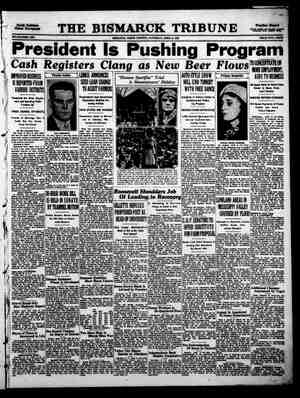

Evening Star Newspaper, April 8, 1933, Page 15

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

FINANCIAL. *% A-JS5 ° STABILITY EVIDENT FINANCIAL. CHANGESINBOND |[BoNDS THE EVENING STAR, WASHINGTON, D. C., SATURDAY, APRIL 8, 1933. VEGETABLE PRICES |CURB SHARES DROP| ["N. Y. CURB MARKET Received by Private Wire Direct to The Star Office. ON NEW YO STOCK EXCHANG - PRICES ARE SMALL Recovery Scored by German Dollar Issues After Re- cent Declines. BY CHARLES F. SPEARE. @pecial Dispatch to The Star. NEW YORK, April 8—Compared with recent sessions the bond market tor day was sluggish and there was less fluctuation in prices. The most im~ portant development was the improve- ment in German dollar loans, which have had a decline this week that seri- ously affects those portfolios in which , they are held in volume, ‘The recovery in German loans was mainly technical, for there was notihing in the news from Berlin to support it and - prices for the Government issues in London were off 2 to 3 points. the same bonds started fractionally higher and maintained this gain most of the session. There was some irregularity in other dollar loans at the opening, but later these followed the trend of the national JAssues. The only other feature in the foreign department was an advance to new high prices of the year in Japanese government 51, and in Tokio Electric 6s, the one up about 17 points from the low and the other 12 points. In the domestic list there was con- siderable irregularity. Bonds like New York Central 3l2s and Northern Pacific (g g 0 15t 45'48. 0 3s declined to new low prices. On the other hand Western Electric 55 made a further advance of a point, showing a Tecovery of 5 points from this week’s lowest, and Detroit Edison 5s, which touched a new low of 90 Friday, recov- UNITED STATES. Lib3%s832-47... High. 10113 1 Lib 1st4i4s 32-47. 102 6 101 1 Lib 4th 43 #33-38 102 8 102 6 U 8 3s51-65 . 10421 10417 . 10781 10728 Sales. High. Ab & St 5%s 43 Alleghany 5s'4 Alleghany 5s "4 Alleghany 5s '50. Allis-Chalm 55 '37. Am Beet Sug 68'35. Am Int15%s 49 Am Metal 5%s " Am Sm&Ref 554 Am Sug Ref 65’37 Am T&T 4%s 39 Am T&Tc tr 5s Am T&T deb bs Am T&T deb 5s'65. Am T&T 5%s'43. . Am Wat Wks 5534, Argentine 535 '62. Argentine 6s '59 Oc Arm & Co 4%s'39. Arm Del 5%s '43. . Atchison gn At CL col & Atl Ref db 5537 Australia 4345°56. Australia 5s Australia Austrian 7: . Austrian 75’57, P B&O 4%s® B&O1st5s B & O ref 559 B&0Swdvis B & Toledo 45'59 Batav Pet 4%s° ered 1Y points. American Telephone & ‘Telegraph 5s were fractionally higher, as were Consolidated Gas of New York 5s. The McKesson & Robbins 5158 touched minimum for the year. As a class the junior rails were steady. Changes in the list of U. S. Govern- ment loand were slight ard varied with the different issues. The 3s advanced LOSS IN BANK CLEARINGS CONTINUES DURING WEEK By the Associated Press. NEW YORK, April 8.—Bank clear- ings again show a considerable decline from those of a yeer ago. The total ‘week, at all leading cities in States, as shown by the treet, Inc., of cent under lew York City. $3,085,975,000, a reduc- cent, while the total New York of cerft smaller. . Clearings this week exceed those of last week by $558,382,000 wherezs last year at time, the increase was $1,612,018,000. ‘The heavier total in both instances will be accounted for, in part, by the fact that this week’s clearings cover the larger monthly and quarterly settle- jments payable now. © The report for leading centers show- decreases as compared with those Belgium 6s ‘55 Belgium 6%s " Belgium 7s ‘55 Belgium 7s ‘56 Bell Tel Pa s B'48. Bell Tel Pa 55 C'60. Berlin Cy El 6s'55. Berlin CEl 63%#'51. Berlin C El 6%45s'59 Beth Stl pm 5s5°'36. o Brazil 6348 '26-'57. Brazil 634s°27-'67.. Bklyn Ed 5s A '49.. Bklyn Elev 6% Bklyn Man 6s A *68 Bklyn Un Gas 55’50 Budapest 6s - Buenos A R 6s'61.. BR & Pitts 4%s'57 Bush Ter con §s'55. § o - DA NN OBNREDRDBEAR OO HNB D NWDO R DD 5~ Can Nat Ry 4%5'54 Can Nat Ry 4148’57 2 Canada 65s '52. Can Nat Ry 44851 4 Can Nat5s'63 July 5 Can Nor db 63 °46. .| Can Nor deb 7s "40 Cent Pac 5s 60.... Cert-td db 534s '43. C&Oconbs 39. 82 27% 9615 9613 . 9814 9810 100 27 100 24 9812 100 27 100 20 100 30 108 1 Low. 82 27 104 104 20 10731 Close. 82 27% 20% 9% 65% 42 25 65 67 65 83 104 101% 101% 101% 103 100 103 99% 103 100 99% 99% 99% 108% 103% 103% 8% 78 8 441 44% 4% 48 80 48 80 48 80 5% T4% T5% 8T% 52% 99 3% 6% 86% 98% 27% 23% 34% 15% 80% . 1 Ches Corp 55 '47....10 C&O4%SA'93... 8 2 1| CB&Q I11 4" CB&Qrfs’'7l.... 2 CB&QII13%s'49.. 10 Chi Grt West 4559, 4 CM & StP gn 48’89, 4 Chi M&EStP 4%sE. 1 C M StP&P bs'75., 2 year, is printed herewith; also, | CM&StPad 532000 3 clearings bank since October: (Totals in thousands). Week April 5, 1933. 9 . 24.0 4 1 5 =Y e R GAIN IN SUGAR OUTPUT REPORTED BY INSTITUTE By the Associated Press. * NEW YORK, April 8.—The Sugar Institute, Inc., i that imports of foreign and insular refined sugar in- creased 244 per cent in the first two months of this year compared with the s:m: period of 1932. Cuba shipped from insular possessions 34,735 against 30,040. Total deliveries of all refined sugars in the United States last month are estimated at 347,302 tons compared with 345812 in February, 1932. Deliveries for the first two months amounted to 690,742 tons compared with 701,997 in the same period a year ago. SHIPMENTS OF LUMBER SHOW SHARP INCREASE By the Assoclated Press. Lumber production and new business booked during the week ended April 1 ‘were lower than the previous week, but shipments were the highest of any week since last September, on the basis of reports from leading mills to the Na- tional Lumber Manufacturers’ Associa- tion. Orders for the week amounted to 155,023,000 feet, and production amounted to 96,339,000 feet. Shipments from the mills aggregated 150,617,000 Teet. Curb Seat Sells Higher. NEW YORK, April 8 (#) —Sale of & New York Curb Exchange member- ship at $27,000, up $2,500 from the previous transaction, was announced yesterday. CHICAGO STOCK MARKET CHICAGO, April L ‘(‘;‘)-!——!"‘Oll:wing is the complete offic] of trans- actions in stocks on the Chicago Stock Exchange today: Bales. STOCKS 150 Abbot Lab. . 100 Asbestos MIg. 100 Bastian-Bless 100 Bendix AV . 300 Borg-Warner % Shret - Chi R14%s'60. gTHhBE in 58 "6 Chi & NW gn 4s'87. 10 Chi&NW 43452037, 15 N 45 CI [+ Childs deb 5543 Chile 6s 60 Chile 65 ‘63 Cologne 6%s '50... Colomb 6s '61 Jan. . Colomb 6s°61 Oct.. 11 Col G&E 68’62 May 9 ColGas& EGs'61.. 1 Colo & Sou 4%s'30 8 ConG NY 4%s'51. 4 ConGasN Y 5s°'57. 4 Con G NY 5%s 45, Copenhag 4%s '53. Copenhag 5s°'52.... 2 Sanaanane omam S ™ a ‘uba R Cuba Nor 5%s '4: Del Pw&Li4%s'71. Denmark 435 '62.. 1 Denmark 5%8°55.. 1 Denmark 6s'42. ... D& RGren 4s D&RG W 5s"18.. Det Ed 4%sD'61.. Det dison rf 5549 3 104 4 62 The total was| Det Edison §s’52.. 98,254 tons against 78,983 a year ago.| Dodge Bros 6s'40.. 63,335 tons against | Donner St 7s’42.. 44,551, a rise of 42.16 per cent. Imports | Duquesne412sA’67. aggregated | Duquesne4 3 sB'57, DE15%s'53 Nov.. Dutch East 165’47, Dutch East ] 6562, East C Sug 7%s'37. Erie gen 4596 Erie ref 5s Erie ret s Finland 5%s Finland 6s ‘45 Finland 63%s Finiand 75 '50 French Gv 7% 5 Gelsenk'hen 6s ‘34, 12 Gen Baking 5%s'40 1 Gen Th Eq 5s'40... 2 Ger Cent Bk 6s'38.. 34 Ger Cen Bk 6s'60J 17 Ger Cen Bk 65 600 29 Ger Cen Bk 7s '50. . Ger Gen Elec 6s'48. Ger Gen E1 78 '45. . Ger Gov 5%5°65...14 German 63%s'50... 8 German Rep 7s'49. 53 Goodrich 6s°45..%, 15 Goodrick 63%s°47.. 3 Goodyr Rub 58'57.%, 15 Grand Trunk 6s'36. 1 Grand Trunk 7s'40. 11 N BRI N A O N oo GrtNor4%sE'77. 2 Grt Nor gn 78°36.. 12 Hudson Coal 58°62. 7 Hud & M adj 68'57. 3 Hud & M rf e 1 Humble Oil 58 111 Bell Tell 55 56 111 Cent 4% s "66 111 Steel db 43 s’ 2 Inland St 4%s8 A'78 2 in® Rap Tr rf$s 66 48 Int& Gt N5s B'56. 2 | Int Hydro Bl 6s'44. 3 Int Pap ref 58 A'4' 5: «|Int T&T s 55 Italy 7s ‘51 Japanese 6%s'54.. 43 Kan C F S&M 45'36 36 1ot G 7% Kresge Found 6 Laclede 53%s C '53. 003 64 33% 67% 100% 100 87 52% 99 2% T6% 24 24 104% 104% 36% 35% 86 98% 27% 28% 33% 15 80% 73 % 99 % 103 62 64 33y 67% 874 52% 99 Sales. McKes & R 51;s'50. 25 Maphat Ry cn 4590 1 Market St 7s A 40. Milan 636852, ... Mil E Ry&L 55 °61. Mil E Ry&L 58 '71. MSP&SSM cn 4s '38 MSP&SSM 54%s'78 Swe MK MEK&T4%s T8, .. MK & T adj 5s°67. Mo Pac gn 4s'75. .. Mo Pacrf 6s A '66. Mo Pac 5s F'77 we Bl vnovwnoanriearme YCrf4%s2013. 3 Y Crf43%s2013n 20 YCrf5s2013... 4 NYC&StL5%sA'74. 1 Y Centdb 6s'35.. 2 YC&StL 415s'78. 6 Y Edison 55 B'44 10 Y Edison 55 C'51.°13 YEdrf6%s'41. 42 Y EL H&P 4s'49. 5 NY EL H&P 5548, NY NH&H 3%s 56 NY NE&H 65'48... NY O&W rf 45°92.. NY Rys Inc 6s°65. N Y Steam 5s '56. . . N Y Tel gen 4%s NY W&B 4%s'46. . Nia Sh Md 5%s 5 Nord 6%s'50 Nor & Wn en Nor & Wn div 45’44 North Am Co 5s’61. Nor Am Ed 5s C'69. Nor Am E 5%s'63. Nor Ger Litd 65 '47. Nor O T & L 65 '47. Nor Pac gn 35 2047 Nor Pacr 1 6s 2047, Nor St Pw 5s A "41. Nor St Pw 6s B'41. Norway 5s°63. Norway 6s '43. Norway 65 '44. Norway 6s'52. Ohio P S 7%s'46... 4zz2 Z22222 Oreg-Wash 4s'61. . % | Orient Dev 53 s ‘58 99% 97% 99% I;OK 110% 110% 673 100% 101% 101% 101% 97 97T 97 67 122 55 Gt Brit&Ir 5%s'37 53 104% 104’ 98% 98% 67 121% 54% 99% 1% 441 35% 35% 47% 26% 29% 381 41% 59y 35 % % 36% 36% 46 31% 43 73 96% 684 57 45% 20% 43 73 2 101% 101% 7 103% 108% 7 33 32 96% 68% 56% 19% 25 40% 10% 23% 19 98% 9815 67 121% 56 9% 1% 50 39% 38% 52 27 40 101% 103% 33 96% 6815 56% Mo Pac 5s G Mo Pac 5s 181 Mo Pac5%s A Mont Pow 53 '43. Nat Dairy 5% s'48. . Nat Steel 63 '56. ... Nw S Wales 55'58. . N Y Cent3%s'97.. Port Gn El 4%s Pos Tel & C 5s'53 Public Serv 4s '7’ Orlent Dev 6s '53.. Pac G&E 5s"42.... Pac T&T 1st 5s'37. Pac T&T rf 55°62. . Param-Pub 5%s'50 Penn 4% s D'81.... 1 Penn cn 41560, Penn gn 4%s"65. Penn 4%s D '70 Penn s "64 Penn gen 5s '68 Penn 6%s°36...... Penn P&L 4%s'81. Peop Gas ref 5s "47. Phila Co 5s '67. . Phila Elec 4s°71. Phila & Read 6s *49 Phillip Pet 5% s "39 Pillsb F M 65 '43. Poland 6s 40 Poland 7547 Poland 8s '50. . PubBv G 4%s 67 Pub Sv G 43%s°'70 Queensland 7s'41.. Rem Arms 6s A '37 Rem R 5% SA"4Tww Rhinelbe U 7s '46. . Rhine Rubr 6s'53.. Rhine West 6s '52.. Rhine West 6s '53, . Rhine West 6s '55. . Rio de Jan 6%s '5 RioDeJan ext 85’46 Rome 63s '52. Royal Dutch 45 "45. Rumania 7s '59 StL IM R&G 45'33. StL&SF4%s'78, St L&SF §s B '50 Sao Paulo 8s'36 Sao Paulo 7s '40 - —a B ARRARNE0- N B e Shell U O11 55'47. . Shell U O 5s "49ww. Silesia Prov 7s ‘58 Sine Oi1 6%s B '3 Sinc Ol 7s A '37 Sinc P L §s 42 Skelly Oil 5% Solvay Am 5s*42.. Sou Bell T&T 55’41 Sou Pac col 45'49.. Sou Pac 4%s°68. .. SouP4%s 6 ww.. Sou Pac 4%5°81... Sou Ry gn 4sA'56 '56. StOIINY 4%s'51. Studebaker 6s *42 Sweden 5% s ‘54 Swiss 5%s '46. Tatwan E P 5%s'T1 Tenn EI P 6s A *47. Ter As St L 5544, . ‘Tex Corp cv 58 4. Third Av rf 48 '60 Tob P NJ 6% 20 Tokio 5%s '61 Tokio EI Lt 6 Union El L&P 55'57 » PN NG O D 5 TN TN G GO DA IS b B et G0 0 » RBeson Un Pac 1st 4547, Un Pac 4s 68 Un Pac 4%s 67 U S Rubber 55 "47 Un St W 635 A'47. Un St W 6345 A'51. Un St W6%sC'51. 0 o | Live Utah P& L 5s'44.. Util Pw 55’59 ww. Util Pow 534s47. ., Vanadium St 5s'41. ’a Ry 1st 58 A 62, Va Ry & Pw s '34. Wabash 4%s'78. .. Wabash 1st 5s°39. . Wabash 53 B '76. Wabash 65 D '80. Webash 53%s'75. Walworth 6s A "45. Warn Quin 6s '39 Warner Sug 7s Warsaw 7s '58. West El db 5s'4 West Pac 53 A "46.. West Union 5s 5. West Union 5s ‘6 West Un 6%s 36 Westphalia 6s'53. . Yokohama 6s°61. .. Yestn S&T 53 A'78. Ygstn S&T 58 B'70. » » arS avsrnuSoarmrnenss Ron oRnaBasaate Baltimore Markets Special Dispatch to The Star. BALTIMORE, Md., April 8.—White potatoes, per 100 pounds, 85a1.00; new, bushel, 1.25; sweet potatoes, bushel, 40a90; yams, barrel, 1.25a1.60; aspara- gus, dozen bunches, 1.00a3.00; beans bushel, 1.00a1.50; beets, per half crate. 1.00a1.25; cabbage, per ton, 15.00a17.00; carrots, bushel, 45a55; caulifiower, crate, 1.25a1.40; celery, crate, 1.25a2.50: cucumbers, bushel, 2.50a3.50; eggplants. crate, 1.00a2.00; kale, bushel, 15a20; lettuce, crate, 3.7524.75; onions, per 50 pounds, 60a275; lima beans, bushel, 2.25a 3.00; peas, bushel, 2.00a3.00; peppers, bushel, 75a1.50; spinach, crate, 150; uash, bushel, 1.50a2.00; tomatoes, luz, 1.75; turnips, basket, 25a40; apples, bushel, 35a1.50; strawberries, quart, 10a20; grapefruit, box, 1.75a2.50; oranges, box, 2.00a3.25; tangerines, haif ! box, 1.00a1.50. Dairy Markets. try—Turkeys, hens, pound, 23; g rs, 17al18; hens, 20; old toms, 14ald; capons, 20a35; chickens, 20a22; broilers, 21a25; hens, 11a15; Leghorns, 11a12; old roost- ers, 8a9; ducks, 11al3; guinea fowls, 25a45; pigeons, pair, 15a20. gs—Receipts 2,005 cases; current qu;m;uek eggs, 14al7. tter—Good to fi STILL UNSETTLED Irregular, With Lower Price Range. Vegetable markets were dull, irreg- ular and slightly lower in price for most lines the first week of April, says | the United States Department of Agri- culture, Bureau of Agricultural Eco- nomics, Market News Service. Warmer weather lessened the demand and im- paired the keeping quality. Supplies of Southern produce from sections north of Florida and Texas are competing more strongly with Northern vege- tables. Carlot shipments of fruits and vege- tables total about the same as in re- cent weeks and the corresponding weeks last year. Potato markets still show a strong tane in most producing sections, and receipts of Northern potatoes are decreasing. Onions and cabbage, old and new, are declining gradually in price as Southern shipments increase. Apple shipments are lighter and prices hold recent gains, although demand is not very active. = Potato Market Firm. Prices of potatoes have not held all the gain made last month, but recent prices, slightly below the top, are being well maintained and there is a tendency toward higher levels in some producing sections. Shipments of old potatoes are decreasing gradually and Southern shipments are not very active yet. Southern potatoes are selling about $2 a barrel lower this year, compared with April, 1932, but Northern potatoes sell not far from last season’s price level Prices advanced 2 to 5 cents per 100 pounds in Western New York, some sales exceeding 70 cents. A few dealers have been brushing some of their stock this season and were able to get about 3 cents premium. Country roads are in poor ccndition in Eastern producing sections, resulting in light haulings from points off the main highways. Buyers with motor trucks are paying about the same price as dealers are able to 1:: on wire orders. Prices to growers advanced in early April, averaging about 30 ¢ents per 100 pounds in bulk. Some dealers, East and West, are reported in- clined to hold in the expectation that higher prices will prevail. Something depends on the ments, which, according to local re- ports, are expected to range from 8,500 to 11,500 cars from now to the end of the season; but the activity during the last part of the season will depénd con- siderably on the extent cf Southern competition, which has been moderate so far. Dealers in Maine producing sectionghave been paying growers 60 to 80 cents per barrel in bulk. They are selling sacked stock at shipping points at 50 to 55 cents per 100 pounds. Country-wide shipping pcint prices range from 50 to 75 cents and the trend was quite well maintained during the first week of April. Supplies of old po- tatoes are moderate in most Esstern markets, but rather liberal in the Middle ‘West. Demand appears to be generally moderate. Jobbing sales of Maine pota- toes range. about steady at 90 cents to $1.20 per hundred pounds in Eastern markets. New York and Pennsylvania stock is quoted at 85 cents to $1. The Chicago market was fairly steady the first week of April at 70 to 75 cents. Prices cf sweet potatoes did not change much the first week of April. They are selling relatively higher in the East and the Middle West. Eastern Shore stock of the Jersey type brings $1 to $1.35 per bushel in Eastern mar- kets. Bushel pack from New Jersey i ll;:g:g! $1.25 in Pittsburgh. North Caro- Puerto Ricans range from 60 to 75 cents in Eastern markets. Nancy Halls l.);:h qixo\‘.ed steady at 50 to 70 cents a el. Onions Lower. The onion market weakened consid- erably in late March and early April. Heavy shipments, including. many onions of poor market quality, together with the unexpectedly good condition of some of the Southern receipts, have apparently dulled the outlook for the small remaining holdings of Northern onions. Demand has slow in Western New York, and prices declined about 10 cents per 50 pounds in early April, sales ranging from 50 to 60 cents. Most of the onions remaining in Wcst- ern and Central New York are in grow- ers’ possession and are of rather ordi- nary quality and condition. Not much Eastern stock is good enough to bring more than 75 cents per 50 pounds in city markets, and the bulk of sales is at 50 to 65 cents. Massachu- setts stock of fair grade sold at 60 to 65 cents in Boston. A few Midwestern yellow onions sell as high as 80 cents. Few white onions are good enough to bring more than 50 cents. Prices of Southern onions have declined rapidly since the beginning of the season. The season for old cabbage is nearly over, although local estimates show 200 carloads available in Western New York for April shipment. Probably many of these will be shipped by motor truck. The condition is rather poor, and the stock does not carry very well. Market has been weak in Eastern producing sections, and prices declined to $8 per ton for bulk cabbage. The season has been unprofitable to growers, Most of the cabbage was sold to dealers at $3 to $5 per ton early in the season, com- pared with $5 to $12 the season before and $12 to $45 two years ago. City prices of cabbage have declined consid- erably further this month, ranging $12 to $16 per ton bulk in Eastern markets the first week in April, A few sales of carrots are reported in Eastern producing sections at slightly higher prices, around 50 cents per 100 gound.s for sacked stock. Shipments ave been much lighter this season, scarcely exceeding 1,000 carloads from New York shipping points. Apple Markets Steady. Demand for apples has been slow since the prices were advanced in late March and early April. Accordingly, the rising tendency been checked, although shipments are decreasing rap- idly. Trading has been rather limited in Eastern producing sections. Prac- tically all of the Greenings are cleared up and buyers seem unwilling to pay the asking prices for Baldwins at $1.12- $1.15 per bushel in Western New York. Romes sell in the Rochester district at $1.20-$1.30 and McIntosh at $1.20-$1.25. Most of the demand was for bushel pack, and there are only a few sales of barrel pack for export. Carlot arrivals are light to moderate in Northern markets, but demand is only fairly good. Jobbing sales of East- ern Staymans range mostly 90 cents to $1.15 per bushel. Some overripe sell lower. Black Twigs are quoted 75 cents to $1 in Philadelphia, Baltimore and ‘Washington. Greenings in best condi- tion reached $135 in the New York market. Spys and Kings sell at $1 in Pittsburgh, Best lots of McIntosh sold from $1.50 to $1.75 a bushel in New York. Yorks ranged mostly 85 cents to $1. Sales of the batrel pack of dif- ferent varieties were quoted at $3.25-84. | GERMANY IS .PLANNING FIRMER GRIP ON MARKET By the Associated Press. The Commerce Department is advised that stronger government control of stock exchanges in Germany is em- bodied in new official regulations issued by _the government. Directors of the stock exchanges must now have approval of the cham- bers of commerce before they can take their seats. These chambers are in turn controlled by the government. On 1to sell or neglect the extent of Maine ship- | tel IN SMALL MARKET :!Markets Remain Dull and|Flurry in Copper Issues Is Feature of Dull Week- End Trading. BY JOHN A. CRONE. Special Dispatch to The Star. NEW YORK, April 8.—The Curb Ex- change moved narrowly lower in to- day’s inactive short session. The market leaders, Electric Bond & Share, Standard Oil of Indiana, Amer- ican Superpower, Cities Service and Gulf Oil from the outset pointed down- ward. Their direction was not changed by the opposite paths taken by other active groups. Strength and dctivity of the gold mining stocks featured early dealings. Then followed a flurry in foreign cop- shares. Deaed by a sell-off in the oils, based on higher State gasoline taxes, and by some impmvemen§ ‘}a miscellaneous in- dustrials and specialties. Over the last two weeks there has been a decided tendency to purc! so-called “commodity-inventory” stocks, like sugar producing and refining com- panies, silver and gold mines, food, steel, farm implement and motor issues, ung “rate regulated stocks, such as public utility and rail- road securities. Naturally today, as in preceding ses- sions, these general trends had impor- tant exceptions. Lone Star Gas, for in- stance, pointed higher as a result of its 1932 income statement, which showed 71 cents a share, against 75 cents in 1931. On the other hand the weakness of Woolworth on the big board caused a recession in Woolworth, Ltd. Mergenthaler Linotype, which has not appeared on the tape in some time, was | 18 bid and 21 offered. Subsequently it sold at 20. Parke-Davis lost some of its recent buoyancy. Great Atlantic & Pa- cific Tea common ned up 4 points. Ward opened up & pant. opened up & 3 Cord, Ford Motor, Ltd, and Stutz were the most interesting issues in the motor division. American Cyanamid B overshadowed all other movers in the chemical list. A wide range of gold se- curities were represented, as Pioneer Gold, Lake Shore Mines, Wright-Har- greaves, Teck-Hughes and Hollinger Consolidated came out at frequent in- rvals. Following the early activity of some South African copper mines, Roan An- telope, for example, holding companies like Newmont Mining pointed upward, Aluminum Co. of America reacted. Trading corporations lagged. National ‘Transit, one of the few pipe lines to ap- pear, was lower. BONDS ON THE CURB MARKET. Salesin DOMESTIC BONDS. thousands. High. 1 Alabama Pow bs 3 Alabama Pow 55 i Dis El 4%s 'T0A 4 Chi Dis El 5135 "70A" 39 Gitles Service 5s 50 8 Citles Service 5s '60. 9 Cit 8rv Gas 5 was ;3 2153 EERF IZRERS I EE TRt Sttt S 3 > Do mamansngae Ze2NB32323555 & Narraganse! 5 Narragansett 5s 5Nat P & L fis A INat P& L bs B PS 9 s s 'S80 71 '50 105% 1 1268 19 & 15 Pac G&E 4las '57 las P '60 B4 o5 58 L 5 przazyryyyy 5s C 2025, d Bs '5: By ,_ vEeres FOREIGN BONDS. 3 Buen Al Pr 7las '47 27 Cen B Ger s A 3 | S FEPESEEES & e W WRES BFE F RS This_movement was suc-| 2ot mo':: than $100,000, operating ex- 4 | $100,000. .|WHOLESALE DRY GOODS % [By the Associated Press. AirInviIncvte.... 1 Alum Co America. .600s Am Beverage 1 Am City P&L B 15¢ Am Cynamid (B).. Am Dept Stores. .. Am & For Pwr war. Am Founders. ..... Am Gas & El (31).. ‘Am Gas & El pf(6). Am Investment. Am Superpower . Ark Nat Gas (A)... Asso Gas&Elec (A) Atlas Plywood . Atlas Utilities. ... Atlas Util pf A(3).. Babcock & Wil(1). Benet Ind Loan 134 Blue Ridge pf (a3). Brill CorpB....... Brillo Mfg (60c)... Cable&Wire A rets Canadian Marconi. . Carib Syndicate. Celanese 1st pf.... Cent States Elec. .. Cent Sta Elec war. Cities Service. ... Cities Service pf... Claude Neon Inc. .. Clev El llum (1.20) Col G & E cv pt (5). 25 Comwlth & Sou wr. Cont Shares cv pf.. Cord Corp (10¢). ... Creole Petroleum. . Cresson Consol (4¢) Crown Cent Pete. .. Crown Cork Intl A. Deere & Co.... Duke Power (4)... East G&F As (60c) El Bd & Share b6% El Bd & Share pf 6. Elec P&L 2d pf(A).150 Fisk Rubber (new) . Kord Motor Can A 5% Ford Motor Ltd. 3% Grt A&P T n-v(17) 40s 146 Gulf Oil of Penna.. 12 32 Hollinger Goldt80c 5 6% Hudson Bay Min... 2* 3% Huyler StoresDel. 2 % P &Lpt (6)....1258 22 1mpOil Ltdcou50c 2 6% ImpOllCanrgb0c. 5 6% COSTS IN CLOTHING INDUSTRY INCREASE Retailers Have Difficulty in Bringing Expenses in Line With Sales. % 45% s 'S Py N N L 1) » & TR ST TSR PN - 5% 1 5% ama 146 30% 6% 3% % 22 6% 6% By the Associatéd Press. CHICAGO, April 8—The men’s re- tail clothing industry has found that its efforts to curb operating expenses during 1932.were, on the whole, “futile.” A survey by the National Association of Retail Clothiers and Furnishers, made public today, says apparel stores “were unable to check mounting costs, even when the most drastic cuts were made in more flexible items.” ' Such constant factors of selling ex- pense as rent, light and heat, taxes and insurance, are listed as why retailers’ efforts to into line with reduced unsuccessful. Cost Factors Rise. - _As sales volume continued to decline, the survey shows, constant cost factors et rlaen‘ expenses of stores verage opera with a yearly volume of less than B}W.- rom 9, per gross 4 36.18 per cent in 1932. A For stores having an annual volume pense in that same four-year period was fcund to have jumped from 31.35 to 38.27 per cent of gross sales. Comparatively little was aged 31.88 per cent for 1932, and 3346 fcr stores har a volume in excess of $100,000. Both these represented cnly slight declines #1929 per- centages. # * “Despite hand-to-mouth buying,” the during This slowing down was noted larly among the smaller group.” Rent Item. in groups of stores from 1931 to 1932, it was found, with an average rise from 7.77 to 10.53 per cent of gross sales in smaller stores, and from 7.67 to 9.65 per cent in larger stores. ‘The percentage of gross sales paid for rent was found to have remained un- changed at 5.09 during the last two years for the average small store, and to have increased from 5.4 to 6.25 for the average store with volume over BUYING IS CONSERVATIVE NEW YORK, April 8.—Buyers in the wholesale dry goods market continue to purchase conservatively in spite of the general opinion in the primary textile circles that prices may advance as a result of reported administration plans for commodity 1evels. In most lines, it is said, jobbers are covering only their immediate needs in addition to placing some advance busi- ness on blankets. Motor Sales Increase. DETROIT, 8 (P)—Harry G. April Moock, general sales manager of Ply- mouth Motor Corporation, has an- will justify one of the largest produc- tlon schedules in the concerns’ his- Construction Awards. engineering construction awards last week totaled $17,256,000 compared with $11,994,000 in the previous week and an average of $11,743,000 for the past four weeks, the Engineering News- Record reports. Market Averages By the Assoclated Press. o g3ngus 351 17001402 1 L1800 £2 Int Petrol (1) 15 Int Util B 2 Kerr Lake 2 Kirby Petrolm 10c. 1 Lake Shore M (2).. 38 Lehigh Coal&N 40c 1 Libby McNeill & L. 1 Lone Star G bédc... 8 Mavis Bottling A.. 7 Mergenthaler k13 . 258 Midland Steel Prod Montgom Ward(A) 20 Nat Bella Hes: Nat Fuel Ga: =g [FERAOTPS U I 1 N Y Shipbldg (10c) Niag Hud Pwr (1). Niles-Bement-Pond Nipissing. . Parke Davis (1) Penroad Corp Pioneer Gold (24c). Pitts Plate G (0c). Premier Gold(12c). Prudential Invest. . Pub Util Hld xw. Pug Sd P&L $5 pt Pure Oil pf (13%) Rainbow Lum A Roan Antelope Rossia Intl. Safety Car H & Lt. 100s 3t Regis Paper.... 1 Seaboard Utilities. 1 Sel Ind all efs¢5%) 50s Shawin W&P (50c) 2 Shenandoah Corp.. 2 Silica Gel ct. . 1 Smith (A 0). . 50: So Am Gold & Plat. Sou Cal Ed pf A 1% Sou Cal Ed pf B 1% Sou Cal Ed pf C 1% Stand Ofl Ind (1).. Stand Oil of Ky (1) Stand Ol of Ohio. . Stand P&L pf (7) - wae-S ey S35 % Stutz Motor Car. Sun Investing. .. Swift & Co... .. Tampa Elec 2.24.... Technicolor. ...... Tech Hughes (§0c) Trans Alr Transp. . Tri-Cont Corp wr.. United Car Fast. United Founder: United Gas...... United Gas pf (1).. United Lt & P (A). United Lt & Pwr pf Utd Verde Ext 40c. Ut Pwr&Lt..... ‘Van Camp Pack pf. Woolworth (F W) Litd (p24 2-5¢)... Wright Harg t20c.. 47 Dividend rates In dollars Based on Stock Sale— Stock and Sale— Dlvldend!ln:h. Add 00. High. Low. Close. Dividend Rate. Add 00. High. Low. Close. 9% 1 IN 30 INDUSTRIES % Trends in Important Lines 30 5% 2 5% ¥% 30% 9 1% % 23% k] 22% 20% 18% 19% | o Running Close to Last Year, Review Reveals. * | Special Dispateh to The Star. BOSTON, April 8.—In an analysis of trends of the 60 leading industries of the country, the United Business Service concludes that in 30 important lines effects of the courageous adjustments that have been made in operating and overhead costs. . The 30 industries with stable trends follow: Aircraft, apparel, automobiles, baking, bread; baking specialty; can- ning, chain stores, chemicals, cigarettes, coal, anthracite; coal, bituminous; cot- the preceding pansion halts. Activity has been cur- tailed more and more as prices have dropped. Today’s prices are so low that many producers have shut down—others per e:;,“-;g 23 per cent“:‘md:‘r 1929. vacuum m filled, | the review. FREIGHT CAR LOADINGS ARE HOLDING UP WELY By the Assoclated Presy. RANDALL H. HAGNER & CGOMPANY INCORPORATED . REAL ESTATE NP 135/ Conneclit Soenaa NH Competent Management of Rental Properties in All Sections of the City nounced rapid upturn in retail sales | NEW YORK, April 8 (M,—Hu\'y' T S22 szagas eazsaasoed MORTGAGE LOAN CORRESPONDENT PROPERTY " Apartment House - MANAGEMENT MANAGEMENT ENTING is only one of the many features of our Prop- erty Management Service—and owners of apartment houses will appreciate the relief from worry with details when they place their properties under our charge. It carefully and consistently ren- dered—for a fee that is- very nominal. B. F. SAUL CO. 925 15th St. N.W. MORTGAGE NA¢1 2100 LOANS NOTICE We are prepared to act promptly on appli-. cations for Loans on Real Estate in the District of Columbia. No Commissions Charged. We Pay 5% to Investing Members Columbia Building Association 716 Eleventh Street N.W. Member of Building Association Council i 4 10% 5. 7! L & Nuni4s'40.... L& N 5s B 2003.... Lyoas 65 '34.00000s 01 tore packed, of the District of Columbia il April 29 a new board of directors will be elected to the Berlin Stock Exchange. There will be only 43 directors on the new board instead of 72 as in the past, the report sald. .., BRIE AR EEREESNSIZRIENEAS! ERIERSNSATGSRNER ! TS ant i d, 19a21%; ladles, 15; 2% 28,,179013; process butter, 16} 81% 81% AL Cuba is taxing salaries, pensions funds, e gEEigezesgenat, Pt sansasates -1 BoaInS 10% 1 WwW_With warrants. Xw-_Without warrants. ew. ‘wi—When issued. 67% 67% 101 fees to raise unemployment (Copyright, 1933, Stand. Statistics Cs.)