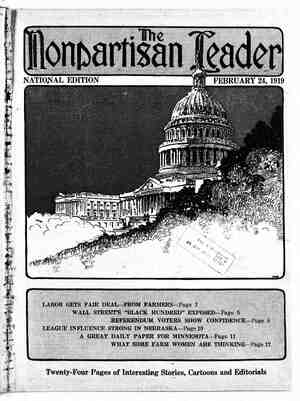

The Nonpartisan Leader Newspaper, February 24, 1919, Page 13

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

City Bank of St. Paul A Great Success Publicly Owned and Managed Institution in' Favor With Small »Depositors— : Saved the City From Clutches of Money Trust | BY WALTER THOMAS MILLS HE business of a bank is to find those who have more money than they wish to use and those who need to use more money than they have and then to gather in one place the money of those who have too much and loan it to those who have too little. Those who have too much money and are not in touch with the regular and responsible borrowers are obliged to employ and to pay the banks for finding the borrowers. That is what one does when he becomes a depositor and not a borrower at a bank. The usual borrower has no means of find- ing those who have more money than they can use, and hence the borrowers are obliged to employ and to pay the banks for finding the depositors whose money the bank loans. The banks pay themselves for the services of gathering the small sums of the many depositors and for making them available for loans to the smaller number of borrowers by charging the borrowers higher rates of interest than the banks themselves pay t6 the depositors. North Dakota has been marketing its state bonds at 4!; per cent, but the average intcrest rate paid on $309,000,000 of outstanding farm mortgages in that X state amounts to a little more than 9 per cent. Since the Federal Farm Loan bank of St. Paul, as stated by its presi- dent, is making $500 a day lending money to farmers at one- half of 1 per cent ad- vance on what it pays on its bonds, it would seem that the North Dakota farm- ers are losing about The fact that the farmers of North Dakota are planning a great state bank _to serve the people rather than the * money trust will make the story of the city bank of St. Paul, Minn., of par-. ticular interest to Leader readers. For five years this bank has gathered in the deposits of the people and uczed them for financing the city and making other investments. It now has nearly. $3,000,000 on deposit. This bank shows that the common people will "patronize a publicly owned bank here as in other countries where state-owned banks have been a great success. The cutting down of the wide margin between in- terest paid to depositors and interest charged to borrowers™is a big, abso- lutely necessary step in reconstruction. private banks. It pledged in security for small deposits the city’s bonds or other forms of evi- dence of the city’s indebtedness and accepted e 'LOOK OUT!! | deposits in small sums secured by these public sccurities. It offered to pay 4 per cent on all such deposits and immediately the city was given more funds by these depositors than it needed for its own purposes and since then the city itself has becn a buyer of other securities. Unable to deal with the banks, the city reach:d over and beyond the banks and dealt directly wish the depositors with the result that the real moncy lenders 'got better interest than the banks paid them with better security than the banks coud offer and at the same time rendered an important and patriotic service in helping to deliver the city from the grasp of its money monopoly. A RUN THAT RAN THE OTHER WAY A campaign of misrepresentation was unde:- taken by the banks, A grand jury on which there were two bankers made a report which was entirely without any just excuse or any legal authority. The report was published and every St. Paul paper with a'single exception raised a “hue and cry” over the falsely pretended dangers of this municipal undertaking.: A run on the city bank was the result, but . before the run was over it turned into a run on other banks, with their own deposits being e transferred to the city bank until the run was called off by the same private in- terests that started it with the result that after all with- drawals had been re- placed there was nearly $1,000,000 added to the deposits of the city bank. More than 100 frater nal societies, trade unions and other such organiza- Eag i . tions now carry their e banks and ‘mortgage The.re-are mdxv1dua1.de- companies instead of posits from all portions ,% with the. nationally of the United States. i owned farmers’ bank. Each day the St. Paul. 45 = Daily News, which de- % ST. PAUL SHOWS fended the bank, carries ) THE WAY OUT a standing notice on its B 2 first page of the total of 3 Five years ago the all deposits for the day, Y ?ank:edotfé St. i’;ul :t- of all withdrawals for " | emp raise the rates the day and the sum re- 4 of interest charged by maining in the bank’s 1 them to the_city of St. possession. On December R Paul for loans on tax 23, 1918, it stated.that S levri"ficel;:tlficgtes.' Thes.e the - new deposits made- R certificates ' were evi- dences of indebtedness issued by the city and sold to the banks for se- curing funds for wuse while the city was: wait- ing to realize on tax col- lections. This effort of the banks to raise the interest rates charged to the city on these certificates was simply an- effort to put into the private pockets of the bankers a larger share of the money paid for public purposes in taxes by the people of St. Paul and that in excess of any reasonable pay- ment- for any services actually rendered by the banks. : were $10,760, the total of all withdrawals $230 and the total of all sums re- maining on deposit $2,- . 850,920. The city bank carries no checking accounts. It grants no small personal- loans. It redeposits in a private bank its cash on hand. Nevertheless, it ~has demonstrated that a / publicly owned bank can reach the depositors to the great advantage of the small depositors, to- the great profit of the city and with good re- sults as related to the general welfare. There is no reason why the other fea- - : 3 tures of a modern The flnancx.al depart- o 2 bank should not be ment of the city govern- e added and a “public ment refused to submit —Drawn expressly for the Leader by W. ¢ Morris- road” be provided to this extortion. It opened at the city hall what it call- ed the city bank of St. Payl and made its appeal directly to war economic kerosene.” QOur great reconstruction peril lies in the fact that those who control our business and industry appar- ently haven’t learned anything. Their spokesmen, to be sure, rant a great deal about reconstruction” "and the new age, but their remedies for our problems are all, as Cartoonist Morris here shows, “Pre- New solutions are needed along the line of that suggested by the experience of the city bank of St. Paul and by the farmer program being enacted in North Dakota. have spent vast sums for .war; our resources are diminishing; our population is grow- along which lenders and borrowers can come together with- out paying the enor- mous and needless tolls now paid to the We the depositors in the ing, We must weed out the miserable inefficiencies of the pre-war period: banking monopely. “PAGE - THIRTEEN LS T LN T P S S P A A A 3 A e 3 P T N 1 505 A S GE A G it MR T R N