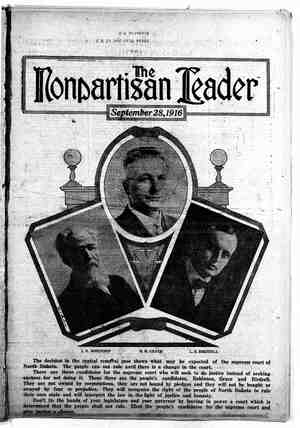

The Nonpartisan Leader Newspaper, September 28, 1916, Page 6

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

. . e 2 ‘ Practice of European Countries and Canadian Provinces i May Become Guide to American States HE incoming administration and Frank 3 80 then such value was fixed and in ar- legislative assembly should care- = : By E‘ Packard riving at increment must be used as the 3 fully consider the question of an Chairman Tax Commissi % inerement tax. While such a it st oo o : FEW MISSTATEMENTS tax would not be productive of any great i ' OF VALUES ARE MADE lamount of revenue, while values are yet M t f : ow and the state is young, the public any great fortunes that are a drain upon Records were made of the assessed ought to see to it that the values created . : z uation of lands i ithi by society are in part, at least, retained | SOCiety have been created through the “unearn- | reiuston of lnds coming within the for public use. : - ed increment” of land site values, due to the | registrar of land titles. Payment of the This tax would be difficult of adminis- A . . tax is made a necessary condition to the tration on agricultural land, but as far | ETOWth of a community. Many men who did | i made 2 necessary con “No tax is oo e e contemed the &iff- | nothing to build up their cities have been made | levied upon the registration of auy land culties are not insurmountable. Pe - = P grant from the crown or upon the trans- i That this tax is receiving carefal con- millionaires through its growth. The new | Spubfrom the <rown or upon the person eration by publicists is indicated by 3 : : his heirs. e Tact that s’ 911 Goagay Sosiier theory in taxation is that the state should keep toTo w0 DO led such a tax on increments and the | for public purposes part of the site value thus ks of th pitelincs g ban ot Bt 1t famous 1909 ‘budget of Lloyd George created, is provided, through amendments to the proposed such a tax in England. The \ 3 lanl:l titles act, that both transf d province of Alberta has'an increment tax ; transf shall take oath w?flr:-m In full force and such & conservative - A : sidera:i?: involved? Morea:ver if fi fi;’gfi o"; ;cg::::ilg: :ts é’:l‘,v::;m:fi: . thereof according to the last preced- lanC would be negligible but the real registrar is not satisfied that the sworn Versity, commends the principles of in- izft vahie dfgr _th;1 lpurpose‘:h of sthx‘s‘. purpose of this provision is doubtless so- ]s;:teme:h a::.l correct, h%e may cause an » excluding in all cases the cost o: cial rather than fiscal. It is evidently independent valuation to made, which crement tax. improvement or development work intended to discourage- the practice of shall be binding for the purposes of the COMMUNITY CREATES e omade ot done upon 9t I puilding up large estates. All lands, ®ct. It is the opinion of the officials that “SITE VALUE” IN CITY connection with the said land. other than farm lands, as above defined, Some misstatements are made in the g : e travelite in altEd 2 What is known as site values in citieg - 30dItion to the allowance for the = that is of e e R e oot Dt are created, not through the effords of . " . el;:bended to farm !;ands with tivation, are subject to the tax. cular moment. “If the value is not ey of the Jooperty, but by e ortain limitations, Pavm land ia:de- * In-onder o have souie base or level Canght.this Hoe, ft will be the-next,” is ::11,“;11:8 “lli'e::ithee‘;’mtz‘m;"ym; %el;e:“g scribed as “undivided land of which at from which the increment could be their attitude. e least ten per cent was under cultivation measured, the provincial parliament de- Reparts are availabls only Sor two soclety. 3 5 A and which was actually in use by the creed that the 'assessed valuation for months or 19%S, but during the iast two The building of street railroads, the in- . o =F for agricultural purposes dur- 1913 should be taken as such base or lev- months of that year the new law netted stallation of telephone, light And: water ing the twelve months preceding the el. That is, when a piece of real prop- $5,446.50 in receipts. The estimates for systems,f paving and all the improve- ion which results in the trans- erty changed hands, if it was sold at an the year 1914 from- this source were tend to create a value which is not a re- yondb(:io ;c.fi?’ “'mt Whioh the trt‘;hs.fi:;r :;n 5 l;’cf s :d ;t::fi wo:lsd I lfl'c;‘:mmt: amoun:lto &:nglsfi7g70th';hisy§sarlalg§; Sult of the enterptiss, foresight or. ef., (0A LISy Siorsate immedistely the Domiuim trens eovided that after explained hy:the fust thet: tha vbniae, ton. iz ooy o Droperty VEIY -the making of the transfer™ i mabject to 1915 any Jand Incorporated within a iy mexts: sdoptad-under the proviion o6 tus often this property is unimproved and the five per cent levy, but only “to the or town should have an arbitrary value act as level or base from which to meas- Pa ::: :gv;:;:":xéyrxgsef flra‘;ghr:;:rré extent of the excess value of the land of fifteen dollars. Owners- were given ure additions in value, were very high, as a result of the expenditures and ef- lt;'ansferred bey‘.’&d t'l;“? sum of fifz.,f’?l‘ fifi; yea;i&nr::llzxc:alt:ea?e::ism;b?stab- ;‘;g the prebs;lnmeg;:mo? mar:al mmmnt: 1 forts of the property owners in that lo- r’;hper afe yasaousimprovemen = a iperer If they failed g‘sy menlue_ roducer. With thg i of cality: ; - e revenue from such a levy on farm ue was unjust. ey o Zonl estalt:e acti vi'ty it i < rel i that - John Jacob Astor early in. the nine- : il ' the tax will become of very much great~ er fiscal significance, “WILD LAND TAX” 4 DISCOURAGES SPECULATOR Late in 1914 the legislature of Alberta passed another act which it seems to me is worthy of careful consideration on the part of North Dakota. It is known as teenth century secured for a nominal gutlay tracts of land in New York City. i This today is the foundation of one of | the most colossal fortunes in the world. i The wealth of the present day Astors comes from the unearned increment of early New York holdings. The Bedfords g in England a century ago leased for n' ninety-nine years a tract of land then adjoining London. At the conclusion of the century the unearned increments of this tract of land, which is now in the heart of the city, makes the Bedfords one of the wealthiest families in the world. ) : Some of the German cities take as i high as thirty per cent of this unearned i increment. Careful allowance is made for the value resulting from improve- ments and upon the transfer of the pro- perty, thirty percent of the increase in price, minus that resulting from improve- LAWYER SAYS FRAZIER OF “RIGHT METTLE” Editor Nonpartisan Leader: The statement made by Hen. Lynn J. Frazier before the plat- form committee of the recent Republican state convention at Bis- marck, namely, that he will run for governor on the platform on which he was nominated for governor, conveys the sound of the right mettle in the next chief executive of our state. . 3 Nothing will sooner do away with individual political bosses for any purpose than will the absolute loyalty of the man elected to his electors. x : All honors to Mr. Frazier for his absolute faithful and fearless stand under the pressure brought upon him by the majority of that committee! A For the benefit of such as think that Mr. Frazier is at the mercy of political bogses for private ends, please insert the above in the Leader. | s g J.F. SKULSTAD, Lawyer. Maddock, N. D. . it rate of one per cent is imposed upon all land in the province which is not specifi- cally exempted. { The most important exemptions ares land for which homestead entry has been made; land held under grazing lease grazing purposes; land within the limits of an incorporated city, town or village; enclosed land used for grazing purposes to at least the minimum degree specified in the law. (che horse or head of cattle ments by the transferor, is taken. The - , or three sheep to each fen acrgs during tax is levied against the transferor and # j : ” 8ix months of thé\preceding year); land is simply confiscation for public use of HOW MUCH SOCIALISM ' further? The péople of this country ©°Wned by a bona fide farmer, actually a part of the site value which was creat- The Grand Forks Herald seems very want to live under the best conditions Tesiding on some portion of the same, to ed by the public. The famous Lloyd much disturbed at the rate socialistic: possible and if socialism is the solution the amount of 640 acres; and the land of George's budget proposed to take twenty ideas .are being taken up by the people- why be so afraid of a name? There is. 30Y owner where one-fourth of its area percent of the unearned increment of the of the state. The Herald might go fur- -no danger that the people of this state, 18 under cultivation. ; large land holdings in England. The ther and be even more seriously alarmed or of the United States, will go to the = The section describing the mode of Alberta law provides for taking only over the rapidity with which the whole length of ~wrecking the government - 38sessment reads as folows: ; five per cent_of the unearned increment. nation is taking socialistic tendencies. merely to try out a theory, but they do i bt e 5 ol “Land shall be assessed at its ac- . Municipal ownership is socialistic, and want to experiment a little, and are rd S iororan PLANGEOR most towns aud cities have something willing to foot the bills f the experiment MAL,ASH s o T be 8 TAXING THE “INCREMENT” - of that nature, even Grapd Forks own- fails— CRYSTAL CALL. - T & dobrect e - The Alberta statute. was pasfed in ing its water plant. 'Light and power : : 3 the value of any buildi erected 1913. By it five per cent of the increas- plants are ‘socialistic, and what city or IT MAKES ’EM SORE thereon or of any other increase in es in land values are appropriated by the. village would hesitate to engage in either me caused by any el:Bendxture of provincial gevernment. The law is so. enterprise if it looked feasible? Street Farmers are begmnmg to do their own - 'abor or capital thereon. i drawn that only in rare instances is the railway ownership is but a short step, thinking; and.if there is_anything to Sucha law would not onlyis rate applied tosother than urban lands. and from that to interurban-and trans- make an old standpatter insanely.riled, it gome revenue, but it would have l:dtm-m Section three, subdivision one, df_ the act continental systems would not be far. is the thought of a real democracy so : dency to f larg, land reads: State owngd elevators, mills and packing well read and educated that, as individ- i o 1;,: > Dmaung af > , ] g j acking especially in western part of the plants would be no more socialistic uals and as a class, the common people state, under cultivati i .~ “There shall be payable upon the . : S ise their Ameri ight to v, ¥nder cu lvation. There 5.8 con- +-registration under the Land Title doctrines. 3 msel elr erican rig vote a8 giderable portion of the desirable land in Act of any trandfer of land a tax of Those that have been tried thus far they please. The. ruling . class' have A the western portion of th vhich i five per cent. on the increased value *have not been disastrous to any one, and always feared the man who- thmks.—\ x JEE Eae wich i of the said land and above the value if successful thus far, why not go a little KENSAL PROGRESS. o 4»[ . 'mains in a wild state. It is generally agreed that the holdi{ng-df land by speculators who do not improve it but wait for . others to make their land valuable is a detriment to any state. Alberta’s ““wild land tax,” i passed in 1914, is a modern remedy for this condition, - the wild land tax. By its provision a ° from. the Dominion and actually used for. being held by speculators and it yet re- -