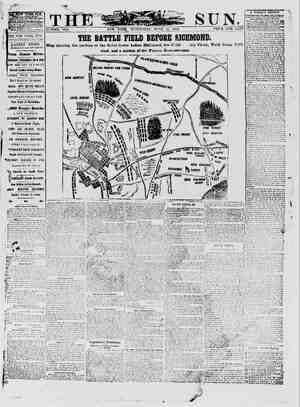

The New York Herald Newspaper, June 25, 1862, Page 3

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

‘wiolating or r: to comply liable to a fine of five Fae | dollars, to ‘be recovered in. manner aid form as ‘provided im this eet. — mani ’ . . Ierchage, r artcis an herelaiter motioned wide out compliance on the part of the party manufacturing the same with ail or any of thé requiremeuts and regu- lations prescrilod in this aot in ve'ation.t assis(ai t,assesgor may, upon sveb inforn ationas he may. yo, ussome and ertimmte the ameung and yalue of suth mauufactures, aud upon sich ass amoant assess the duties, and said duties shall be collected in like manper as iD case the provisions of this act in rela- tion thereto bad beeu complied with, and to such articles ali the foregeirg provisions for liens, Unes, pensities and forfeitures shail im like ma:ner apply. Sep. 13. Amdt be it further enacted, That sil goods, wares and morchandise, or ai ticles manufactured or made by any person or persong not for ste, but for his, her, or their own use or consumption, and all goods. wares and wercbandise, or articles manufactured or mace and seid, except spirituous and malt liquors, and manufactured tobacco, where the annual product shall not exceed the sum of six hundred dollars, shall be and are exempt trom duty: Provided, That this shall not ap- ply to any businces or trensaction where one party fur. Birhes the materials, or avy part thereof, and employs acother party to mauufacture, make, or finish the iy wares and morehandise or articles. paying or promising to pay therefor, and receiving tho goeds, wares and mérchacdise or articles. Sec. 74. And be it further enacted, That the value and quantity of the goocs, wares.and merchandise required Wo bo stated, orcéaid, and subject loam ud valorem duty, shail be estimated by the acti al sales made by the manufacturer, or by bis, hor or their agent, or person or persons acting in hi, her or thew bebalf; and. where such goods, wares and merchandise have been Temoyed for cinsumpticn, or for delivery tw others, or placed on shipboard, or are no longer within the custody and con. trol of the macuiacturer or manufacturers, or his or their agent, not being in his, her or their factory, store or warehouse, the yaiue shall be e:timated by tho ave- rage of the Wwe of the ifk. goods, wares and merchandise, during the time when the same would have become liabie io and charged with duty, Sec. 75 levies duty om cer.ain inanulk¢tures and eee (See compiiation pubjished im yestorday’s ALD ‘The following is the section impostug #tax on cotton:-— Sees atter the first day of August, ey hieoo hundred and sixty-two, thore shall be levio., collected and paid a $ax of che bait cent per pound on ail ovtton held or owned by any person or pors:ns, corporation, or ass: cin= tion of persons; and such taxe)ai! hea lien thereon in the porsessioa of any person Whomsoover, And further, Af any person oF pei suns, corpo! ations, or assoviation of persons, shall remove, carry, or transport the same from ‘the place of its production before eaid tax shall have een paid, such persoa or persons, corporation, or aasu- elation of persons, shall forfeit and pay to the United Btates double the amount of such tax, to be recovered Jo apy court hiving jurisdiction whereof: Provyded, huw- ever, ihat the Commissiover of {internal Revenue ig herey authorived to make such rules aud regulations a8 may deem proper for the payment of said tax, at Places different from that of the prod:ction of said cot- ton: And provided further, That ali cotton owned ard held by any manufacturer of cotion fabrics, on the first day of May, eightecn hindrediand sixty-two, and ‘prior ‘thereto, shall be cxcinpt trom the tax bereby impored. Whenever, by the provistous of this bMla duty is im- pote" upon any article removed for consumption oF sale, it shail apply only to such articles as are manufactured on or after the 1-tday of August, 1862, except in cases where a duty is speciaily assessed upon articles manu- factured prior to that date. AUCTION SATES. Sec. 76. And be it further enacled, That on and after the first day of August, eighteen hundred and sisty-two, ‘there shall be levied, collected and paid on all sales of real estate, goods, wares, merchandise, articles or things at auction, not inciuding sales of stocks, bonds aud other securities, a duty of one-/urth of one per coutum on the gross amount of such sales, and a duty of one-tenth of One per cent on the grove amount of all sales of stocks, bonds and cther securities, and every auctioneer, making @uch sales ag aforesaid, shail, at the end of each ard every month, or within ten days the: eafter, make a list Or return to the assistant assessor of the «istrict of the goes amount of such sa es, made as aforeswid, with the a@mount of duty which has accrued, or should accruc thereon , which jist sbail hay thereto a declara- tion under oath or affirmation, in form and manuer as be prescribed by tie Comm’ssioner of Iaiernal Revenue, that the same is true and correct, aud shall at the same time, os aforesaid, pay to’ the. collector or deputy collector the amount of duty or tax thereapon, as aforesaid, and in default thereof shall be subject.to and - @ penalty of five huudred dolisis, In all cases of de- jueney in making said list or paymont the assessment collection shall be nade ia the manner p-escribed in general provisieus cf this act. Provided, That no ‘Qnty shall be levied under ie provisions of this section ‘upott any sales for which no license is required by law. Sec. af Seaposee & tx on Calile, &c., siaugutered for sale. [See compilation published in yesterdays HERALD.) Sec. 18. And be it furihsr cnacted, that on and after thé date on which this a¢y shall take effect, any person OF persons, firms, or compaiNes. oF sgeuts or employes thereof, whose business or occupation it is toslaughter for sale any cattle, calves, sheep, or hog*-shall be requi. ed to makeand render a list at the end of each 2Sdevory month to ghe assistant assessor of the district where u:% business Je transacted, stating the number of cattle, cas res, if epy, the numberof hogs, if avy, aud the number sheep, if any, slacghtered, as aforesaid, with the several rates of duty as fixed therein iu this act, together with the whole amount thereof, which list shall havo aupcxed 8 declaration of said pe-son or persous, agents or employes thoreof, as aforesaid, uncor oath or uifirma- Yoh, such mannéy and form as’ may bop ribed by the Commissiuner of Internal Reveuuc, shal 2 Balng | true and correct, and shali, at the time of rendering said Ust, pay the full amount of duties which have accrued or accrue, as aforesaid, to the collectoror deputy oollector of tho district, ag aforesaid, and in case of de- faalt in making the return or payment of the duties, a8 id, the assessment and collection shall be made as inthe general provisions of this act required, and in ease of fraud or evagion the party offvadiag shali forieit and pay a penalty of ton dollars per head for any cattle, ealves, hogs or sheep, 80 slaughtered, upon which the uty Meira: ilently withbeld, evaded, or attempted to be evaded: Provic ed, That the Commissioner of Internal Revenue shall prescribe such further egies and regula- ‘Hons as he may deom necessary for ascartainiug the cor- rect nuinber of cattle, calves, § aud sheep liable to Ba tavad nner "> orovisiony of thig aot, 009 eine i TaiLncary emamavats AND FLKRY BOATS, Sec. 79. And ce ti fu: ther enacted, That on and after the Srat day of Acgust,cighteen han tred and sixty-two, any Person or porsons, firms, companies or corporations ‘Owning or possessing, or having the care or management Of any railroad or railcoais upon whch stcam 18 Use as & propelling power, or of any steambort or othe? vessel vy steam power, shail be subject to and pay a uty of three per contum on the mount of all the Fecvipts of such railroad or railivads for the iransporta- tion of passengers over and. upon the same; and any mn Or persous, firms, companios or corporations ewning or posscssing, or having the care or Management of any railr-ad or ratiroads using any other powor than steam tiereon, or Owning, possess- ing, or having the care or management of any ferry Dual, or versel used as a ferry boat, propelled by 6 or horse power, ehuil Le subject wo aud pay a duty of ono and one Lalf per contum upen the gross receipts of such railroad or (erry boat, respectively. for the § ausporta tion of passengers over ani upon said railroads, steam- boats, veascls and ferry boats, respectively; and any person or persons, ficiia, companies or cor ‘ Owning, possessing, or having the care or management of any bridge authorized by iaw to receive toll for tho transit of passengers, beasis, carciages, teams, and ight of any tion, over sach bridge, shall be ect to and pay a duty of three per centum on tho Gross amount o, all their secei,is cf every doscription, And the owner, )» 8% or person persons having the care aud mauagement of eny sucn railvad, steam- boat, ferry boat, or other verso or bridge, as aforo- eaid’shail, within five cays tor the cad of each and every mouth, commeonci:g a8 hereinbefore méutioned, maké a list OF return to the assistaut assessor Of tive dis. trict within which such owner, pesseso: ,company or cor- poration way have his or its pisos of business, or where any such railroad, steamboat, forr bat or bridge it loca. or Lolonge, respectively, staling the gr. amount of euch receipts for the month next preceding, which revurn shall be ve. iGed by the oath or affirmation of such owa- @r, possessor, manager, agent or other proper officer, in the mauher and forin fo be présccivel, from time to time, by tho © nissioner of Invernal Royenue; and shall also, monthly, at tha tune of a such return, pay to the colivetor ot deputy cujicctur of tho district the fai amount of “utios which hye accrued on such receipts for the mouth aforesaid, and fn ens¢ of negtect or refusal e sail lists, ur fetutn for ths spico of five days ch rctarn shod ve made as aforesaid, the as- fstant assessor shalt proceed to estiniate the ed dud (10 duttes payable thoreon, as here- inbefure provided im other caaes of delinquency to make Teturn for purposes of ascesstwat; and (or the purpose of making such (sgossinelt, O° of ascertaining tho cor- £ return the books of any such per- y Or corporation saa'l be eubject to the in- Of tho agssssor or assistant agsegsor on his de- ‘oqucst therefor; Gud in case of neglect or re. Tosal to pay the dutios a4 Morerald, whou the same have Been asc®iialied as aforesaid, for We space of five days alter tho same saul lave become payabie, tne owa- possorcur, or person hayitig the | manage. as aturesald, hall pay, im addition, per cootuin on tho amouat’ of such duties; for any attempt knowingly ty ovade the payment seh duties, the suid owner, porsce r, oF person have ont a8 aforesaid, shail be liable usond dollars for every such oO. in tals act ivr the of pont all provisions of this actin retacion to liens aud ccllention by distraimt not iveom- pitible herowith shall apply lo this section and the ob- jects therein cmbraced: Provided, That allsach persom, Sanpurios and oorporaijvas rial) have the sigitw add tho duty oF tax imprsed hoceby to their raves of faro aewover thelr Mabiiiey, tharete may commence, auy Himituions wale moy evict by law or by agreement with ay person 6: com; any Which may Rave paid or be liable t pay wucb fure to the contrary notwithstand- ing. RATROAD voOXM, And det Surtrer nate’, That on Wat after the f, elghivon houdied andl sixiyetwo, any Sug, or haying tha yd Gompatly Or ral road eerpn: boing inde for ony sum or suns of monoy (or which bouds cr dlhar evidences of judetnod> none Lieve buch isd, Payable im one oF Me ra afor date, upon which titores? is Or ehAllbe stipulnved to ba paid, o¢ copoms reprepoutiog tho. interest shall, beor fh Veo ised to ba pill, ‘dud all dividends fo money or sutie Of money theroatter declared ayabie (0 elockuolde ® of Ay radroad domypany, é wniegs, PROM, Of KAiDS Of Baid com: fo and pay duty of threo per am Af all sugh intovestor goupons or ver. the same shell be paid;and sald QHiOns, OF any. pers Why ng the cate or oF day TAH Oat Company, OF Failroad dors . Leroy anthormod and required to deduct fhiidid front Ad payinowts Mido. any pers pormbusyor pry? after the figat day of August as ato gail, ob vccusueol auy MbOrest oF couDoLM Or dividends ¢. $0. ae due and payable as aforesaid, the said duty or sum of three per contum,; and the duties deducted as seen, guid cor t eae ee cteeme ies & aaa ou) or rations, and 5 sossors and agents on dividends and on bonds or fanvor Cousins are Yayebion holdea’ by" say ‘persue ot ty ? ae ae with ¢birty days after the ti daid interest cr coupons or dividends become due or pay- able, and ag Often as every six a nths, to the Comm: jouer of laterbas Revenue, which shail coutaina true and faithrut account of the duties reveived and chargeal aforesaid, during the time when such duties have orfed of shoud accrue, and remaining unaccounted for; and there shall be annexed to every’ guch list or return a declaration under oath or affirmation, in manner and form as may be prescribed by the Commissioner of In- tornal Revenue, of tbe Ageridept Weasurer, or some proper offcer of said railroad cot pany or railroad corpo- ration, that the game contains @ true and faithful ac- count of the duties 80 withheld and received during the Uime-when such duties have accrued or should accrue, and not accounted for. and for any default in the making or rendering of such list or return, with the declaration annexed, a8 aforesaid, the person or persons owning, Possessing, or having the care or management failroad ¢ Mpany or rai'road corporation, making default, shail forfeit, as 2 penalty, the sum of fivehun- dred dollars; andin eugo of any default in the making or rendering said list, or of any default in payment of the duty, or any part thereof, accruing or which should accrue, the assessment ‘and collection shall be made ac- cording the general provisions of this act. BANKS, JRUST COMPANIES, SAVINGS INSTITUTIUNS, AND INSUR- ach conti wras, Seo, 81. And be it furtier ‘nact d, That, on and after the diss da; OF AA usb, eighteen hundred and sixty-two, there shall bo levied, collected, and paid by all peak trust companies, and savings institutions, and by all fire, marine, life, in and, , and mutual insurance compa- ules, under whatever style or name. known or called, of the United States or Territories, spec: incorporated or existing under genéral laws, or which may be here- after incorporated or exist as. aforesaid, on all dividends. in scrip or money thereaiter declared due or paid to. steckholders, to policy holders, or to depositors, as part of the carniigs, proitis, or gains of sald banks, trust companies, savings institutions, or insurauce companies, a duty of three. centum: Provided, ‘Yhat the dutics upon the dividends of life insurance companies shall not be deemed due, orto be collected until such dividends shall be payable by such companies. Aud said banks, trust com) anies, faving’ institutions, and insurauce companies a.0 heroby auihorzed and required to deduct and withhold from all payments made to. any person, persons, or party,on account of any dividends or sums of mouey that muy be duc or payable, as aforesaid, after the first cay of July, eighteen hundred and sixty-two, the said duly of three per centum, And a list or return shuli be mace and rendered within thirty days after the time fixed wien such dividends or sums of money shall be declared due and payable, and as often ag every six mouths, to the Commissioner of Internal Revenue, which sifall con- tain a true and faithful account of the amount of duties accrued or which should accrue from time to time, as aforesaid, during tho time when such duties remain un- accounted for, and there shall be annexed to every such list or return, a declaration, under oath or a(lirmatien, to be made in form and manner as shall be prescribed by the Commissioner of Internal Revenue, of the presi- dent or sume other proper officer of said bank, trust company, savings institutions cr insurance company, respectively, that the same contains a true and faithful acc.unt of the duties which have accraed or should accrue, and not accounted for, and for any default in the delivery of such jist or return, with suct declaration an- nexed, the bank, trust company, saviugs institutions or insurance company making such default shall forfeit, as @penalty, the sum of five hundred dollars: And pro- vided, further, That the tax or duty upon dividends specified in this act shail not be deducted {rom divideuds or stock held by any othor company or corporation, from the dividends whereof an equal and similar tax is to be levied under tho provisions of this act: And provided, further, That nothing in this act shall be construed to inciude savings banks whose business it is to receive and take charge of smail deposits, and whose annual net profits do not exceed six per cent on said deposits. Nec. 82. And be it further enacted, That avy person or persons owning or possessing, or having the care or management of any railioad company or railroad corpo- ration, bunk, trust company , sayings institution or in- surance company, as heretofore mentioned, required under this act to make and render any list or return to the Commissioner ef Internal Revenue, shall, upon ren- doring the saing, pay to the said Commissioner of Inter- nal Revenue the amount of the duties due on such list or return, and in default thereof shall forfeit, as a penalty, the sum of five hundred dollars; and in case of neglect or refusal to ake such list or return as aforesaid, or > pay the duties as aforesuid, for the space of thirty days after the tmewhcn said Jist sheuld have been made and rendered or when said duties shall nave be- come due and vayablp, the astessment and collection shall be made according to the geueral provisions here. tofore proscribed in this ict. Sec. 88. And be it further enacted, That on tho first day of Oowber, anno Lomini eighteen hundred and sixty. two, aud on the first day of each quarter of a year thereafter, thero shall be paid by each ingurance com ny, whether inland or marine, and by oach judiyidual or as tion engaged inthe business of insurauce from loss og damage by fire,or by the perils of the sea, the duty of 0:3 per centum upon the gross receipts for ted miums and i its by such bal ae wa @r company duri apes then preceding; un duty siiall be paid by baumony pis foreign insur: oor eres «ncfce or doing business within the United Mates: lrovided, that nothing in this act shall be conatrued to extend to wutual fire insurance compa- uies whose busiccss js couflned to the insurance of the property of its members, and have no capital but the premium So{¢a_ of its members, and neither collects, nor has, nor is {0 haye avy qrofits. . 84. And be it further enacte?, That on the first day of October next, and on the first day of each quarter thereaf.er, am account shal: bo made and readered to the Co.umissi‘ner 9° Internal Revenue by ail insurayce com- P nes, cr thelr Agome, OF associations, or. individya s inaking insurance, except five Wiadtaney, e'yding agents Of ail foreign insurance ¢mpinies, which su. “*"tall @trueand faithiul aceount of the insurance mado, re- nowed i oF centinued, or endorsed upon any cpen policy by said companies, or their agents, or associations, oF tBlividuals during the preceding av “.er setting fort the amo: nt insured, and ssimount receive" ana the ai we 6! © duties wcrning Ufiefount under this act; ind there shall BO dargxed to and delivered with every such quar- terly accouns an tifidavit, in the form to be prescribed by the ‘x mirsioner of Iutermal Revenue, mude by one of “ae cilicers of said company oF association, or indi- eidual, or by the agoat in the ease of a foreign company, that the statements in sold accounts are i all respects just. and true; and such quarterly accounts shali be rendered te the Commissioner of Internal Reyenve with: tn thirty days after the expiration of the quarter for which tiey shall be made up, and upon rendering such agcount, with such ailidavit,as aforcsaid, theveto an- nexed, the amonut of the duties due by such quarteriy accoun's hall be paid to the Commissiover of Internal Revenue; and for every default in the delivery of such quarterly acccunt, wiih such affidavit annexed thereto, or in the payment o; (ho amount of tho duties due by such quacterly nt, the any or agent or ussoci- ation or individual making sceh default shall forfeit and pay, in addition to such duty, tho sum of tive thousand dollars. Sec. 85 requires a duty of threo per cent from off cers in the servico oj the United States. PASSPORTS, Sec. 86. Ani be it further ence’ad, That for every pass- port issued from tho vilice of the Secretary of Siate, aiter the thirty -iirst day of July, cigtiteeu hundred and sixty- two, there shall be paid tho suin of three dol’ars; which amount may be jaid to any collector appointed under this act, and his receipt therefor shail be forwarded with the apylication for such passport to tbo ollice of the 3 ary of State, or avy agent appointed by him. And the colectors shail account for ail moneys received tor Passports iM (he inanner bereinbofure provided. Anda like amount shali be paid for every passpurt issued by any foreign Minister or Cousul of ths United States, who shall agcount therefor to the ‘reasury, © ADVERTISEMENT \. Seo. 87. And be it furiher enceted, That on and after the first day Of August, elyhivon Lundred and sixty-two, there «bail be levied, collected and paid by any person Or persons, firm or company, publishing any newspaper, 8 ac- Magazine, review or other iterary, scientific or news wubiieatic ued periodically, on’ the gross receipus Pir sil advertisements, of ait matters tor the inser- tion of which to said newspaper or cviber pubiica- tion, a8 afvresaid, or in extras, supplements, sheets or fly loavee accompanying the sams, pay is hired or ro ceived, @ duty of three per contum; aad the person or persous, fir or compauy owning, pvesessing orhaving the care or management of any «nd every such newspaper or Other publication, as alvvevaid, shall makéa lisvor re. turn, quarterly, commencing a8 heretofore mentioned, Containing the gros* omount “f receipts ag aforesaid, and the amount of duiior which hove accrucd thoreou, and fonder the samo to the assistant assessor of the respec: tive districts wheresuch newspaper, magazine, review or acutlon is or may be published, U have wppexed a declaration, nm, ty be made according to the tanner aud forte which ibay ba from timo to time pr ibed by the Commis: foner of Internal Revenue, of the : he care or manage- jew or otter pu’ 8 PIU 18 true aud correc: and shail also, (Garter ne at the time of making said list of return, pay to the col'cctor or dep collector of the district, as aforesaid, its full amocut: sald duties, ‘and jn case of neglcct or ref isat to comply with avy of the provisions cont:imed in ih!s section, ur to make and render snid list or return, as woresaid, for the spac thirty days.after tho time wh to havo been made, as alore: yp, feapootive districts sha}! proves: wuimate the dus ie8, a8 heretofore provided in ther ca delinquency; and in cake of fe, lect or reusal to pay the dutios, as arore- tald, for the syace of thirty days ator said duties bow duo and payable, said owae’, possessor or porson or sons haviog the bare or manifoinent of Bald newspay or pudlicationa,ns uforesatd, sil pay, fu addition th to, @ penalty Of five percontom on tha amount dt fn cas of frand.oe eyasivn, Whoreby the roven tempted to be defranded, oF the dusy withbolt, said Ow hors, Possessors, oF Perren or ‘per or tinugentont of said new, ‘aforc said, shall forfeit pay @ penalty of five Jurs for Sach oitones orto’ any Aude ontited for, amd all owls fone itt Cm Rot Mn yee Jan te Ad, COLIC LOL, NYbdpe ‘blu Are wish, £ivall apply, to 1s eeetion and hore ebibfacod, Proved, thot in als oi prito Of ndvertisig tefxed by a Paited sates, State: oF Lereitovy, ie stia\l Ledawful Cor the company, parson or pe publishing sald alver- tiemonts, t» adil the daty ef tax imposed By this vet to the price of said advortisements any law, as nroresand, ty the ecntrary notwithstandm, > Proviued further, Wat the receipts jor advertiscments (0 the amouvt of one thousund dollirs, by ahy porkon Or parsuns, firm oF com: pary, publishing aiy nowepnper, magnrine, review, oF other Htoeary, sciwiile news tion riodiontly, shall bo exempt from duty: further, that ail neweparpors wilose etre exceed UO thousand Copies srt}! be oxen taxes for advertiroment ICOM He Sec, 88. And be # furher nw istant assessor of cu fed from alt ‘That for the purpors Sec. 89 imposes'a tax on incomes. [See compilation pupaes. im yesterday's HeRaLy. Mind bed fosiher pee That in estimating annual gaing, profits or income, whasher subjeot to Snbeap paovided in. thigact, of three per centum, of five per centum,all other ‘national, State amd local taxes, lawfully assessed upon the property ur other sources of income of any person a8 aforesaid, from which said annual gaing, profits or income of such should be derived, shall be first deducted from gains, profits or income of the person or persons who actualiy the same, whether owner or tenant, and all ging, protits or income derived from salaries of officers, or pa its to persons in the ‘civil, military, naval or Other service of tte United fad including Sena roti 05: ‘én y ress, except above $000, or toy a interest or dividends ot ste capital oF de Jo apy bank, teuse y¥ OF save ings iustitution, insurance, gas, bridge, express, tele- graph, steamboat, ferry boat or railrodd company, or corporation, or on any bonds or other evidences of in- deotedness br a enone company or other corpora- tion, which sball r@ Leen assessed and paid by said banks, trust companies, savings institutions, ineurance, boat, ferry boat, express or derived gas, bridge, telograph, steam’ or railroad compauies, v8 aforesaid, from advertisements or on fey. artic) tured, upon which specific stafhp dr ad" valo shalshavo beea dicectly paid, shail. alyo:be deducted; and the duty herein provided for’ shail ‘be ‘aseessei! andicollected upon tho income Jor the year end- ing the thirty Jirst day of Dovember. next preceding the ume for levying and’Coltecting sald duty, that is to aap, @n the first day of May, eighteou hundred and ‘sixty, three, and in year thereafter: Provided, that upon ‘such portion of said gains, profits, or income, whether. subject to a duty as provided in this act of three ventum or of five per centum, ‘which shali be derived from.juterest upon notes, bonds or other securities of the United States, thore hall be levied, collected and paid a duty not exceeding one and one half of one per Seay ine in this act to the contrary notwith- standing. Sec..91, Andbe it further enacted, That the duties on ipcomes herein imposed shall be due and payabse on or before the thirty-first day of July, io the year eighteen hundred and sixty-three, and in cach year thereaitor until and including the year eighteen hundred and sixty- six and no longer; and to any suin or sums annilally due and unpaid for thisty days afters the thirty firstor July, as aforesaid, and for ten days after domand thercof by cvllector, there shall be ievied in addition thoreto, the sun. of five per centum ou the amount of duties unpaid, as a penalty, except from the estates of deceased und in- solvent persous; and if any person or persons, or party, habig;to pay such duty, shall neglect or refuse lo pay the samé, the amount due shall be a lien in favor of the United states from tho time it was so.due until paid, with the interest, penalties and coste that may accrue in addition thereto, upon all the property, and rights to property, stucks, securities and debts of every descrip- tion from which the income upon which said duty is as- sessed or levicd shali have accrued or may or should ac- erue; and in deiault of the payment of suid duty for the space of thirty days, aftor the sam i have become ve, and be demanded, ag itoresaid, said lien may be euforced by distraitit upon such property, rights to pro porty, stocks, securities and evidences of debt, by whom- goever holden; and for this purpese the Commissioner of Internal Revenue, upon the certificate uf the collector or deputy collector that said duty is due and unpaid for the spice of ten days after notice duly given of tue levy of such duty, eball issue a warrant, in form and madner to be preescribed by said Commissioner of Internal Revenue, under the directions of the Secretary of the Treasury, and by virtue of such warrant there may be levied on such property, rights to property, stocks, secu- rities and evidences of debt, a further sum, to be tixed and staied in such warrant, over and above the said an- nual duty, interest and penalty for non-payment, suifi- cient for the fees and expenses of such levy. and iu all cases of saic, as atoresaid, the certificate of such sale by the collector or deputy collector of the sale, shall give title to the purchaser ,of all right, tite and interestof such de- linquent in and to such property, whether the propert be real or personal; and where the subject of sale shall be sticks, tue certificate of sxid sale shall be lawful authority, and notice to the proper corporation, cem or association, to retord the same on their books ur records, in the same mavner as if transterred or as- signed by the person or party holdmy the same, to issue hew certificates ef stock therefor in lieu of any original or prior certiiicates, which shall be void whether can- celled or np nd sald certificates of fale of the col- lector. or deputy collector, where the subject of sale shall bo securities or other evidences of debt, shall be good and valid receipts to the person or party holding the same, ag against any person or persous, or other party holding, or el, hola, Pyeseusion of such securities or other ey Bec. 92. And b tt further enacted, That it shall be the duty of all persons of lawful age, aud «ll guurdiavs and trustees, whether such trustees are #0 by virtue of their office as executors, administrators or other fiduciary capacity, to make return in the list or schedule, as pro- videa in this act, to the proper ollicer of internal reve- nue, of the amount of his or her income, or the income of such minors or persons as may be held in trust as aforesaid, according to the requireménts hereinbefore stated, and in case of neglect or refusal to make sueh Teturn, the asgeaser or sanislank ”qspeqor shail assess the amount of hiswr her ineome, and proceed thereafter tocollect the duty thereon in the same manne? 48 js provided for in other cases of ueglect and refusal to fur- nish liste or schedules in the genera! provisions of this act, where not otherwise incompatible, and the assistant ‘Assessor may increase the amount of the list or retro of pny party making such return, if ho shall be satis- fled that the same is u.derstated: Provided, That any party,in his or her own behalf, or as Py heat tras tee, ag aforesaid, ehall be permitted to ré, URI oath or affirmation, the form and mannor of w! gh prescribed by the Commissic vernal Revenue, ii or ‘she ny hot tuateceot hoe ‘mcome ‘of si Aundred dollars, liable to be assessed according to the viz'ug of this aot, or that he or she has been as- besred elsewhere ang the sme year for an income daty. Andsy gasarie <P eee We AEs SLO mare. 5 b inane soy Us WDE UDIEEE Soares, uu -- upon beexempt from an income duty; or, if the list or return of any party shall have been increased by the assistant assessor, in manner as afore » he or she may be permitted to declare, as aforesaid, the amount of his or her annual income, or the amount held in trust, as aforesaid, liabie t» be assessed, as aforesaid, and the same so declared shall be received as the sum upon which dutios are to be assessed and collected. SrAxi? DUTIES. feo, 93, And be it further enacted, That on and after the first day of August, eighteen hundred and sixty. two, (here shail be levied, collected and paid, for and in respect.of the several instruineuts, matters and things mentioned and deseribed in the schedule (markea B) hereunto annexed, or tor or in respzct of the vellum, parchment or paper upon which such iustruments, mat: ters or things, oF any of them, shall be written or print- ed, by apy porsen or persons, or party, who shall make, sign Orggsue the samo, or {or whose usc or benefit the same shail be made, signed or issued, the reveral dutie or sums of money set down in figures against the same, respectively, or otherwise speciied or set forth in the bald schedule. bec. 94. Amd be it further enac'ed, That if any persou or perscus shall make, sign Or issue, or cauee to be made, sighed or issued, any iastcument, document or paper, of uny Kind or description whatscevor, without the sare being duly stam;ed for denoting the duty hereby im- posed thereon, or without haying thereupon au we btamp to denote said duty, such person or persous shali incur @peuaity of fitty dollars, and such instrument, dvcument or paper, a8 aforesaid, shall be veemed tavaid and of no effect. oc. 95. And le it furrher enacted, That no stamp ap propriated to denote the duty charged on any particular inatrument, aud bearing the name of sch insirament ou the face therovi, shall bo used for dohoting any other duty of the fame amount, or, if 80 used, the same shall beof no avail. Sec, 96. And be it further ence'ed, That no vellum, parchment or payer, bearing @ Stamp approjriated by baie to any particular iustrument,shail be used tor aay other purpose, or, if 80 used, the samo shail be of no avail. Sec. 97. And be it further enactel, That if any person shall forge or counterfeit, or cause or procure to be forged or couuterfaited, any stamp or die, or any part of any stump or die, which shall haye beon provided, made or used in pursuance of this act, or shall forge, counter. feit or resombie, or cause or procure to be forged, coun- terieited or resemb od, the impression, oravy part of the impression, of any such stamp or dig, 48 aforesaid, upon any vellum, pa: chmeut or payer, or shall stamp or mark, or entixe or procure to be stamped or marked, any vel- Jum, pavehment or paper, with any such (orged’ or coun. terfeiied stamp or dio, or part of any stamp or die, as afovoanid, with intent Wo defraud the United states oi any o: the duties hureby imposed, or any part thereof, or if any person shall ter, or sell, Or expose to sale, any vellum, parehment or paper, article or thing, haviog thereupon ‘the ‘mp cession of any such counterfeied stamp or die, or any part of any stamp or dio, or any Buch forges, counieriestod or resembled. impression, part of impression, as aloresuid, knowing the kame respectively to ‘be forged, countgrfeited or resembled; or if any person shail knowingly use any stamp or die which shali have been so provided te or used, ag afvresuid, with utent to defraud the Unitea States; or if any person shall fraudulently cut, tear or get off, or canse or procure to bo cat, torn, or got oil, the fmupression of any stomp or dio which shal have eon provided, made or usod im purstance of this act, from any vellum, parehmont or Paper, or aity inatran Wwriking Charged or chargeable with any of the ¢ hefeby imc , then, and in every such case, person so offending, mud"@very persou Kuowingly aud wilfully alding, abetting or ass) mMittiig any 4 aforernid, sh deomed) putty of convichon dk: reot, be punisle usind cols, @ wo hard labor vol exoeediy komment anid c five years. buses wh Andteit further enact d, That ti any ant all i! OS usal for deni jog any duty 4 6-88 hevehvftor provived, the persen vemg or thy same shall Weile therenpou the intcials of his ume, und the sate fypda which the same ehai) be atiae the kane may wet Agat be uked, ay perso OF an adhesive atannp Ww de Hiiby fin pe y thia act witht £ Wid OLLiterAtig Lach starop, tiothidy he, sho, us Ui Holtars, (Yevided, nev propristors uf proyrietary duty. ua wed ing, Without @xperee tothe Uisiiod foray 4 bo apyroved by the Gomiais- chal exue, Lis or ther own for stata @ bo be sewed thereon, tie possession of the Commis for hie oF thelr o KO. tom yotnor person. hat Diy viel, duntond of Nig. or and’ the dati thereon, ed Od thd. Vox, bottle or dosigns be retuned in sioner of Iplor mal Koyen which hall sot be dupticat to in ali cass where sitoh bu Crete writing fifa or tole imit 0 sti | Many Phald Yo #0 package, that im opening the Woreol, the suid stamp shall be ciweruaiy | Seip for nani toate scribed in this aet. Any pe son who sha.l fraudu- Uy «btain or use any of the avoresaid stam s or de- signs therefor.and any person forging, or counterfeit- || Peer causing, or weoenrine, the \orging or countor- feiting any re, resentation, likences, similitude or evlor- able imitation of the anid last mentioned stamp, or sell? ing the same, or, being a merchant, broker, or person dealing, in Whole or in part, lar goods, wares, mecchaudise, mapufuctures, prepa- rationg, or artigios, or those designed for similar objects or pur} oes, shall have knowingly or fraudnlontly im his, her or (heir possessicnany such forged. counterfeited ker ness, similitude, or colorabie imitation of the said Inst mentioned stam}, or any engraver or printer who shall ‘sell or give away said stamps, shail be deemed guilty of a’ misdemeanor, and, upon conviction thereof, shall be subject to all the ponaities, fines aud forfeitures pre- scribed in section ninety-three of this act. Sec. 99. And be & further cnact-d, That if any person or peewee shall make, sign, oF issue, or cause to be made, signed, or issued, or shall accept or pay, or cause to be accepied or paid, with design to evade the pay- meut of any stamp duty, any bill of oxchange, draft or oF er, or promissory note for the payment of money, liable to any of the duties imposed by this act, without the, same being culy stamped, .or haying thereupon ap. adhesive stamp (or denoting the duty hereby charged thercon, he, abe, or they shall; (or everysuch bili, drait, order or note; fu {*sampas bone ioa bee eit the sum of two hundred dollars. 100, And be i furcher en ieled, That the acceptor or ac pera bili of oxchange or order far the pay- ment of any sum of money drawn, or purpoi ting to be drawn, in any foreign country, but payable in the Uni- tod Siates, before. paying or uccepiing the same, place thereupon a stamp, Indicating the duty upon the same, ag the law requires for inland bills o° exchange of Promissory notes, and no bill of exchange ebail be pais or negotiated without such stamp; and ii any pei son shall pay or négotiace, or offer in payment, or receive or take ln ent, ANY such draft or order, ‘the person or orsone 20 otendmg thaitfortols tho sum Of oue hundred ars. Sec. 101. And be it further enacted, That the Coninis- sioner of Internal Reveuue be, aud is hereby, authorized to geil to and supply collecturs, deputy collectors, post. maste 8, station orany other persons, at his discre- tion, with adhesive stamps or stamped paper, vellum, or parchnient, as herein provided jor, upon the pay- ment, at the time of delivery, of tho amount of duties suid stomps stamped paper, vellum, or parchment, #0 sold or supplied, represent, and may thereu,o1 allow and deduct trom the aggregate amount of such stamysy ag aforesaid, the sum of not exceeding five per centum a8 commission to the collectors, postma-ters, stationers, or vther purchasers; but the cost of any paper, vellum, or parchment shail be added to the amvunt, uiter de ductirg the a:lowance of per centam, as aforesaid: Pro- vided, That.no commission shall be allowed on any sum or sums 80 sold or supp.ied of Jess amount than fifcy dol- lacs. And provided turther, That auy propriewwr or proprietors of articles named in schedule C, who shall furnish his or their own die or desiga tor stamps, to be used especially for his or their own. proprictary’ arti- cles, shall be allowed the following discount, nauiely: not on amounts purchased at one time less than fifty nor, more than five hundred dollars, five per centum; on amounts over five hundred dollars, ten per centum. The Commission- or of Internal Revenue may from time to time mike re. gulations for the allowance of such of the stamps issued under the provisions ofthis act. as may have been’ spoil- od or réndered useless or unfit for the purpose intended, or for which the owner may have no use, or which through mistukt may have been improperly or unueces- sarily used,or where the rates or duties represented thereby have been paid in error or remitted: aad such a@lowauce shall be made either by giving other stamps in lieu of the stamps go allowed tor, or by'repaying the amountor value, a(ter deducting therefrom, in ouse of ple aaa the sum of five per centum, to the owner \ereor, Sec. 102. And be it further enac'ed, That itshall be law- ful for any person to present to the Commissioner of In- ternal Revenue any instrument, und require his opinion whetiier or not the sane is chargeable with any duty; and if the eaid Commissioner shall be of opinion that such instrument is not chargeable with. any samp duty, it shall be lawful for him, and he is hereby required, to impress thereon a particular stamp, to be provided ‘tor that purpose, with such word or wordsor device the;oon ag hé shall judgo proper, which shall signify and denote that such instrument is not chargeable with any stamp duty; and every, such instrument upon which the said atamp shall be impressed shall be deemed to be not so chargeable, and shall-be received in evidence inall courts of law or equity, notwithstanding any objections made to the same, as being chargeable with stamp duty, and not stamped to denote the same. Fec. 108. And be it further enacted, That on and after the date on which this act shall take effect, no, telegrayh company or its agent or employe shall receive from any Person or transmit to any pers any déspat h or mes- sage without au adhesive stamp denoting the auty 1m- posed by this act, being affixed to a copy therevf, or hay- ing the samo stampod thereupon, and in d@ault thercor shall incur a penalty of ten doilars: Provided, That only one stamp shall be required, whether seut through ouo or more companies, Sec. 1¢4. And be it further «nacted, That on and after the date on which this act shall take effect, no express company or its agent or employe shall receive for trans- portation from any person, any bale, bundle, box, arti- cle, or of any description, without eithor deliv- ericg to the consignor thereot'a printed receipt, having stamped or affixed theroon a stamp denoting the duty imposed by this act, or without affixing thereto an adhe- sive stamp or stamps denoting such duty, and in default thereof shall incr @ penalty of ton dollars: Provided, ‘That but one stamped receipt or stamp shall be required for each shipment from one party to another party at the same time, whether stch shipment consists of one or more packages; And provided, also, that no stamped receipts or stamp shall be required for any bale, bundle, ‘box, article or ‘age transporte! for the government, nor for such . bundies, boxes or packages as ure transported by such companies without charge thereon. And be it enacted, ; Sec. 105. |) That all the pro- jons of thia act relati to dies, stamps, adhesive imps and stamp duties, shall extend to and inelude whero manifestly inapplicable) all the articles or objects enuinorated in schedulo marked C, subjéct to stamp duties, and apply to the provisions in relation thereto. Sec. 106. And be i: furtther enacted, That on and after > firat dav of July. eighteen hundred and sixtv-two.no ee c og mat VIN ne person OF ‘porsthé,” Arhig, cofupaniéS Ui terporations, shall make, preparé and sell, or for consump. tion or sale, drugs, medicines, prepafaticns, composi- tions, articles or things, including pertumery, cosmetics and playing cards, upon which a duty is imporod by this act, as enumerated and mentioned in scfiedule C, with. ont affixing thereto an adbesive stamp or iabel denoting the duty before mentioned, aud in default thereof shall incur a penalty of ten dollars: Provided, That nothing contained in this act shall apply to any unc.mpounded medicinal drug or chemical, nor to any medicine com- pounded according to the United States or other national pharmacopia, nor of which the fulland proper formula is published in’ either of the dispensatories, formularies, or text béeoks im ccmmoa use among physicians and apothecaries, including homoopathic aud ecicctic, or in any pharmaceutical sournal now issued by any {dcorpo: rated college of pharmacy, and not gold or olfered ‘or sale, or advertised under apy other name, form or gulso than that under which they may bo severally denomi- nated and laid down in said pharmacopa.as, dispensa. tories, textbooks or journals, as aforeanid, nor to medi- cines sold wf for the use of any person, which may bo mixed and compounded specially for said persons, ac- cording to the written recipe or prescription of any phy- sician or surgoon. Sec. 107. And te it furvher enacted, That every manu- facturer or maker of any of the articles for saie men- ticned in scvedule ©, after the same sball have besa 50 made, and the particulars heretabs.ore required as ty siamps Lave been com) with, who shall take oif, remove or detach, or ¢ or permit, or suffer to bo taken off, or removed or dotached, any stamp, or who shall use any stamp, or any wrapper or cover to which any stainp%8 ailixed, to cover any other articic ur com- Modity thn that originally contained in sueh wrap- pox or co ich such stamp when first, used, with the intent to ev amp duties, shall for every Such article respectively, in respect of which any such offence shail bo 2, bo Bub-ect tow penalty of tity dol- lars. to bo re ‘ith the costs thereupon accruing, and every such article or commodity as afuresaid shail alse be forfeited. Sec, 108, And be it further enac'ed, That every maker or Mad uivcturer of any Of the articies or commodities men- tioned in schodule C, a8 af resaid, who si.all sell, send Out, romove or deliver ony article or commodity, mana. factuied <8 aforesaid, be:ore the duty theroon shall baye been fully paid, by allixing thereon the proper stamp, as jn this act providei,or who shall hido or conceal,’ or ¢aue'to be hidden or conceal d,or who shall remove or convey away, oF deposit, of cause to be removed or conveyed Away from or deposited in any p a.y such articie or commodity, Lo evade the duty char Able thercon, OF any part thereof, shall be subject to a ponaity of une bundret dollars, together with he forkeiture & any seh article or commodity: Provided, com) ositi perfumery required by tue act, may, wuon Intended for exportation, bo inqnu- fictarefand ¥elt, or removed withont biving s:amps aliiaed (hereto, and without being charged with duty,as Af rossi), and eve y manufecturer or maker of any ar- ticle, as aluressid,imcenled for exporta fon, shall give Buch bonds aud Dé subject ty such rules aud regulations to protect the revenue against des may be from time to Ume proses ibed by the Secretary of the reasury, ec, 100. And be U further enacted, That every manu facturer or maker Of any of te ar as aforesaid, or his chiet workman, a dont, sha‘lat the end of each tavation tn writi aforesaid, has, ¢ b prev Whey bie last dockitation was made, been ree moved, carried or sent, or cased, or suifered, or known fo have boeu removed, carried or sent from tho promicos 6. stich mannfacturer Ov maker, other than such as have Boon duly taken scoouat of and’ charged with tho stamp duty, on pa makor for, o\t ing for every sch gent Or superiitens h, make and ‘¢ oF coin. iy tontit, ring Bat of sich man facvuyer o make fosal OF neglel t dolls OF Maks all wake y ve declaration, vor Maker, OF chide’ WO. Kien, Agent OF Bus poriiqudant, maki» (he game, shail forcelt five hundred qotare, se DF imposes stamp duties, which wero pub- Hsbed i yesterday > Hamed LEGA RS AND DTRUROTI 2 OF PRRANAL PROPERTY, 110. Andblert farther enact, Chat any. person or port Aig la Charyve of Wust, as aliministratora, ox. ecULOr's OF [ruses OF ANY Jegncesor Cotribativesiwes perty, of any kind. whatso- (ot adh perednal pro wed the sum Ob.une thou ing from any de Arising from personal p tha whole at v9 person aftor ot thi act” pow rc ey by will or by tho Loteataté Laws of Voffitory, or avy part Chervin, Geguatortedt by dead, 1 Wade oF MLenod to take sminit afer the loath’ of the rargainyr, 0 any pers’ oF persons, or to Uudies po itis or corporate, in trust or other ibe, ahi bh reby are, magg subjevt to a duty to be pa die the Uieite t Stade 1. Ande OP the et, That the tox or duty aid slall be @ Veh Win Oba. .@ Upon the property of of auteh property or grantor or ez person deceased as aforesaid, until the same shall fu'y paid and to discharged by the United States; and every executor, administrator, or other person who may take the burden or trest of admin'stration upon such pro- ty shall, after % Sich burden or trust, and be- Te paying ans in. any ,ortion thereof to the | le-ateen oF entitled to beneficial interest | therein, pay lector of deputy eoileetor of the district the am unt tho duty or tax, as aforesaid, aud shall al-o mike and render to the assistant assossor of the district a schedule, list or statement of the amount of guch propecty, together with the amouut of duty which has aecrued or should accrue thereou, verifled by his oath or alfirmatiou, to be administered and certi- fled thereon by sume magistrate or ollicer baying lawful power to adminisier such cathe, in gvch form and) manner as may prescribed by the Commissioner of Internal Keyenue, which sch @ je, jit or statement sha!l contain the names of each and every person entitled to any beneficial interest the:ein, together with the clear value of such interest, which schedule, list or statement shall be by Bin de- Tivered to such collector ; and upon such payment aud de- Lyery of such schedule, list or statement, said co.lector or deputy coilector sill grant to such person. paying Buch d ty or lax a receipt or receipts of the same in du- plicate, which 8! be prepared as hereinatier provided; such receipt or ‘eipts, duly signed and deitvered by such collector or do uty collector, shall be suti'cieut evi- dance to entitie the person who paid such duty or tax as having taken the burden or trast of administering such property or pe:sonal estate to be allowed for such (ya) ment by the person or perg ing entitled to the beneticial interest iy respect to which such iax or duty was paid; and such person administering such)» operty or pe, 8oual estate shall bo credited and allowed such paymont b; every tribunal which, by tho laws of any Stuto,or Terr tory, is or may bo ompowered to decide upon and settle ‘the accounts of execators and administrators; and in case Such person who has taken (he burden or trast of admin- istering upon any such property or personal estat: shail refuse or neg'eot to pay the aforesaid duty or tax’ to tie collector or deputy collector, as usoresaid, wiihia the time hereinbefore pro. ided,'or shall negicet or ref.se deliver to gaid collector or deputy collector the dule, list oF statement of such legacivs, property or P rsqnal est ite under cath, a8 aforesaid, or shall deliver “to said collector or depu y ovilecior a fulse echeduie or statement of such legacies, property or persunai cstata, or give the namés adie ati-nship of the persons en: titled to benviicial interests tueveim uutruly, or shai not truly and correctiy set forth and state therein tho clear value of such bencfleial interest, or whero no adifnistration upon euch property or persoual estate shali have beea grantd or allowed ander exisiing laws, the proper ollicer of the United Stiles shall com mence such proceedings im law or cquity before any court of the United States as may be pro, er and neces a- ry tocnforceand realize the ten or clurge nj proverty or pe-soual estite, or ar which such tax or duty has not b« Onder sich proceedings: the enforced shall be the highest rate i sed OF as=es-ec by this act, and shal! be in the name of tho United staies aguinat such person or persons as may have the actuai OF constructive custody or possession of such property part ther: trely and justly to of duty or tax of porsons} estate, or any part thereof, and shall subject such property or personal estate, or any portion of tha saine, to be sold‘upon the judg:nent or decroe of such court, and from the proceeds of such sale, tho amount of such tax or duty, together with. all costs and expenses of every description to v0 ailow- ed by such court, shall be first paid, aud the balance, if any, deposited according to the order of such court, to be paid under its direction to such zrson Or persous as shall establish their lawful titie to the same. ‘Tho deed or deeds, or any proper conveyance of such property oF personal estate, or any portion there. of, so sold under such judgment or decree, executed by the officer lawfully charged with carrying the samo into eifect, shall vest in the purchaser thereof all the tide of tho delinquent to the property or personal estate sold wn. der an: by virtue of such judgment or decrce, and shull release every other portion of such property or persur al estate from the lien or charge theroon created by this act, And every person or persons who shall have in his posses- sion, charge or custouy. any record, flleor paper con- taining or supposed to contain any information con- corning such property or personal estate, as a’vresaid, passing from any person who may die, as aforesaid shall exbibit the same at the request of the collector of the revenue, his deputy or agent, and to any law oflicer of the United States, in the performance of his duty under this act, his deputy or agent, who may desire tu examine the same; and if any such, person, baying in his pegscesion, charge or custody, any such recurds, files papers, shall refuse or neglect to exhibit the same on request, as afore-aid, he shall forfeit and pay the sum of five hundred’ dollars ; and fa” tse of any delinquency in making the schedule, Net or statement, or m the payment of the duty or tax accruing, or which should accrue thereon, the assessment and cotlection’shall be made as provided for in the getieral provisions of this"act: Providcd, in legal controversies where such deed or titie shall be tho d ts ‘subject of judicial investigation tho recital insaid shail be presumed to be true, and that the require Of the law had been complied with by the officers of the government. Sec. 112. And be it further enacted, That whenever by this act, any license, duty, or tax of any degcriptionjhas been finposed on any corporate body , or propert; ofaay incorporated company , it shall be Jawful for a missioner of {oternal Revenue to prescribe aud deter. mine in what district such tax shall be assessed and collected, and to what officer thereof the officiai noticos required in that bohalf sha 1 be given, and of whom pay ment of such tax shail be demanded. See. 118. And be it further enic‘el, That all articles up- ‘on which duties are impored by the provisions of this act, which shall be found im the possession of any pcr- son'or persona for the purpose of being sold%by such Person or persons in fraad thereof,and with the design to avoid pay ment of the said duties; may be seizod by any collector or di paty collector who shall have reason to wame are ed for the purpose be forfeited to the United ‘States, and the proceedings to enforce said forfeiture sbail be in the natute of a proceeding ia rem in the cir- cuit or district court of the United States for the district whore such service is made, or inany other court of com- ae jurisdiction; aud any person who shall have in possesston any such articies for the purpose of suiling the same, with a design of avoiding ayent of the du- ses jmponed, thereou by this act, shali be liable to a povalty ef $100, to be recovered as hereinbefore pr- vided 1. PE es APPROPRIATION. Seo. 114. And be tt further enucted, That the pay of the asscssors, sssistant assessors, collectors and deputy collectors, shal! be paid out of the ac cruing internal duties or taxes before the same is von into the Treasury, according to such regulations.as tho Commissioner of Internal Revenue, under the direction of the Secretary of the Treasury, shall prescribe; aud for the purpose of paying the Com: missioner of Internal Revenue and clerks, procuring dics, stamps, adhesive stumps, paper, printing forma and regulations, dvertising, and any other expenses of carry- ing this act into effect, the sum of tive huadred thousaid dollars be, kod hereby is appropriated, or so much there of a@ may be iiccossary. ALLOWANCE AND DRAWBACK. Soc. 115. And be it further enacted, Tuat from and after the date on which this aet takes effect there shall be au alluwrance or drawback on all articies,on which any in. ternal duty or te, shall have deou paid, except raw or unmanufactur d cotton, equal in amount to the dyty or tax paidth-reon, and no more, when exported, the evi- denco that any suckduty or tax has been paid to be furnished to the satisfaction of the Comu-sioner of In- terial Revanue by such person or persons as shall claim allowance ar drawback, and the amount to be as.orte‘ped under such regulations as shall, from timo to time, be prescribed by tho !Commissioner of Internal Revenue, under the direction of the secre. ts y of tho Troasury, and the same shail bo paid by the warrant of the Socreta*y of the ‘Troasury on the Treasurer of the United states out of any money arisiag from internal duties not otherwise appropriated: | Pro- vided, ‘that no allows orsdirawback shall be nade or had {vr any amount cidimed or due less than twenty dol- ything in this act to the contrary notwithstand. ing: Aud provided f ruhor, That avy certificate of draw- back for goods exported, issued in pursuance of the pro- visions ofthis act, may, under such regulations as shall be prescribed by the Secretary of the Treasury, be re- evived by the collector or his deputies in payment of duties under this act; and the Secretary of the Treas ity may make such regulations with regard to the form of Said certificates and the iswuing thereof as in his judg- ment may be nocesvary. The Conierence Committee reported the following a@mondments to this section:—Compiting the aliowance or drawback upon afticles: inenufuctured exclusively of evtton when exported, there shail be allowed, iu addi- tion to three per cutum duty which shall have doen paid on such articles, a drawback of five mills per pound upon sich aiticles m ali cases where tho duty im- posed by this act upon the cotton used in tho manufac. ture thereof has been previously paid to the amount of suid allowanog, to be ascertained in such manuer as may bu preseribed by the Oommissiuners of fntertial Revenue, ander the direction of tho secretary of the Treasury, See. 116. And be it fur jer macted, Tit it gny person or persons shall fraudulently claim or seek to obtain an allowance or draw buck on goods, Wares, or merchandise, no interual duty shall have been paid, or shail fraaduiently claim wny greater allowance or drawbacic than the duty actually paid,as aforessid, such persoa or faone shall forreit “triple. the amount wrongfully or rauduiently claimed «r sought to be obtained, or the sum of (ive hundred dollars, at the élection of tue Secro. tary of the Treasury , to be recovered ay in other cases of (oceituce provided for in the goueial provisions, of this act. Seo. 117, And be i further enacted, That the sum of Sixty Uo sand dollars, approp:iaved to eompiete tho pitol in Now Moxieo, by the second section of an act of od June twenty-five, eighteen hundred the sum of fifty thousand doliars, appro- Projeiated for military roads in New Moxico, by act of Cougvoss approved March two, eiglitoen hundred aud six- ty.oue, be, and the same aro hereby, crotited to the forritory of New Mexico ii pay mevt of tho direct annual tax of sixty-two thousand six Nuudred avd forty eight dollars levied upon said Territory ender the eighth see Hon of an vet of Congross approved August five, eighteen hundeed and sixty-one, to be taken up on acocunt of said direct tax unver sald act as the same may fall due to the Caited States from said Territory. See. 18. Ant be t fur her enactet, That 40 much of an act entivied “An act to provide increased revenue. from iinyort, lo pay intorest on the public debt, and for other purposes,” approved Angust 6, 1861, ag im a direct tax of iweaty wiilions of doilara om the United States, ig suspotded until April 1, 1805, Corrections, ‘The above contains all the amendments made by tho Qonferenco Committee, with the following exceptions, nainely — ADDITIORAL DUTIES OF COLLECTORS. It js made (he duly of every coliector to keep a record of all sales of land made in hiscoilection district, whether BK oF bie depnbios which plik bo set forth or wh ch aay Bu le Was mado, the dates of nil gato, Vhe tame of tho party aeseasod, and all Proveedinga in making suid ealdy tho amount of feos anit expenses, the pame of the purchaser ‘and the date wf tho , Which | eeoril stall be certified By tho offiesr mal ing tho salo; apd it shall be the duty of any deputy mak: ihe #06, A8 Aforesail, to return a® Siatement of all his P-voeeings (0 the cologlor, and to certify the record glin'l be evidence in any eourt of therein stated; and whep apy sball be redeumed ag hercinbefose tor or clork, a8 the ease may be, sha’ janie, aoid a1 alocenuid, pro ed 5 ne oat muke in entry of the (act upon the mecord a‘ oresaid, and the said eutr, In any case whe | be evidence of such redemption, tho government to land sold uni foregoing provisions shal! be held to have ace time of seizure thereos. ‘and the claim and by virtue of tho rued at the RES, Br oods, chattels or effects Sufficient to sacisfy Une duties imposed vy this act upon Ang 20 som to pay the same shall not be found by tho. 2) or dep ity eollector whose duty it may be to evliect the same, he is hereby authorizet to collect the same by commissions Seizure and gale of real estate. Assessors’ Ou sales to bo five per cent. REDEMI TION. Liberty of redemption is extended to any person hav— ing an interest in the property seld. J ‘Tho foil wig Amendments made by the Conference Committco were inadvertently onutted from the com Pilation published in yosterday's issue-— twenty de ot, issied Sight checks, drafts, &c liays, two cents CHEOKS, DRAFIB, ETY. , for any eum exceeding am dairy BILLS OF EX) HANGER, Bill of oxehange, inland dratt or ordor, otherwise than. at sight or d-mand, or any promimsery-m te ,execpt Warie for gireuly Oa, for BUY SM oxccordiy treaty wn not exceeding one hundrod dollars, five center eroding one the one hui sind, twebl <exceeding twenty-five hun@red aut no hounwnd dollars, one-dovJar and tity cents each. excouding CONVEY ANCK:. xceoding five thodsand apd 1 ‘thousand,ten dollars exeh: execet- thousand aud vot «xceeding two.hwndred y dolinrs, aud for each aud covery add! Lional ten thousand dollars, or fractional part, thereof, twenty doilars. of the same, twenty-tive cent shapes. i I Hw. 20% and LOW FOURTEENTH CLEARING SALE FOR TUNE, 45c. 25e, 31 at 2c. AL how offering INSURANCE POLICIES, All insurance polices of every ah ha renowala each. MORTGAGES. On mortgages, for every additional ton thousand dol- 8, or fractions ui $l EAL LACE POINTS, ‘A tine asgortinent re a 1 our We are now offering Nos. all Shi ns PINEAPPLE GOODS part theroof, exceed ny twenty thou- MRS ELGER WiLL ed per steamship Chi FOR SALE BY" tigen CONSTABLE & (1 Canal strect, corner Mercer, RN! NDIA WASH SILKS, ner des ravly and curious ai tcles, Ame- ¢ Bead Work, Fans, with over vaste RIBBONS 3Te, $00. at it” at We, Bde. Sle. 87ee 4 and § Cor'et Edge TRIMMING RIB- 8, 25 per cent under regular prices. recucton all our Olfering at a BONNET SILKS AND NILLINERY GOODS Clearing sale of th» 0 © SPRING AND SUMMER STRAWS: All our jou. Bic. $10 $2 $2 50 $3 STRAWS clearing wt oat at at at at Ble. 620, b7e. Sl Sh ® $. yaCiearing BLOOMERS, FLATS, f., much below the regu r prices, C.caring sale of FRENCH FLOWER: learing sale of 3. HEADDRESSES, RUCUES, Ac. Clearing aile of EMBROIDERIES, ACONYE: Allour SWISS AND J. which we sell for i will be offered de, 18d. 25, Sie. We. CLEARING AT VERY LOW PRICES, f COLLARS, Toe, $l $2 $3 at at at 75e. $1 $1 50° 1,000 SILK SUN UMBRELLAS. all colars, SIXTY-THREE CENT Every size and GLovE Former price, 37, $153, $175, $3 00, eae $113. 91's. $1's0, $1'7s B20 SILK PARASOLS offering at 50 cents, cF 600 SILK PARASOLS, Former priee, $2 0, $250, $3 00, $3 50, Closing at ‘at at at Be 81 G0, $2.00, $2.50, $276. INFANTS? WAISTS for SOc. $1, $1 50, $2, $3, WH be offered at tb AL ab, Se te, Pa, $° ates s ude. dest ana id Party KID , OnF own importation, Equ sted, G3e. a pair, (ka aud eat A dinpose of the: the utmost val prices and then 5 10 t le@ep do not furget to cail on’ or ems C. MISH, The « qhird Srgnue, wear fourteenth street. A . ‘Sixth avenue, two doors below Fourteenth at, HARRIS'S by other d T THE ORIGINAL WELL, tore, 166 Bevent fest and Twenty-second sueeis, east «ff Clothing, Gurpet at no humbug as to oiferin, ee halt Lad.es attended by Mis. H. KNOWN DEALEE cs and g-enJemen can Carpets ara Purnitare, ab numerous. 2 value, a8 oilers, Picase eull or address and Has /E NEW STORE, 14 THIRD AVENUE, LADIES: entiemen can dispose of their Cast Ot Cloching, rnituse, &c, J guaranwe to pay for Dresses rom Coats (rom $4 to $15, for Punts frome] to «ies attended by attended to by Mre. roa ntost val Rosent ‘Great thal POSITIVE FACT.—LADIES. AND GENTLE a5 get the full vaine for your cust off Clotith Please remember, and uy 33 Jones street. MEN, IP Carpets and Jewelry, the best can do is EiTor sha ube bo A; HARITS. 361 Tuirdavence, betwers Thirty-eighth and Thirty-uimth streets, ‘side. Ladies — of cast awl 7G Wo. is HoweRY—H, RosENTHAL, SAVING 3 large quent eat ire to purchase @ a Weatfag ‘Aiavel Farnitie, Catpets seweiry, Ke. be di 1b or address uo Le@Mmel vucoat value Tor each article. “Ladies attended. to by Sirs Bowery, A* al and Farniture tor Ne ceived a large order, amounting to $25,000, EXTRA PRICE WILL BE PAID FOR LADIES ud yentlemen’s Bit OF Clothing, Carpets, Jewelry w Orleans. . leans. “The undersi; ned ta: for which he guarantees to par tha’ following prices for ean! artie'e:—For Silk Dresse: Pants, from $5to $31; for Coats, Irvin $3 to $i te Sa for ass cali on of address by note Jy ANLIALT, 152 Beventh avenue, berwcen Twenceth and Tremy-livet etrectas Ladies attendes fo by are Anbalt.“N. B : Ali busin RARE CHA! CE. coutidenially, WORTH OF CAST OFF 44-4 Lae —$15, Clothing wanted, within « mouth, tor New tlemen” hi Orieans. amg any of the above to ‘isposs of vices —From $6 te RPe Soe Sle iowii n 890 $18 for doaim, froin $l 10 $9 fur P tr Iso Shawis, Clocks, Carpets, Furnitures the highest prices Aare. Please cali of or anaress.a note to 8, Min iy Avenue, near Bighieenih street. Ladiew attcadel wy Mra, Mintz, ten avi enue, Orders from Brookiyn or Jersey City panetedily to, Please remember tue original B, Mintz, 238 Sixth. At and from $1 to ‘ke. Indies anc § ceive the following prices coats $3 to $15; pants Pleas: try be ERG, 212 Se irs. BR. fo Cail on or addrcas ve punctuall Pr v ry 8 Mi beat you oun ¥. Harris, 156 Soventh aveuue, will $5 Streets, bey street. Marris sz cat (pier No. a) T-THR StBAMBR bts Dr iver dally, ot ress gin tine Wy connect with the Hotrenton! a Been are i ee oke A note our ies af oF Shu Sith avenue, NTION! LADIES AND GENTLEMEN.—A LARGE TTENTION! LAD! eat venue, PRICE © 2) for C MRS. EZEKIELS © will be paid (or Silk D: $9 for Par “LARGE ORDER HAVING BEEN purchase east of Clotiin, Cu ‘nt emen having rey venth avenue. LADIES AND GENTLEME to meet with & tlt 9 {ol clothing, ‘arpeta, furnitar {8 tosend & uote eventh avenue, where you will be Wo yuu. eettuction; for alk dieaiet f nits to $15, for ba Gwen tech ant twesty drat sireetec ened by Mrs, Harris, GREAT QUANTITY OF lag We id city Carp st foots’ Ne, wantsd.=<T pay. as Totlovea:—From $10. to" 6 re em, Coate iron $5 1 at peices in the elty by caliing on or address. Ladies attended to by Mrs. between Lavties attended to by Mra. A. $5 TO $30 FOR SILK DRESSES, $5 TO omg to $5 for Pao New Orleans war NG Seventh avenue, Uy attended to by Ales, Buell tent, betwerk Rineweenth and Twentieth ter it pA EUELVEY TO if “ a aM cemepeey to he above to dlepore of cw ny 4 from $5 to SIM; wo Yee Balin’ He id a note by post to T. a Ladies attended punctualiy by Ir you a spore nd jewourr, the the well known dealers w th and hy to CAST, OFF CLOTHING trade, Furniture, to $15, Pants from $2 wo $5. Dacas, Seventh avenue, where you ly Attended tw. Ladies aitended to by @ AND GENTLEMEN HVE rehase Cast of Clothing, Pure tifornia market, Lao promise 137 Sixth avenar, two Cours above Sakeet ‘Minw. Remember, t oedeny received ee br wes Tor Arvin) ieniture, Carpets, Ae, LW eee rive in tne cit tyealling’on or Sirona M“KBRAHA NS, 288 Seveuta wen y-fi'th aud Tweniy-sixth streets, je paid’ for the reaxing @ note to Levensiyn, ended by Mra. et, by “ta {LOTHING, —GENPLRMEN ‘east off cloths coh pies, by calling Doyle, 491' Pearl ntrew AVING ANY NEW OR » cam obtain the highest ee, OF addressing Daniel to die} tu 17 ANTED—$10, 000 WORTH OF CAST OFF CLOTHING. Furuitare, Sewolry, 40-4 Po ah “Lo stand, 203 Be euth avenue, ya or address COREE REG Cea Beta ‘y Soran ee palde tgheat cast rice will or addres d: BTBRN. na iPaalos atecuded to by ford Railroads: wlso,the and New La enty-f0 weet, for which tha in ationdance, Calk —s Se ee 000 WORTH OF CAST OFF CLOTHING, FUR- altare. Carpets, ‘&e., wanted, a the old standy vebween ‘ty be tht OO leaves maton. , Nixd LINE FOR PREROKILL THe AURORA N viennd uae mire. LX shy et ton, 1. on kers Hy "su deersteaw Graney Fotae aut Bi NG ee Peekskill ay 10. oka ne and Thirtieth Te atihnrerenemnenaelianat iene Nou Seas f BUSTON and OIT (Bondays excepted), at Fo'elock, bier 89 Nera Hyer,