste and the rail- roading of the resolution to close the bank without discussion or proper investigation would plainly show the political nature of the move, and prove that the purpose was to wreck a farmers’ institution regardless of its condition or the facts. Langer and Hall gverrode the governor and forc- ed an instant vote on the question. The governor, of course, voted “no.” The directors of the farmers’ bank have taken the matter to the courts. Every ounce of strength of the many farmer banks and business enterprises of North Dakota will be devoted to fighting Langer and Hall and the powerful interests they serve to a finish on this matter. It means a big fight. That ~ the farmers will win, as they did in the attempt of -a former attorney general of North Dakota at the behest of the Chamber of Commerce of Minneapo- lis, to wreck the Equity Co-Operative exchange, seems a foregone conclusion. The very existence of all farmer organizations and co-operative busi- . A STATEMENT BY GOVERNOR FRAZIER “It is my opinion that the attorney general and the sec- retary of state overstepped the bounds of their authority and have violated all rules of common justice by their action in closing the Scandinavian-American bank at Fargo. “I am confident, from the facts which have been disclosed, that the Scandinavian-American bank is not insolvent, and that it can take care of all its obligations, and judging from the actions of the attorney general and the secretary of state, it would seem they are making a'determined effort to wreck and destroy all farmer organizations and all banking institu- tions friendly to farmers’ organizations. “l wish to assure the depositors of the Scand American bank, as well as all 'other state banks of North Da- kota, that there is no cause for alarm, as the state guaranty fund act protects them against. loss, and I will do everything in my power to see that justice is done, and to see that the credit of our state is not needlessly or unnecessarily em- barrassed. : i “I am heartily opposed to these high-handed methods and will do my best to put a stop to them.” inavian- ness enterprises in North Dakota and perhaps in other states is at stake. The Nonpartisan league has no interest in the Scandinavian-American bank, except as one of many farmer institutions which have done business with it and have borrowed money of it, although the press has carried-the impression it is a bank owned and operated by the League. The whole business is intended to discredit the League, to make its financing impossible by declaring farmer paper worthless and to wreck all farmer organiza- tions and enterprises in North Dakota. Under a law passed by the farmers’ legislature, all deposits in North Dakota banks are guaranteed by the state, but the bank’s officers, who claim the institution is perfectly solvent, say they will not have to avail themselves of the stateguarantee to protect depositors. They say they have confidence that the courts will not permit the success of this amazing and sinister attack on the farmers and that the bank will be reopened in due time, having gained strength by coming successfully through the ordeal. g 3 The facts are understood in. North Dakota and nobody, not even the League opposition there, pre- tends that the closing of the bank is anything but a political move. Nevertheless a desperate effort is being made in other states to show that the ac- tion of Langer and Hall is the patriotic act of of- ficials who desire to protect the public against wild-cat banking. ' Governor Frazier has expressed the opinion that Langer and Hall had overstepped their legal au- thority and had violated all rules of common justice in closing the bank. His statement was based upon chapter 53 of the session laws of 1915, amending section 5189 of the compiled laws of North Dakota relating to insolvency of banks and the liquidation of the same by the state examiner. It says: LANGER IGNORED -LAW IN CLOSING BANK “A bank shall be deemed insolvent, first, when the actual cash market value of its as- sets is insufficient to pay its liabilities; second, when it is unable to meet the demands of its creditors in the usual and customary manner; third, when it shall fail to comply with any * lawful order of the state banking board within any time specified therein; but its property shall not be subject to attachment or levy, nor shall a receiver be appointed during such rea- sonable time as the state examiner shall re- quire for examination. After such examina- ' tion, if the state examiner shall deem best, he shall, with the approval of the state banking board, ‘appoint a receiver, who shall take pos- session, under the direction of the state exam- iner, of books, records and other property.” Attorney General Langer, through his. personally conducted banking board, failed to consult with the state examiner, or comply with the provision giv- ing the bank a reasonab}e time before the appoint- ment of a receiver, as required by the state laws. Another of the startling features of Langer’s and Hall’s political play was the ar- rest of H. J. Hagen, president of the bank, and P. R. Sherman, cashier, on thg complaint of Langer’s own re- ceiver. . o '“I am in the dark as to why this charge was brought,” said Mr. Hagen. “I know of no action of mine in con- nection with the affairs of the Scan- dinavian-American bank or any other of the banks with which I am connect- ed on which criminal charges could . - be possibly based. I have been in the banking business for 27 years in North Dakota and I have weathered several banks through ' several panics, but during all that time all my banks have paid interest and dividends. “The Scandinavian-American bank has made unprecedented record for: growth, especially the past year, until it is now the second largest bank in the city of Fargo. . Since the bank affiliated with the farmers’ movement in this state, it has been the subject of all manner of attacks from inter- ests inimical to the farmers; but in (Continued on page 13) B7LT /.