The Nonpartisan Leader Newspaper, December 9, 1918, Page 9

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

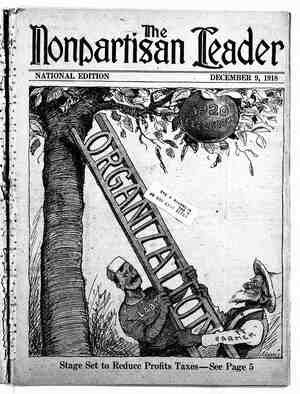

Tax Wealth to Relieve War Burdens Levies on Incomes, Excess Profits and Inheritances, With Government Ownership of Transportation and Basic Resources, Would Meet Serious Problems »JUR reliance on bond issuing to finance our war effort has added much to the ‘very serious prob- lems the American people must face in the near future. To the natural necessary burden of the war which was unavoidable, has been added a vast mass of secur- ‘ities, public and private, issued: because of our, financ1a1 mistakes, which the people must now pay interest on. These securities are now on the market. They have been taken up by banks, insurance companies and private mvestors, and failure to make good on them will mean panic and widespread -distress if not more serious trouble. There is one way out, and that is to begin to do vigorously what we failed to do when we en- tered the war. Heavy and heavier taxes.must be laid on excess profits, incomes (especially unearned incomes) and inheritances. So far as possible taxes must be taken off of direct mdependent production and the things labor must consume. Monopolies must be taken over by the federal or state govern- ments. The most effi- cient marketing methods must be worked out re- gardless of any special interest. With such methods we ean not only save America from the strenuous readjustments many parts of Europe are now .going through but prepare it for per- - manent prosperity of the working classes. With- out these strenuous measures now we may put off the day of reckon- ing until it is too late. Prior to the outbreak of the European war the American . peoplé = were groaning under the heavy - payments that had to be made on watered stock and other forms of monopoly exaction. Stocks .and. bends had been issued much in ad- vance of what the busi- | ness conditions justified; we were very near to the point where returns on'a . great deal ofsthis paper property- could mot. be paid, a point which marks the beginning of a panic. Then the. war came along with artificial stimulation, - and paper " profits and property. be- gan to pile up. Our entry into the war gave still greater stimulation. "So soon as the big profits began to show up, the blg corporations be- gan to issue paper stocks and bonds absorb these earnmgs hem Steel corporation made 70 per: cent in 1916, it increased its stock so that this income would be only 8 to 10+per cent. If in the next year, 1917, it t%ade 50 per cent or more on the real investment us the ‘watered stock, it went to the watering trough ‘again. Another type of expansmn is 1llustrated by the . monopohzers of natural resources, such as coal, iron, copper and ¢il. The great demand for raw- materials which labor and capital could convert into . war materials was immediately capitalized into what amounts to fictitious values: for these mines, forests and oil wells. Stocks and bonds have been msued to eover these new valnes. If a certain firm like the Bethle- - under this vast mass of really false capital claims which our capitalists will demand payment on be- fore labor gets its share. If we are going to do nothing, the share of labor on the farm and in the factory will have to be very slim. REDUCTION IN PAPER PROPERTY NECESSARY ‘On the other hand, the vigorous program outlined above, which the Nonpartisan league farmers have demanded and which progressives everywhere have been asking for since the war started, provides a way for quickly retiring our 15 billions of Liberty bonds, and for squeezing out the water from the great mass of private securities, which water prob- ably amounts to at least five times as much as the Liberty bonds. At the same time our natural re- sources will be opened up to labor much more ef- fectively than is possible now, and the goods which we need for livelihood can be produced. We simply must reverse the process of allowing the ‘special interests to prey on the wealth produc- " tion of the people with their paper property AT THE BOTTOM OF A COPPER MINE Here we see labor employed in getting out an essentlal hatural resource. Between the laborer and the’ mine, however, are the stocks and bonds, now greatly watered because of war conditions, on which in- ' comes must be paid or the mine will be closed and labor can not work. But if we make good on all the watered stock consumers must be overcharged and labor must be underpaid. Obviously we must find a better and moré secure way of -bringing labor and natural resources together. schemes and of placing the tax burden on the com- mon people or we shall know by our own experi- ence what nation-wide bankruptcy means. We ought _to be able to learn from the experienc of the de- feated central powers the folly of pyramiding stocks and bonds. Two years before the war ended financiers were warning us that Germany had reached the limit of natural credit expansion, but Germany kept on.multiplying private and public . securities on which there was no real chance of .making good. Most if not all of this paper proper- ty in Germany has to be swept aside or the people can not eat, live and work. If the people do not eat and work, produchon can not go on and the securi- ties just as surely fall. That is what national . bankruptcy means. The paper property would have -to be repudiated even if there were no revolution. Our-financiers thoroughly understand this. ’11:07 - 'eould eloquently point to the rocks on which Ger-: . .many was steering. Yet they do not apply the same . mmmgathme. They think the American farm- and cit Brs ¢an d the pace which ,,;..geygetbeyondthlsbybo!d-upmethodswm capitalists win. It is a big gamble on which greed has forced them to stake everything, including the welfare of our whole nation. We can avoid the crash which would follow the : failure to make good on private stocks and bonds by taking the income on them, above a certain amount, after it has been paid to the. individual to relieve taxation on consumption and general busi- ness. As Representative Little of Kansas said re- cently: “No man needs more than $100,000 a year to live on. Let John D. Rockefeller come down and give the government all he has over $100,000 a year.” Mr. Rockefeller’s annual income is hardly less than 100 million a year; so this sum so obtained would relieve a large block of our taxes that fall on the poor. There must be at least 30,000 mil- lionaires in the country now with incomes ranging from nearly as large as Rockefeller's down to $50,000 a year. And these millionaires could re- lieve a very large block of the taxation which must fall on labor and general business and so hinder production. Again by allowing only a moderate return on stock and bonds, we would add another huge sum to the treasury which like that from the first source could help pay for the general government bur- * den and to pay off the war debt. Mr. Rocketellers pri- vate fortune is now esti- mated at about two 'bil- lion dollars. When he~ has passed on to his other reward, there is no reason why nearly all this wealth, which con- stitutes about one-hun- dredth of the total wealth of the nation, should not go to the federal govern- ment with its income producing power of 100 * million a year. Other big fo like Rockefeller’s m g0 through the same mill, One result would be that in a few years the gov- ernment would either hold enough of their stocks and bonds to con- trol the basic resources of the nation or it would have the means to pay off a very large part of bonds issued to take over monopolies of these re- sources under . govern- ment ownership. Every big company, of course, sells some of its stock to - the general public, but- most of the stock and- bonds of the monopoly corporations is' so nar- ~ rowly held that the gov-: emment would come very near to getting all of . them with a generation of stiff inheritance taxes. The government bonds in the taxed private fortune: would be especially easy to handle because all that — :(;l’lld be needed would be to deatroy evidences of ebt. All serious mmded observers must admit that the time is passed for unlimited private incomes and inheritances. Our prosperity does not require such an unhealthy economic condition. Their limitation would not.only save the working people much: of the burden to be thrust upon them otherwise-but would also benefit every person of normal wealth . and would stimulate normal ambition. Unhampered. - by taxation, it would be only a short time before these immense fortunes controlling-our natural re- ‘sources and therefore assured of safety and a big . annual return, would absorb all the now independent and billionaires have to do to reach this stage is t depend on interest compounded annually. Wha tbis,terr!ble condition the sooner - <:_-4‘.v.\_x‘-§:'s.:s‘?n<mmj \" ereag S e TN U R A T R I T P R NV S A