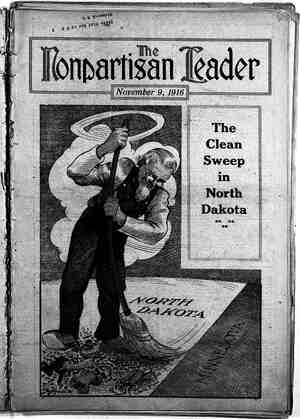

The Nonpartisan Leader Newspaper, November 9, 1916, Page 7

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

NE SMALL county in the west- ern part of the state, on the < Wyoming line; enablesA South Dakota to lay claim to being the fifth state in the union in the production " of preclous metals. - The name of this county is Lawrence and it includes within its. borders practically ‘the 'entire ‘area famous as the Black Hills. Here are located two of the best-known little cities _ - in the world—Lead and Deadwood—and here has been mined, since 1875; approx- imately two hundred million dollars worth of gold and silver.’ Here is located the Homestake mine, the largest— gold mine in the world. The Black Hills started to ‘yield gold and silver at the rate of $2,000,000 a year in 1877, and the annual production increased constantly until it - reached about $7,000,000 in 1900, and since then the mines have produced between $7,000,- 000 and $8,000,000 annually. Last year the gold aml silver outPut was $7,704,000. ’I‘ungsten is now. becommg' an important item in the Black Hills mining industry, $180,486 worth being produced last year, with ‘promise of greatly increasing in the future. Mica, lead, tin, gypsum and coal are minor products of the region ! in their infancy of development. ¢ WEALTH OF BLACK HILLS i 1 NEVER A REAL STATE ASSET 11 { The great natural resources of the Black Hills have never been a real state- wide asset of the people of South Dakota. ~ B o e S e e LB L 55 L S st RISTINEURE (S S A ST B e mensurate with the vast value" ; pnvately ‘owned mineral depo ;7,ooo,ooo and ssooo,ooo a:im;aly : “net pro The great Homestake mine at Lead, South Dakota, whlch produces nearly all state spends more to assist and encourage the mmmg mdnstry than 1t gets Wealth of Black Hllls Adds to Capltahsts Rlches | Butlsa Burden on Farmers of the State dwxdends in Lawrence county | totaled $2,500,000, clear profit of one year dug out ofrth‘e ground. ~ Yet the total tax- paid the. state .on mineral land and all structures on mineral land, such as mllls, in 1915 was only ‘$18, 000, .- 5 In fact the mlnmg industry - in ~South Dakota ‘is~ costmg the tax- - payers of the state, in actual money outlay, almost twice the return to “the state in taxes from mines. Accordmg to an official pubhcatxon of -the state govemment the state main- tains a school of mines at Rapid City whose “chief aim” is “to aid the exploi- tation of the mineral resources of the state.”. Besides turning out mining engineers and experts for the mining companies, this school; according to the official statement. of the state’ govern- ment, ‘“aids‘ the development of “the mineral. resources by investigation of: mining- and metallurgicdl :problems” and “issues bulletins treating of Black Hills economic geology ~and: of mining and . metallurgical - methods” “for the- benefit those: who ‘are exploiting : this natural - In addition, the school, this: - ~publication says,” maintains &" library and laboratory - for the benéfit: of the - development- -of . ining in. the Black" resource. Hills. = The school turned out 10 experts fox:‘the mines in :1915 and the total cost ! < ; : 4 7 of o mehboliaits txneyers. that yoar ‘are conducted by one corporation, the of alll t}fne taxes p:é;l $131101:11e ’state. '1;’11: : ation is - there- ~school of mines co; 000 & year, but- Ho?ucstake. One - corporation is : ere the” rineral mnds Shuvi g of oniy was $30,000.- Yet the state got in taxes froms the mmeral lands only $18 000. TAXPAYERS FOOT BILI]S : TO AID MINING INDUSTRY 3 ~mining industry” than it gets back. i - Pretty soft for the rich owners of the bonanze production last he mmeral output of South Dakota. The Proportion to the v m taxes. s ".fore prachcally the sole:. beneflcmry ‘of i found in low gtade:ote. @ the state’s expendlture 0f-$32,000 a year the entire mdustry South ‘Dakota pays out more to"" develo , —taxes. gold mines, isn’t 1t" ne mine alone produces nearly seven. nullions z? year in ore, yet the total mineral wealth of the state is “valued”—for taxation purposes-— at less than eighteen millions. The total mine year amounted to 42 per cent of the tax “value.” The gross return of all farm crops was only 29 per cent of the tax = “value.” The South Dakota mining “velvet”—dlvndends paid after deducting all labor and borrowed - capital costs—was 15 per cent on the assessed valuation. The farmer had to be satisfied mth 8 per cent above actual money costs and pay his own wages and those of his famlly out of that : el $18,000. Ati-the rate of 10 mining school graduates a: year: turned out last yea»—-th ‘cost s per graduate.” The mmmg sehoo tacnlty consxsts ‘of :15- persons, e tor every graduate. NO ATTEMPT MADE’TO‘ TAX ON SC[ENTIFIC BAS basis. A value is: pu _taxation purposes by the local and thns 1s revxewed by. : commission. land is a guess. aneso - mineral land in the u'onranges. the ‘ore ‘in ‘the ground.: the ore deposits are. asce! “:No attempt is; 'n Dakota by taxing auth anesota. Nor ha.ve the taxing: “authi ) o - ities ever worked out a tonn 7 or tax: on~the value .of ore p which is reaily ‘better 1 ; “of these methods n mdustry, the 1 ines-; are pa; than any other property and their profits: « ~ The gold and’ silver in the Black the “mine inspector. and . school; of -averag -values, i)