The Nonpartisan Leader Newspaper, April 22, 1918, Page 9

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

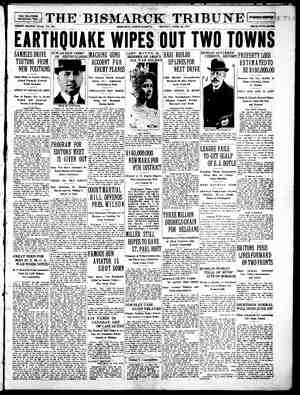

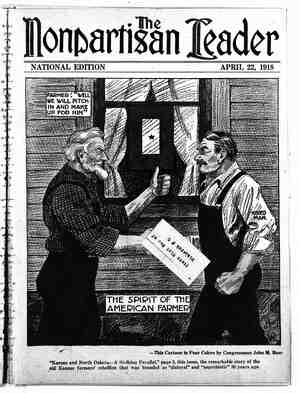

Taking the Gamble Out Farmers of T'wo Canadian Provinces Prove That State Insurance Is System That Will Grow Until It Makes Raising Crops No Longer ~ Wheat is the great crop in Western Canada, and here is a great field of breadstuff bein 7 g put out of the wa, of Hail Storms Economy—A a Speculation —Courtesy of the Canadian Governmenrt¢ y of one of the farmers’ perils; hail no longer will be able to break down the mellow stalks. An enemy of this farmer that he still has to face is the grain gambler. . ‘ BY A. B. GILBERT ‘ . THE program for making farming a business, as set forth by the Nonpartisan league, there is no plank not in successful operation some- where in the world if not in the United States. Just across the Canadian border, two provinces, Saskatchewan and Alberta, have had splendid success with state hail insur- ance. Their latest reports confirm state hail in- surance as a way to dodge the excessive cost of private hail insurance. At the same time it has provided a more equitable method of raising the premiums. Insurance used to be regarded as a gambling * arrangement between the company and the in- sured, whereby the insured had to die, have a fire, or suffer loss by hail to beat the company. But the modern idea of insurance is a common fund into which all subject to a certain kind of loss pay something and out of which these suffering the actual loss can be paid. As soon as the thought that insurance is a common fund is grasped, the foolishness of leaving it in the hands of private profiteers becomes apparent. It is a social service and not the proper subject for private exploitation. Contrary to the impression given by insurance agents, it is one of the simplest forms of financial transactions. This is because once the rate of risk is established from experience in the particular kind of loss covered, there is nothing to it but _ collecting money from a great many and paying out money to a few and investing the surplus funds. Any of the common forms of insurance can, therefore, be easily handled by the state. No kind of business subject to risks beyond the control of the man engaged in that business, should be without insurance to cover those risks. This is a principle accepted by all business men except the farmer. There are sufficient risks arising from individual mistakes to make business very un- certain without exposing it to those risks beyond the business man’s control. 5 LOW COSTS OF OPERATION v ol IN WESTERN CANADA “The cost of administration for 1916,” accord- ing to the Saskatchewan report, “is considerably higher than for any previous year, the relative percentage in proportion to the income being 6.12 per cent, or, to be more explicit, for every $100 of revenue an amount of $6.12 was spent in ad- ministration of the business.” e ai ) No private insur- ° _ance. firm would think of trying to furnish State crop insurance against destruc- tive storms is one of the reforms in which the National Nonpartisan league - believes. Here is an account of the success of the publicly owned and oper- ated system of hail insurance used by - the farmers of Saskatchewan and Al- berta. Through the fact that the en- tire provinces are covered by the poli- cies, the cost is surprisingly low. In fact, it’s so cheap as hardly to be noticeable. O L] < insurance without an’expense, or, as it is called, loading of 25 to 40 per cent, or $25 to $40 out of every $100 taken'in as premiums; yet the Sae- katchewan hail commission thinks it necessary to explain that the 1916 expenses were a little higher than normal because of the widespread hail losses of 1916. The Alberta report speaks as fol- lows on cost of administration: “The $1,741,372.32 includes all moneys raised for the purpose of pay- ing claims and -includes the cost of administration for the four years. It includes, of course, the surplus shown in the present statement of assets and liabilities. This shows the costs of adminis- tration for the four years to have been a little less than 4% per cent of the gross revenue.” NO FEES A NO & ADVERTISING COSTS In other words all but a small fraction of the revenue (6.12 per cent for Saskatchewan and 4.375 per cent for Alberta) is paid out to farmers who have suffered losses from hail. Nothing is spent for soliciting business; the local agents, the gen- eral agents, the high salaries of the central officers, the advertising—all these are 'dispensed with. The expenses of the hail commission of Alberta for 1917, during which year it handled $1,048,606.77, were made up of the following items: .- Inspection of losses........$12,350.48 A Board of commissioners.... 3,664.70 / General expenses:......... 9,019.70 Totali .......0.c.......$25,034.88 The general expenses included $1,040 for office rent, $888.52 for office supplies and printing, $1,372.35 for annual and special meetings, and $2,400 for the services of an expert. s The Saskatchewan report for 1916 gives the .~ PAGE 'NINE O A X following striking comparison between thl of the state hail insurance and that furnisi: the same province by private companies: “A comparison of the report of the work of th commission and the private companies for the past three years shows that for every one dollar col- lected by the companies from the farmers, 87 cents has been returned to them as indemnities for Icsses sustained and 63 cents/ has been absorbed in expenses and profits, while in the case of the commission, for every one dollar collected, 73 cents has been, returned to the farmers as indemnities, 21 cents is held as a reserve fund against future abnormal losses and 6 cents has been absorbed in expenses of the commission and commission to secretaries of municipalities. It is evident by these figures that had the same amount of insurance been carried by private companies that was carried by the commission, the farmers would have paid over. $3,000,000 more than they did pay to the com- . mission for ecarrying such insurance.” LEVY ON LAND SPECULATORS WHO ENJOY BENEFITS But more important than low cost of operation is the fact that state hail insurance is the only way by which this form of insurance can be put on a just basis. Both Saskatchewan and Alberta make a levy on all country land, with few excep- tions, whether it is improved or not. They recog- nize the fundamental fact that anything which makes farming more profitable adds value to land held out of use. It is but the beginning of justice to make this idle land bear part of the cost of hail insurance. Mutual hail insurance could show very low cost of operation, perhaps as low in some cases as that supplied by the state, but the mutual method can not, of course, put part of the burden where it belongs—on land held for. speculative " purposes. The following, taken from the Alberta report shows the method used,in that province: “The flat rate of 5 cents per acre, levied upon '’ all lands withn the district assessable for hail in- - - surance purposes, and the additional rate of 35 cents per acre, levied upon all lands within the district actually under crop, have together yielded sufficient revenue. to pay the cost of administration and the losses of the current year, and to meet ou January 31 last, the note, amounting with in- terest to $137,072.65, being one-half of the amount borrowed to meet the unsettled claims of the years 1915 and 1916.” : i The Saskatchewan method is different in that it ‘levies only a flat rate of 4 cents an acre upon all land and when losses exceed. the amount collected ‘ G A AN R b A T Y LR P A DR T AL G~ b