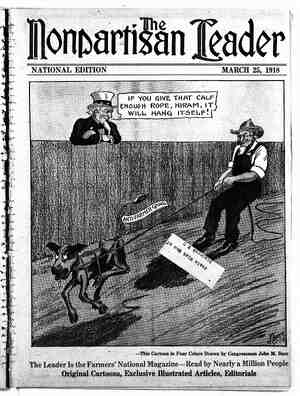

New Britain Herald Newspaper, March 25, 1918, Page 5

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

FINDING IN FAVOR | OF SIX CENT FAR P. U. Commission Finds Connecti- | cut Co. Was Justified in Increase: —In a finding | filed today, the public utilities com- | mission declares that the six-cent f. instituted on its lines 'I']I(!‘ Connecticut Company is equitable and Just and should Hartford, March + allowed to stand. e finding was on a petition agair the increase filed by the city govern- | ment of Hartford and on which hear- ings were given. This was consid- i a test case for the state | he finding follows: ! the Honorable Public Commission the Connecticut: The petition of the City of Har ford respectfully represents: 1 1t your petitioner is a mu- | pal corporation chartered as a| located in the County of Hart- ford and State of Connecticut. That Connecticut a corporation chartered : Assembly of the State | of Connecticut with authority an electric street railw s stre of the City towns adjoi T To Utilities | of State of, nic Com- by par the Ger to system rtford said oper- ato v P ous ing ‘ October 1, Company about onnecticut the five- the f by said said City points wit are dc compar was h rtford of of from rious P r are, date colle point ince ged and Hartford six-cent mpany ithin said ning towns, passenge aid six-cent fare, ccessive and unreaso the lines within the City concerned and in so far the from said City of Hartford to various points in said adjoining towns are concerned (3) That on October 15, 1917, the Court of Common Council of the City of Hartford passed certain resolu- ich were approved by the of said city on October 2 and reading in part as follow Resolved: That the Corpora- tion Counsel be, and he is hereb instructed in behalf of the City of Hartford. to immediately peti- tion the Public Utilities Commis- sion of the State of Connecticut, for he ng on the increase in trolley fares, alleging that the in- crease in fares to six cents is un- reasonable, and praying that said commission page an order requir- ing sail fares to be reduced to five cents within the limits of the City of Hartford and the towns immediately adjoining: Your petition therefor your Honorable Commission will cause such notice as you shall deem reasonable to be given to said The Connecticut Company of the time and place of appearance to answer to the foregoing petition, and upon due hearing, shall determine, order and prescribe a just and reasonable maxi- mum rate and charge to bo made thereafter by said The Connecticut Company within the limits of the City of Hartford and to various points in the town adjoining =aid city for the carriage of passengers, sald maxi- mum rate and charge not to exceed the five-cent fare, so-called, charged by sald company on said lines prior ! to October 1, 1917 Dated at Hartford. Connecticut, this 24th day of October, A, D., 1917. of Hartford, By FRANCIS W. COLE, Tts Attorne Said petition was duly assigned for hearing at the office of the commission in Hartford on Manday, November 12, 1917, at 11:30 o'clock in the forenoon, of which due and public notice was given as by order of notice and re- turn on file will fully appear, and at | and fare 4) called, in so far of Hartford are { | es | | | prays thav which time and during the subsequent | adjourned hearings, the partles in in- terest appeared with their witnesses and counsel and were fully heard. The only issue involved in this cas is based upon allegatians contained in parazraph 4 of the petition. Counsel for petitioner made an opening state- ment of the city’s claims but did not attempt to prove or make out a prima facie case by the introduction of evi- d , relylng upon the theory that the burden was upon the respondent to show justification for its rates. The commission ruled that inasmuch as the old rates had been in existence for | a considerable period of time prior to the present increased rates complained of, and as all the material facts per- taining to the reasonableness of such rates were more -or less exclusively within the knowledge and possession of the respondent, it should proceed by offering whatever evidence it had in justification of its present rates. Whatever weight may ordinarily 1 attached to the presumption of rea- sonableness of a long-established pre existing rate, it is materially lessened by present economic conditions within the official knowledge of an adminis- trative tribunal While the burden of supplying the facts may he imposed upon the respondent, the burden of establishing its material allegations (rom all the facts submitted still rests upon the petitioner, under the laws of this state permitting the company In the first instance to establish its rates or to change a company-made rate. Counsel for the petitioner objected to the admission of evidence involv- ing or affecting the respondent's rail- way tem outside of the Hartford lines as set forth in the petition. Re- spondent clalmed that all lines oper ated by it in Connecticut were oper- ated as one system, co-related in all jts parts, and that it would be impassible | and other similar transactions. | gins on | street railway nAa DAIL 1 NEW BRITAIN ILY e e e et e e . nues, or allocate with any degree of | accuracy the fixed charges and over- | head expenses. The commission ruled, that substantial latitude shauld be given to the respondent, and testi- mony affecting the company’s system as a whole was offered and admitted in evidence, | General Statement. The cvidence in the case consists of more than 700 pages of typewritten testimony, together with 88 exhibits containing detailed statistics, graphic and other information and data, and, by reference, all official records and documents on file and record in the commission’s office, bearing in any way upon the issues involved. Illuminat- ing and somewhat lengthy briefs were filed by counsel, the respondent’s hrief treating exhaustivelw the evi- dence in analytical sub-divisions and e st | roproducing in convenient form most' other constructions, of the exhibits presented. The com- | mission Will not undertake to make a | detailed finding or even a complete summarization of all the facts sub-| mitted, but, having ade a careful tudy and analysis of all the matters presented, will forth as concisely as possible the material facts govern- ing its final conclusions and order. In this connection we deem it infarm- ative to give a brief history of the origin, composition and operating ac- tivities of the respondent com History of the Company. A history of the properties and com- panies now owned or operated by the | respondent is a history of nearly all the street raiiway companies in Con- | necticut. The evolution of what is now The Connecticut Company is the result of many mergers, consolidations and purchases of numerous street ailway companies, changes ot names, It ve- hort, disconnected lines with the operation of a small, wooden, four-wheeled car welghing about 1,400 pounds, With a seating capacity of 14 engers and drawn by one horse, on oval iron rail spiked to wooden stringers. Tts latest maximum devel- opment is a stecl constructed car 33 feet in length, weighing about 45,000 pounds, having a seating capacity of 52 passengers, with four 50-horse- power electric motors, operated over a Jarge system of connected lines with the maximum size steel rail in use weighing 124 to 130 pounds to ths 1 The first charter for a street rail- vy company in Connecticut was sranted in 1859 to the Hartford and Wethersfield Horse Railway company, and at the close of the 1917 session of the gencral assembly there had been granted 166 special charters to street railway companies, involving both horse-drawn and electric methods of propulsion. Of these 166 original charters, 83 have lapsed or have otherwise been discontinued, and of the remaining 83 chartered companies, 63 are now owned or oper- ated by the Connecticut company. The process of consolidation first started with the Thompson Tramway company, chartered in 1901, the name of which was changed by decree of the superior court for New Haven county in 1902 to the Worcester and Connecticut Fastern Rallway company. The name of the latter company was changed by decree of | the superior court for New Haven | county in May, 1904, to the Consoli- dated Railway company, which com- pany, after acquiring many street railway properties, was merged with the New York, New Haven and Hart- férd Railroad company on May 81, 1907. The New York, New Haven and | Hartford Railroad company continued to acquire additional street rallway | properties until June 30, 1910, at| which date practically all of the! properties then owned by that company were turned over to | the Connecticut company on a capi- talization of $40,000,000, the New | York, New Haven and Hartford Rail- | road company owning all of the capi- tal stock. During the fiscal year ending June 30, 1913 the capital stock of the Con- necticut Company was transferred to the New England Navigation com- pany, one of the subsidiary compan- ies of the New York, New Haven and Martford Railroad company. By an order of the district court of the | United States for the southern district | of New York, dated October 17, 1914 said capital stock was assigned and transferred to five trustees, with | set i | authority to hold said capital stock . and exercise all the powers in the management of the Connecticut com- pany which the owners of the shares of said capital stock are entitled to exercise, until the said shares of capi- tal stock shall have been sold, as therein provided. i At the time the several companies were being merged with the Consoli- | dated Railway company. The Con- ' necticut Railway and Lighting com- pany absorbed and operated a num- {ber of street railway lines in the southwestern part of the state, all of which were leased to the Consolidated Railway company in 1906 for the [ term of 999 years and are now oper- {ated under the terms of said lease by ‘lhf‘ respondent. The first identity of the Connecti- cut company appears under a charter granted to the Thomaston Tramway { company in 1905, the name of which company was subsequently changed to the Connecticut company by decree of the superior court for Litchfield county on May 81, 1907. The merger, consolidation, sale, transfer, and lease of all these several companies and franchise rights, culminated in the Connecticut company as herein stated and carried with it all the franchise rights and privileges under the several charters connectéd there- with. | The life of The Consolidated Rail- ' way Company terminated on May 31, | 1907, when it was merged with The New York, New Haven and Hartford | Railroad Company. Previous to its | termination it had acquired all the | capitol stock of the Stafford Springs | Street Railway Company but the fi- nal transaction regarding its transe fer did not take place until after The Consolidated Railway Company merged with The New York, New Ha- ven and Hartford Railroad Company. Effect of Consolldation. to take the Hartford lines separately, or any other sub-division of the sys- tem, and determine either the operat- Ing expenses or the gross or net reve- It appears that the respondent is a consolidation of a large number of originally scparate horse car and | sidered separately I electric street railway companies operating in different sections of the state. As to whether these separate companies should have been merged and consolldated into the respondent as a unified system, or whether the respondent can render as efficient public service as the separate com- panies might furnish if not consoli- dated, is not for this Commission to determine at this time, as the consol- idation was in conformity with ap- parent public policy, having received the sanction of the Legislature of tho State. | As a result of the consolidation, however, all the several separate properties (with one exception, the Torrington and Winchester Street Railway Company), have been physi- cally connected by the completion of extensions, connecting lines, and making possible | the continuous transportation of pas- sengers, freight and express matter over its entire lines, | Should the Company Be Treated AS a Unit? | the particular line: tioned in the petition, namely, lines in the City of Hartford and those extending from the City into adjoining tow be treated separate- ly and independently of the respond- ent’s other lines and property, in de- termining the reasonableness of the rates complained of, or should all the lines operated by the respondent as a unitary system, be taken into consid- eration? This one of the mostim- portant and most controverted ques- tions involved in this case. This petition is brought under Sec- tion 23 of Chapter 128 of the Public Acts of 1911, which provides that any city within which or between which and any other city, town or borough, a utility company is furnishing ser- vice, may bring its written petition, alleging that the rates or charges made by such company are unreason- able. The rates or charges referred to do not necessarily include all the rates or charges for a particular ser- vice or rates charged in a certain lo- callty or between given points. The petitioner in this case com- plains of the rates for passenger traf- fic in a certain locality, namely, the City of Hartford and on the lines ex- tending therefrom into adjoining towns. The issue to be determined, therefore, is as to the reasonableness of the particular rates complained of. While the rate itself may be con- fined to a particular locality, the facts governing the reasonableness of such : rate may involve a greater latitude. The respondent operates 503.76 miles of street railway in Connecti- cut, maintaining the same unit of fare on the zone system over all its lines. Theoretically, therefore, the | rates charged are the same in all sec- ! tions of the state where the compa: operates, and a change of rates 1u one city would necessitate change of | rates over its entire system or the establishment of a unit of fare in such city differing from the unit of ! fare maintaining in other parts of the ! system. The petitioner claims that “in de- termining whether or not the six-cent fare is reasonable for the City of Hartford, the City has the right to have the lines within its limits con- from the other lines of the company” and that “if the five-cent fare is a reasonable fare in the City, the car riders of Hartford should not be compelled to pay more than five cents in order to give the company the funds which it may need on account of unprofitable operation of other lines.” ; The respondent claims that in es- tablishing the fare tariffs, the com- pany, being legally consolidated and operated as a single system under ' one general management, should be treated as a whole; that the book- keeping an accounting system of the company is in accordance with the requirements prescribed by the In- terstate Commerce Commission and by this commission and is kept as a unit, affecting the company’'s entire operations, that the problems of pro- curing finances for the whole or any . part of the system involves the earn- . ings, expenses, and valuation of the company’s property as a whole and the distribution of risk and casualty claims over the entire system. The respondent as a consolidated company is a legalized entirety char- tered to serve the people of the state in all sections where its lines are operated. The advantages of a unified transportation system, serving the people located in different sec- ticns of the state, by physically con- nected and similarly operated lines, attach themselves to all portions of the system. The soclal and business success of individuals, societies and municipali- ties is to a large extent interdepen- dent. The corporate boundary lines of a city do not enclose all the inhab- itants upon whom the city is depen- dent for its business, roc'al and gen- eral success and d:velopment. There is involved in its economic life and daily business transactions, a large rercentage of peopla from the subur- ban and other sections outside of its corporate limits. To Impose a &e- vere or prohibitive burden upon their access to the city would be not only a less to the city but a serious im- pediment to the development of bus- iness and the comfort of the general public dependent upon the respondent for service. Assuming, therefore, as an equit- able proposition, that certain of the more populous lines of a transporta- tion company should help to bear the burdens of some of the unprofit- able ones as a natural incident to in- ter-business and social relations, yet this proposition should not be so far extended beyond reasonable limita- tions as to impose a burden without some corresponding benefits. | No evidence was offered showing the valuation of the plant and equip- | ment or the financial operations of the Hartford lines separate from the other lines of the company’s system. Tt dia appear in evidence, however, that a large number of people from suburban and other outside sections, were utllizing the company’s service and were engaged in the daily routine of the business of the city, and that the general traffic, operating and fin- ancial conditions of the Hartford lines were not dissimilar from those Should men- the | under legislative | opinion of Justi IERA I maintaining in other ters, as Bridgeport, New ‘Waterbury, together with spective suburban lines. In the case of the passenger rates of the Long Island railroad company, decided hy the Public Service com- mission for the first district of New York in November, 1917, Commis sioner Hervey, in writing the opinion states: “The insufficlency of revenue from the passenger service as a whole does not demonstrate that a particu- lar aivision of service or a particu- lar class of service should provide ad- ditional revenue without showing fur- ther what is the basis of the rates as a whole or in different division or classes of passenger service, and which particular divisions or 58 should bear a calculated incres in rates.” The respondent’s passenger rate are the same throughout its entire system. It is conceded by petitioner that the company as a whole should receive increased revenue over that obtained by the old rates. In the exhaustive hearing on all matters pertaining to the company's entire tem, no facts were shown which would warrant a finding that any particular division or municipality or combinaiion of divisions or munici- palities less than that involving the whole systemn, should bear all the burden of producing the necessary in- creased revenue, or that any particu- lar division or municipality should be relieved from bearing its share of such burden. The corporate spondent as populous cen- Haven and their re- [ identity of the re- consolidated company approval is co-ex- corporate operations and the body as a whole must be <en into considera- tion in a proposition affecting any branch of its service. Therefore, in determining the par- ticular issues involved in this case, namely, whether the rates charged on the Hartford lines and lines extend- ing into adjoining towns are unrea- sonable, we must of necessity take into consideration certain facts and conditions affecting the whole system, even though by so doing we inferen- tially pass upon the reasonableness of rates in other localities, not com- plained of in this petition. Valuation. The question of valuation of the company’s property as a whole loses its mportance in a solution of the issues involved in this case because the present rates are not producing sufficlent revenue to pay any divi- tensive with its an entirety, | dends on the capital involved, after the payment of overhead and oper- ating expenses and fixed charges. Many theories have been advanced as to the valuation of a utility com- pany’s property for rate making pur- poses. The United States Supreme Court has laid down certain definite principles regarding this question. Prominent among them may be quot- ed the opinion of Justice Harlan In the leading case of Smythe v. Ames (169 U. S., at page 548), “The corpo- ration may not be required to use its property for the benefit of the pub- ic without receiving just compensa- tion for services rendered by it ‘We hold, however, that the basis of ‘all calculations as to the reasonable- ness of rates to be charged by a cor- poration maintaining a highw un- der legislative sanction, must talr value of the property being used by it for the convenience of the pub- | lic. What the company is en- titled to ask is a fair return upon the value of that which it employs for the public convenience.” And the > Holmes, re-affirm- ing a previous opinion of the Court, as follows: entitled to demand in order that it may have just compensation, is a fair return from the reasonable value of the property at the time it is being used for the public.” (San Diego Land and Town Company City, 174 U. 8. at page 757). Later cases establishing substantially the same doctrine are Wilcox v. Consoli- dated Gas Company, 212 U. §., 439, and the Minnesota rate cases, 230 TS 62 The valuation of a company’s prop- erty used and useful in serving the public is, therefore, the criterion or basis on which the fair return should be flgured in limiting the maximum rates as a whole to be charged. Any theory or process followed in deter- mining such value must of necessity involve many elements which it will be unnecessary to discuss at this time. The Commission, in the Man- chester rate case (Docket No. 8), adopted the theory of replacement or reproduction cost, which is in con- formity with a series of decislons by corresponding commissions and by the United States Supreme Court, and is the theory which the respondent has followed in this case in present- ing the valuation of its property. Re- production, however, naturally im- plied the substitution of a new article in place of an existing one which may be somewhat deteriorated by actual service. Wherefore, in deter- mining the value of a going utility property based upon its reproduction cost, the subject and extent of de- preciation of the existing property have been variously defined and treat- ed. Depreciation as a substantial ele- ment depends upon the nature of the property and its sustained standard of maintenance, The major property of a street rallway company, if prop- erly maintained, s substantially 100 per cent. valuation for service pur- poses. Tt appears from the testi- mony of street railway experts that from 20 to 25 per cent. of the gross earnings is a liberal amount for an- nual maintenance and depreciation charges, and it was shown that the respondent’s average annual main- tenance charges for the past six vears were about 20 per cent. and further that the respondent has maintained no deprectation fund. The valuation of the respondent’s property Wwas made hy Charles Rufus Harte, an engineer of the companv. The method and general unit prices adopted by him wers approved by Professor George Swain. former consulting engineer of the Massachn- sotts Raflroad Commission and at tesent chairman of tha Boston Transit Commission and Professor of Civil Ensinecring At Harvard Univer. I.LD, MONDAY, MARCH be the | ‘““What the company is ! National | sity and Massachusetts Institute of Technology. Irom the evidence sub- mitted on the question of valuation it appears that “In 1907, there was made a valuation of the property of the New York, New Haven & Hart- ford Railroad, including its electrical lines; with this as a hasis, supple- mented by the detailed records of the new work and the reconstruction since that date and such field meas- urements as were necessa to com- plete the information, the property of The Connecticut Company was listed. To these quantities there were then applied prices representing the average for the fiv period 1910-1915, this period chosen as just outside the abnormal price conditions resulting from the war. Tn addition, as a matter of interest a second figure was obtained by ap- | piving to the quantities, prices as of November 1, 1917. Speaking round numbers this last value $102,000,000.00 as compared 57,400,000.00 for the 1910-1914 level.” It further ~vear being wag with price appeared that the mated valuation of The Connectic Railway and Lighting Company’s lines, separate from the other property, in- cludes capital improvements and bet- terments amounting in round figures to $4,000,000, made by respondent since assuming the operation thercof under lease. This amount, added to the above item of $36,458,385 would make the total property and lines owned and operated by respondent $40,458,385 and the total value of all the property and lines owned by re- spondent $45,458,385. Respondent is obligated to pay $1,050,000 annual rental from lines leased to The Shoro Line Electric Railway Company. If the value of the company's prop- erty were vital in determining the is- sues involved in this case, it would be | necessary to make a more critical an- alysis of the valuation submitted, par- | ticularly for equipment, power, and general and miscellancous accounts, but, as stated in petitioner’s brief, “on the present hearing it is unne ry to consider figures on valuation with | a view to determining what is a fair | return for the company, because the | company does not appear to be earn- | ing even fixed charges. Financial Operations. Much evidence and many exhibi containing statistics as to the finances and flnancial operations of the com- pany were presented. Rate of Return. There is no universal the proper rate of return. Courts and commissions have allowed from a minimum of five per cent. to a maxi- mum of from eight to ten per cent. The current market price of mone the character of the utility, its sta- bility and duration of service, its speculative future and financial haz- ards, are.some of the equitable consid- erations which tend to prevent the adoption of any fixed universal rate of return. The question of a proper rate of re- turn, however, is not material or n cessary for the commission to deter- mine in this case, as the minimum rate, without being confiscatory, ou a most conservative valuation of the | compeny’s property as a whole, would be considerably more than the pres- ent rate of fare will produce. rule defining As To Reasonablcness of Rates Complained Of. In determining the reasonableness of a company-made rate, or in estab- lishing a commission rate, many con- ditions and conflicting theories are in- volved, but certain fundamental prin- ciples remain unchanged. It may be assumed, therefore, that the prime ob- Ject of a utility company’s operatior {1s to serve the public within its o cupied territory; that such a service is not a gratuity, but one costing money, in legitimate capital invested, and the reasonable operating and { overhead expenses which the peoplo | served must pay for. | The service rendered is for the pub- } lic, and while an obligation rests upon the chartered utility to render serv- ice, an equal obligation rests upon the public so served, to pay sufficient rates therefor as will enable the company, properly managed and economically operated, to obtain a fair return upon the value of its property so used. The management and economical operation of any large company are always subject to improvement, but if the standard of a given company compares favorably with that of a majority of similar companies, its failure to reach the proper mark of efficiency would apparently be due to general, rather than local, conditions. The measure of success along this {line is generally reflected by the ra- tio of overhead expenses to operating revenue and operating ex|®ases. The percentage of overhead expen of the respondent for the five fiscal vears 1912 to 1916 inclusive, to its operating revenue and operating ex- penses, is compared with that of The Bay State Street Rallway Company, the Springfield Street Railway Com- pany, The Worcester Consolidated Street Railway Company, and the New York State Railways Company, in Exhibits Nos. 65 and in evi- dence, and the respondent’s per cent. of overhead to operating revenue and expenses is shown to be less than those of the companies cited. The public is as much if not more interested in the character of service rendered as in the rates charged, be- ing more inclined to pay liberal rates for good service than low rates for poor service. It is unfortunately true that the character of the service ren- dered by the respondent and possibly by most. street railway companies, is inadequate for the present day de- mands. The report of the Special Recess Committee appointed by the Massachusetts Legislature of 1917 states: “The public is not receiving the service to which it is entitled and the investors in street railway securi- ties are not receiving a roturn com- mensurate with the investments which they have made. The manner in which street railway securities have been regarded by investors is shown to some extent by the market price of the stock. One of the fun- damental difficulties concerning the whole stret railway situation is the fact that neither the stree railways ¢ ‘or he public has recognized the act that neither the street railways | ticut, lines New | could get along, | obligor. | $904,682. nor the publ) community is The quality public is entitlec pany to obtain pay all legitimat charges and allo capital invested capital for nece cilities and extens Considerable o duced tending tg for increased revd €. Noves, chairmg Federal Tr respondent’s this branch “La sprin; altogether. the comm dend in t ary thing, the stockholders ng account of a quiteg of affairs, it amo; failing to make g st. As I think the & the interest on the Hlaven prope Hartford property b by the New YO Hartford Railroad New Haven Railroady stockholder, expected return by way of divide is one reason why we strong moral obligatio; least enough dividend t the bond interest on gur prof which the New Havef Ralilroad % paying. But we difin't have means. We couldn’d do it. So we passed the dividend /altogether. That was, in effect, failing to pay our bond interest—the interest on the iftrst mortgages on our Jproperties. We had Ppropg of te take o 4 unit’ o) bulated sed one system, Iy called the been in vogue ‘tical the street railways ¢ country up to a very recent daf] in most cases up to the present| The distance of the several zond not always remained the same, companies having from time to to take the step, and it will have to | lengthened or shortened certain continue for ths future, until condi- | tions improve. We hoped, by keep- ing that money in the treasury, we but costs continued to increase and pile up, and we found last summer that we would have to do something else. We could not meet our rentals and charges and expenses. So we falled to pay the rental due The Connecticut Railway and Lighting Company. That was a case where we could do that because the lease of The Connecticut Rail- way and Lighting Company was made to the New Haven Railroad, and the New Haven Railroad as- signed it to The Connecticut pany, but The Connecticut Railwa and Lighting Company looked to the New Haven Railroad as the primary . We were not paying interest on our mortgage in- debtedness and were not paying our rentals.” The present six cent rate is an in- crease of twenty per cent. over the old rate and it was estimated by offi- cers of the company that the present rate would yield about ten per cent. increase in passenger revenue, oOr apparent from this statement a It i that the company has not reached solution of its troubles. The respondent's statutory obliga- tion of maintaining streets and high- ways through which it operates, is very heavy. Where the company operates two tracks in city or paved streets, it is required to bufld and maintain nineteen (19) feet in width thereof, and in case of single track nine (9) feet in width thereof, with such type of permanent pavement as the municipality or highway officials may designate, and that portion of the public which uses the company's ser- vice is compelled to pay for such | paving, although the direct benefits thereof result in favor of the public in general and of automobile users and competing jitneys in particular. The rates in Hartford and on radiating lines are the same as main- tain throughout the system. The rates in Hartford prior to the recent increase were the same as maintained | there for a long period of vears. A large amount of evidence was in- troduced showing advances in the | prices of all materials and supplies essential for the maintenance and | operation of street railways, and it is a matter of common knowledge that there has been a material increase in the cost of labor and material during | recent years. While improved facili- ties and increased business naturally reduce the cost of operation in com- parison with gross receipts, yet the history of every industry today indi- | cates that the volume of business, no matter how material the advance, is | not sufficient to overcome the mount- | ing costs of labor and material, and consequently the price of the product has had to be raised. It is not un- reasonable to assume that the cost of providing street railway service in Hartford has increased out of propor- tion to the benefits obtained by an in- creased volume of business. If the lines in the city of Hartford were to be segregated and an accurate | account of each could be obtained, it would undoubtedly show that certain | lines could be operated even on a five | cent basis at substantial margin of profit, while others would be operated at a loss, and if all the lines in Hart- | | not have (usually lengthened upon requ parties located near the fare still retaining the same unit o for each zone. In some cases zones have been lengthened to t! tent of reducing the total num' The development of local co ities and the selection of part] sites for the construction of sub) residences have been materiall; fluenced and controlled by this established zone system in stree way transportation. The petitioner claims that the ent zone system is inequitable that the mileage system, by whid passenger is required to pay { mileage basis for the actual di traveled, would be much fairer. titioner further claims that if elimination of the present zond tem in populous centers, ag Har] is impracticable, that the city should be contracted, with limits of equal radius from th ognized center, the charge ther: be the five cent unit of fare, and traffic outside of such zone be ried either on the present zond tem, rearranged, or on a mi basts. The adoption of the latter or native plan suggested by the tioner would result in suburban and some parts within the city, ing not less than seven cents street railway transportation intf city on the mileage basis and no than ten cents on the zone basi which it is now paying six cent: traffic figures were produced which it could be determined much increased revenue, if any, a plan would produce. Its ge| adoption, however, would eli the populous centers and relievs larger number of street railway) séngers from sharing the burde producing the necessary incr revenue, which would then hav fall upon the comparatively fey However defective the present established system may be, any cal change therefrom should nof adopted without careful study analysis of traffic and other railway conditions on the parti lines and system to be affected. is a practical though somewhat plex economic problem which transportation company itself, its experts and intimate knowled operating conditions, should prim solve. 1If the solution is to be o by the commission or any mandq order issued by it, changing the ent zone system to a mileage syq | 2 combination of mileage and rvice at cost” syste: any other system, it could onl done after a careful investigd cuch as has not been made and d been made upon the presented in this case. We therefore, at this time determine reasonableness of the rates d plained of as levied and collecte the zone system used by the res dent. system, Conclusion, Existing abnormal conditions, sulting from the present internati war, are necessarily involved must be taken into consideratio: [ affecting the cost and selling prig The naf is to the company’s product. result of war conditions I burdens, but these burdens shoul far as possible be equitably distr] ed. The added burdens thus re ing to a transportation com] should be borne in part at leas ford were to be segregated from ra- diating and contributing line: it might show that the Hartford city lines with the trafiic from radiating and contributing lines could be oper- | ated at a profit on a five cent unit of far But the present volume of traffic on the city lines, as well the general business of the city, is more or less dependent upon the traflic brought in over the suburban and, contributing lin: and any segrega- ., tion of parts or radical differentiation in rates would detrimentally affect the social and economic structure upon which all the co-related communities were developed. It is unquestionably true that in the street railway development of Connec- remoze and jsolated and extensions were built which are not and never have been self- supporting, but which are connected with and form a part of the respon- dent’s present system. If these lines were to egated and made en- tirely dependent upon their own pro- ducing revenue, the rates for fl\e] i certain be = as soon exist. and war time and the necessity of mg taining them at are strongly emphasized in the red correspondence between the secretf] of the treasury and the presiden th United States, in which the iaf says: limited service thereon would have to ! jties should the stockholders as a patriotic d as well as by the patrons of compan; That which in no times would be a fair return in way of dividends for capital in ed, might in war times cause an equal distribution of the burden: favor of the stockholders. On other hand, rates of fare which normal times would be reasona might in war times be unreason: low, thereby causing an inequit: distribution of the burdens in f4 f the patrons. Therefore, any ablished under war time cof nd influenced by such co: uld be the subject of rev as such conditions cease The importance of street railw other local untility companied maximum efficle “‘It is essential that these ul be maintained at t be so high as to be prohibitive, and | maximum efficiency and that eve 1t Street railways have been impor: tant factors in the commercial and in. ndonment would necessarily follow. | thing reasonably possible should (Continued On Ninth Page).