Evening Star Newspaper, January 26, 1931, Page 15

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

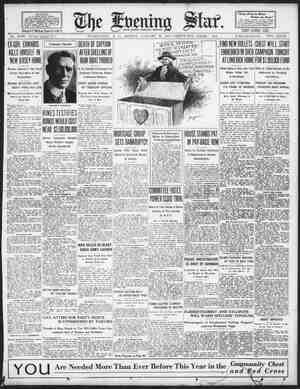

FINANCIAL. CURD SHARES MOVE | N NARROW RANGE| Dullness Characterizes Trad- Ing, Although Market Has a Firmer Undertone. BY JOHN A. CRONE. 8pecial Dispatch to The Star. NEW YORK, January 26.—Dullness marked the opening of the Curb Ex- ‘change today and carried through the morning session, but a slightly firmer undertone came into quotations around 4 midday, ‘The usual market leaders, Electric Bond & Share, Cities Service, American 8u ywer, American & Foreign Power and Middle West Utilities, were exceed- ingly dull and but little change: uAnnouncement nl?l;x fl.s‘ 1931 d‘:n;c- jon program, calling for _expenditures of ugooo 000, by Middle West Utilities had a bracing effect for a time on that stock. Richfield Oil preferred was the feature in the lower-priced miscellaneous petro- leum issues, rising in response to the exchange offer made by Cities Service. ‘The latter would give one of its common shares for each four Richfield common shares. ‘The entry of Swift & Co. into the canned fruit and vegetable business had no effect on stocks of canning com- jes. On the other hand, Libby, Mc- il & Libby turned active and Trunz Pork was up 1%. In the retail food group Great Atlantic & Pacific Tea lost about a third of its 23-point advance of the past few sessions, while Parke, Davis & Co. rose about a half point. —_— Publication of 1930 earnings revealed that profits in most instances were in line with expectations, but this did not certain stocks from selling off. Deere & Co., for example, opened higher hl& quickly "erased all of its early gain d scored & slight loss as 1930 net ved to be $6.06 a share, against 13.13 in 1929. This had a sympathetic effect on other farm implement shares, such as Gleaner Harvest Combine and Oliver Farm Equipment. One of the exceptions to the general trend, following earning publications, m B:ut Co., which eased after the y showed a gain of more than unm in net over the preceding year. ‘The early action of Saxet offered a con- trast with the natural gas list, most of ‘which was strong. United Gas, leader of this group, opened with a block of during period, as were Duquesne and Lone Star, but the latter afterwards inclined to lower levels. PR T PARIS BOURSE PRICES. PARIS, .unmry 26 (#).—Prices were firm on the Bourse today. ‘Three per cent Xm!l!. 86 francs 90 centimes. Five per cent loan, 102 francs 65 centimes. Exchange on London, 123 francs 8815 centimes. The dollar was quoted at 25 francs 52 centimes. FOREIGN EXCHANGE. .lof.lllm!lrlllhld W. B. Hibbs & 00.) ( lwlu ‘Selling checks b2 J. & W. Beligman & eo) aturity i mz 4 iK: s B2t 55} 16 i ;z BONDS ON THE CURB MARKE' geeeREEe 900990 230 somnmsavun-steasunasumcee S . o F.‘,n 33X FRERER! 385554 sheen emic Su 48 10144 1 65 A 2025 x: 1 Sou m ity Ed 55 itk tn N G 65 '44 6% 845 % 65 '42.... 97 Co s '40 . 15 Tenn Elec: Power Tex cify o 4 nited P & 8 Rub 65 '33 24 Yan Syeringe én 65 o3 n Ser 843 A 16 u 2030 "1: ’5" IF& POREIGN BONDS. 'Il". , | for the decline. 3 | the Associated Press: Note—All stocks are sold in one hundred-share lots excepting those designated by the letter s (80s) (250s), which shows those stocks were sold in odd lots, Stock and Dividend Rate, Aero Supply B Affiliated Prod 1. Agfa Ansco. Alexander In Alleg Gas Allied Mi Aluminum Co of A: Alu Co of Am pf (6). Alum Ltd A war Am Austin Car. Am Br B fd sha AmCityP&L B b10% Am Com P A (b10%) Am Cyanamid B.... Am Dept Store: § Am Equities Am For Pow war. ... Am Founders. ‘ Am Gas & Eln (31).. Am Invest Inc B Am Invest war. Am Laund Mach (4). Am Lt & Trac (2%). Am Maize Prod (2).. Am Maracaibo...... Am Natural Gas. Am Superpew (40c). Am Superp pf (6)... Am Superp 1st (6).. Am Ut&G B vte(20c) Am Yvette new wi... Anchor P F (b10%). Anglo Chil Nitrate Appalachian Gas . Arcturus Rad Tube. . Arkans Nat Gas A. . Assoc El In Ltd 30c.. Assoc G & E all ctf; Assoc G & El A (a2). Assoc G & El war. .. Assoc G & E A dbrts Assoc G & E pur rts. Auto Voting Mach. ., Auto Vot M cv pf pt. Aviation Cp of Am. . Bellanca Aircraft. Bigelow Blue Ridg Blue Ridge cv pf a3. 10. Braz Tr & Lt (b8%). Buckeye P L (4). 5 Buft N&EP pf (1.60). Bulova cv pf (314).. Burma rets 127 3-5¢.. Canada Marconi. Cent Pub Sv A al Cent&Swn Ut (h7%) Cent St El (kd0c). .. Centrifug Pipe (60c) Chat Ph Aln.v. (1) Childs Co pf (7). Cities Serv (g30¢) . Cities Serv pf (6). Colombia Syndicate. ~Prev. 1031 Sales— High. x.ov 4% 14% lm 0% 9 % 2% 4% 140% 106% 5% 21 Cmwlth & Sou war Com Wat Sv (b6% Consol Copper. Consol Laund ( Cord Corp, Cor & Re) Cresson Consol ( Crocker Wheeler Cr Cork Int A (1) Cumberland P L (4). Curtiss Wright war. Dayton Air & Eng. Deere & Co (g1.20) Deisel W Gilb (13). Derby Ol Refining. . Detroit Alrcraft Dresser Mfg B (2 Driver Harris new. . Driver Harris pf (7). Duquesne Gas Cp wi. Durant Motors. . . Duval Tex Sul wi.... East G & ¥ Assoc... ucational Pic pf. 250- Elec Bond & Sh (b6). 815 Elec B & Sh pf (6)... Elec B & Sh cu pf 5.. Elec Pow Assoc (1). Elec Pow Asso A (1) Elec P & Lt op war.. Elec Sharehold (1) Emp Corporation. ... Emp Pub Sv A 21.50. Employ Rein (1%).. % Europ Elec deb rts Fabrics Finishing. Fairchild Aviation Fajardo Sugar. . Fansteel Products Fiat rcts (1.25). Filat Stock deb rts. .. Ford M Can A (1.20). Ford M France 28c. . Ford M Ltd (p373%). Foremost Dairy Pr.. Fox Theater Cl A. Franklin Mfg Co Gen Alloys (80c) Gen Aviation. Gen Baking. Gen Baking pt (3 Gen Baking N Y wi Gen Cable war GenE Ltd rt ( Gen Fireproof Gen G&E cv pt B Gen Laundry Mach, % Gen Th cv pf wi (3 Gleaner C Harv ne: Glen Alden Coal (8 Globe Underwriter: Gold Coin new Golden Center. Golden State Mil 4 Goldman Sach T C Grand Rap Var (1) Grt A&P Tean.v.(5). Groc Strs Prod vtc Gulf Oil of Pa (1%). Hazeltine Corp (2) Hecla®ining (1).... Helena Rubenstein. . Hou-Her cv pf A 23 4 Hudson Bay M&S .. Humble Oil (123 ) Hydro Elec Sec (2).. Hygrade Food Prod. Tmp Oil of Can (50c) Imp O Can reg (50c) Ind Ter Illu Ol A. 4 Insull Ut (1b10% Ins Co ofNo Am 123, Insurance Sec (70c). Intercoast Trade (1) 4 Intercontinent Petn. Int Petroleum (1)... 4 Int Utilities B. . Interstate Equities. . Inter Equ conv pf(3) - Moy M AN AT 8 (PR P T » Bawme~ o aelammaxn 0N Add 00. Open. High. . 3% 14%. 15 8 THE EVENING ~Prev. 1931 High, Low. 9 % 1% " 3% 814 ko) 34 4% 106 % 3214 i) % W a1 % 9% " 1o 1% 8% w2y 11 4% 14 221 19% L1V 3 14%, 13% e 106% 3% 8% 1 % 102 100% 2% 144 1 £44 Dy 4% lnnu- tn 814 7% | stock. o Pavabl 3 274 | ment. dlvidend. 20% 29% 29% 3% in ek Stock and Dividend Rate. Irving Air Chute (1) Italian Superp war. . Kirby Petroleum. ... Lefcourt Real pf (3) Leonard O11. ... Ley (FT) &Co (3).. Libby McNeil & L. .. Lion Ol & Refinin, Loew's Inc war..... LoneStar Gasn (1).. Long Island Lt (60c) Long Isld Lt pf (7).. 10 Manning Bow (A)... Marconi IntM(p38c). Mavis Bottling. Memph N G Co (60¢) Mid St Pet vic A..... Mid St Pet vtc B Mid St Prod n (2 Mid W St Ut (1%) Mid W Util B wi Mid Roy cv pf (2) Mo Kan P L (b10%). % Mo Kan P L vtc. . Moh H P 1st pt (7). . Moh H P 2d pf (7) Mount Prod (1.60) Nat Aviation. .. Nat Fam 8 (b10%) .. Nat Fuel Gas (1).... Nat Investors. . Nat Pow & Lt pt 6). Nat Pub Sv A (1.69). 4 Nat Sh Tr SecA (50¢) Nat Sugar NJ (2)... Mat Union Radio. Nauheim Phar. . . New Brad Oil (40c). New Eng Pow pf (6) 100s N Y Hamburg (2%). Niag-Hud Pow (40c) 36 Niag-Hud Pow A w.. Niag-Hud Pow C w.. Nat American Co. ... Niles-Bem-Pond (2). Noranda Mines. Nor Am Aviat A war. Nor Europ Oil Corp.. & So Am Corp A. Pow pf (8) Nor Wevpf (3).. N W Engineer (2)... Okla Gas & El pf (7). 501 Oliver Farm Eq wi.. Outboard Mot A. . Outboard Motor B. PacG&ElIstpf1% Pantepec Oil. ... Paramount Cab M| Parke Davis (11.35) PenderDGr B.. % Pennroad Corp. Penn Pw & Lt PeopL&EP A Petrol Corp Pet Milk pf (7 Pilot Rad Tube Pitney B P n (20, Prince & Whitelf. Prince & Whitely Prudential Inv. Pub Ut Hold (50 Pub Util Hold war Pub Ut Hold xw 50¢. Rainbow Lum PrA.. Reliance Manag. ... Reybarn Co. .. Reynolds Invest. ... Richfield Ofl Cal pf.. Roan Antelope Min. . Roosevelt Field Inc. . Rossia Int Corp..... Royalty Cp pf $1.35. Royal Type (13%).. St Anthony Gold. . St Regis Paper (1).. Safe Car H& L (8).. Salt Creek Prod 42).4 4 Saxet Co Seaboard Util (50¢) . Seiberling Rubber-. .. Selected Industries. . 2! Selected Indus pr pf. Shattuck Den Min. .. Smith (A 0) (2).. South Corp..... South Penn Oil (2).. South CEdpf B1%4. South CEdpf C1%.. Southld Royalty co:. Starrstt Corp pf (3). Stein Cosmetics Sunray Ol (b5%) Swift & Co (2).. ‘Technicolor, Inc Teck Hughes (60c). . Tenn Products (f1).. Thatcher Sec Corp. .. Tobacco & All Stks. . Tob Prod Exp (10c). Tonopah Mining Tran Con Air Tran. ., Trans Lux DLPS.. Tri-Cont Corp war. .. Truns Pork Strs (1).. Ungerieider Fin Cp. . Un N G of Can (1.40) Unit Car Fastener. .. Unit Chem pt pf (3) Unit Corp war.... Unit Elec Sv (pl. ll). Unit El Sve pf war. . Unit Fou (be-36 ah). Unit Gas Corp Unit Gas war. Unit Gas pf (7). Unit Lt &Pwr A ll). % Unit Lt& Pwr pf (6). 1 Unit Stores . 1 U S Elec Power w' U 8 Foll (B) (50c) U S Gypsum (1.60).. U S & Inl Secur. U S & Intl Sec m(s) U 8 & Overseas war. Unit Verde Ext (2).. STAR, WASHINGTON, D. C, Sales— 08 30% 5 108% 3% ? ey 10% 1% . B0 PEPTOTE-15) Sow . 10 T o PO ERN 16 508 92 buy for less and sell for more than in MONDAY, PRICE CONFIDENCE HELD VITAL NEED % Chicago Bank Outlines Best Methods of Speeding Up Business Recovery. Special Dispatch to The Star. CHICAGO, January 26.—The decline .| in business in the United States during | o the last year and a half has been sub- stantjally greater than in the outside commercial world, and thus the as- sumption that business revival here must wait until world-wide conditions improve is wholly unwarranted. This opinion is set forth by the Foreman- State National Bank of Chicago. “Declines and deflations have not been as steep throughout the world as in this country, and American business should be apprised of that fact,” the Business Observer says. ‘“Commerce and industry in this country are still, of course, at levels above the average for the outside world, but, compared with our and their achievements in the re- cent past, the present depression has brought American industry to relatively Jower levels than in most other coun- tries. “Production of steel, for instance, in 1930 was reduced 27 per cent in the United States from 1929 levels. In the world outside the United States it was reduced only 14 per cent. The total volume of international trade during 1930 was reduced approximately 8 per cent from the previous year. American foreign trade was down 15 per cent. Since June, 1929, stock exchange values have fallen slightly further in the United States than they have in Ger- many and more than 50 per cent fur- ther than in either England or France. “Production volume declined 25 per cent in the United States from the third quarter of 1929 to the third quar- ter of 1930. In Great Britain it was down 10 per cent; in Canada 15 per cent. ‘What Comparison Means. “The surface significance of all this 1! '.lut while American industry at- lmur heights of inflation in un it now has experienced a com- penalungly intense deflation. The prac. tical implication is that American in. dustry is now as unlikely to remain be low its normal relationship to other % | commercial nations as it was for it to remain so abnormally g relation to them in 1929. “According to rough estimate we are now in a position-to retrieve from 20 to 30 per cent of the loss volume and momentum of American business before we are back to our usual,parity with outside commercial nations. We have, moreover, & significantly favor- able factor to ald in bringing that about. Commodity prices have declined further in those countries where we buy most of our imports than in those which take most of our exports. “Comparatively speaking, then, we 1929. And while the gradual readjust- ment of world prices will ultimately wipe out this differential, meanwhile it affords us a handicap advantage in re- covery.” Favorable Development. All six of the important interest rates —rates on commercial paper, bankers’ acceptances, time money, call loans, the yield on seasoned bonds, the yield on new bond offerings of the current month—registered firmness from Novem- ber to December and four of them % | actually advanced. This relative firm- T T R N e L L waéz 33 Util PALt(a11.02%). % Util & Ind pf (1%).. Util Equis pf (8%) .. Vacuum (4).. Van Camp Pkg. Van Camp Pkg pf... Vic Finan Corp(40¢) . Walgreen Co. Winter (Benj)... Youkon Gold. Zonite Products (1). RIGHTS. Expire. 1% Sou Calif Edison. ... 11% Com Edison. ol 11 2 o 20 13% 13% 13% 13% quarterly or_ semi- w.hnly n}r- IPlus 4% in k. A Pllis 8% in o CORPORATION REPORTS TRENDS AND PROSPECTS OF LEADING ORGANIZATIONS NEW YORK, January 26.—The fol- lowing is & summary of important cor- poration news, prepared by the Stand- ard Statistics Co., Inc, New York, for Weekly News Review. ‘The security markets moved forward in an impressive manner during the past week. Stock market prices, as measured by our index of 90 repre- sentative shares, gained about 4.5 per nt, while bond quotations continued 3 display sustaing rength, many of| the gllt-edged 1ssues advancing to their tt:‘(hsl" ll.ncem}:z:m Tge l}r::d 's_offer- of new ol ns dec! sharp to lbout '!MMM ‘This abrupt fall- ing off in new financing was attributed to the fact that some the recent originations were mee ith a slower demand origins anticipated. Activity on the stock exchuue ‘was r-huvely light, but expanded substan- t.huy as prices advanced. Sentiment has improved considerably in financial and bull.nm circles since the inning of the year, and this no doubt cited speculators to cover commitments in- | funds in long-term bonds Commodity Prices. Commodity markets were irregular. Of 40 major commodities, 10 recorded lncreuel 12 declined and 38. were un- flun‘q. Silver rose from its record - » low of the preceding week, and cotton was slightly higher on covering opera- tions, but practically all of the other principal products gave ground. Corn fell to & new season’s low, and wheat and other grains were reactionary. Rubber, hide and silk were off. leen on the whole, however, there ap) to be increasing for the llef that a degree of strength will be regis- tered in general commodity prices dur- ing near future months. The early date for Easter should shortly make its influence lel}b in bot:t;.’nlenhnedllh l!:: consumer buy! ough aggrega sales volumes ;lnlf probably compare un- favorably with like periods for a number of years. The increasing rity be- tween wholesale prices and those at retail, lack of final readjustments be- tween mp(r!y and deman terials and legislative barriers to inter- national free trade, however, are factors which, it is pelieved, under normal con- ditions, will tend to keep the long-term trend of prices downward. The principal development in the money market was the further reduc- y | tion in bill rates by one-eighth of 1 per cent, bringing the 90-day rate to a record low of 1 per cent.. ‘This lowering of money ra ultimately be re- flected in higher bond prices, for with call money available at 1 per cent, al- Lhuuhflwoflchlnumulmn 1 per cent, u::dvni: yield on’ b:nhn ceptances other péper &t unpreoe dently low levels commercial tions will find it h hee or & IM-II- factory return. Brokers' loans, as re- ported by the Federal Reserve Board, fell to a new low record in the week ended January 21. As of that date bol rowings stood at $1,757,000,000, or “I. 000,000 below & week previous and the lest since November, 1024, Reports from dmdustry issued of basic ma- | POTY the week indicated a continuance of the upward trend in activity, but, on the whole, the increase has been less than usua! for the period. Improve- ment in the steel industry was slight, operations throughout the country aver: aging about 46 per cent of capacity, against 44 per cent in the Precedmg week. The railroad, structural building and tin plate divisions are providing the basis for a greater part of current activity. Demand for l'zbi: products for The largest single manufacturer is re- ed to have st up output about 20 per cent in the last week or so, but increases by other units are more con- servative. Preliminary ‘estimates for January are that around 200,000 units will be manufactured in the United States and Canada. Deere & Co. Income. & CHICAGO, January’ 26 (#)—Deere & ., 1 it m‘?nu(mn net income of $8,119,112 for ended last October 31, year equal after pre(med dividends to ;uo a share of common stock. Sur plul after dl nts was $3,- 910 111, 'Iu’::.m exceeded but history, com- rred 'm.h $15,181,940 in 1930, equiva- nt_to 81912 l eemmon share. Pive shares. of no were ex- chmged early ln nan !. one share of $100 par. SIS R L County (Chicago) fores! F‘"‘- hatural parks, ., ness, the more significant because it has not happened before in a year, should be interpreted as a favorable de- velopment because all of these rates, with the exceptign of bond yields, are now at extraordinarily low levels. ‘But, the Foreman-State publication adds: “From the above facts it would seem entirely logical to conclude that demand and supply had finally worked short- term money rates into a stable position. But, curiously enough, the arbitrary factors in the money market were ex- erted on the down side in December. We refer to the fact that rediscount rates were reduced at several of the Federal Reserve Banks, with the New i York rate down to 2 per cent—the low- uwlnl in Federal Reserve history.” e deflation in commodity price averages since June, 1929, is now close to 25 per cent, The Business Observer notes. It adds: Price Confidence Needed. “This deflation has the appearance of being adequate—adequate to' remove the artificlality from price levels. There remain, however, many specific commodities which have not as yet been deflated in line with the trend of the times, as well as some which apparently have gone down beyond the point where supply and demand will eventually stabilize them. These pro- nounced contrasts in commodity defla- tion constitute thé® most effective re- sistance to business recovery at the present time. “It is remarked widely these days that business needs only confidence in order to go ahead. It needs confidence in prices. There is, of course, only one possible way by which confidence in prices can be re-established, and that is by completing the deflation of prices. ‘That will be a gradual process, but it need not be indefinitely prolonged. It will require writing off losses. But taking inevitable losses now will, in the majority of cases, prove far less costly than postponing the process. Business intelligence should be concen- trated on the job of completing com- modity deflation. It is the one prom- iseful opportunity for speeding re- covery.” GRAIN MARKET CHICAGO, January 26 (#).—Carried down by stop loss selling, corn tumbled today to fresh low-price records for all deliveries. Rye also broke the season’s bottom record and reached the lowest level in many years. Wheat was rela- tively firm, influenced by & decreue of stocks at uvzrpool Opening ¥ off to 1, up, corn later receded all around. when started at 1 decline to % ad- 'vance and subsequently scored gains. ‘With unseasonably high temperatures diminishing demand from feeders, and with commission houses persistent sell- ers, corn displayed no rallying power of consequence. Statements from official sources at Washington that seriousness 0| of the existing grain situation called for a one year 50 per cent increase of United States agricultural tariff rates € | attracted attention among corn traders especially. Before price downturns were checked May went below 65 cents and March touched 63. Helping to steady wheat in the face of corn weakness was continued lack of rain throughout domestic Winter crop territory. Reports from India telling of good rains there were ignored. An in- crease of nearly 2,500,000 bushels in the amount of wheat on ocean passage compared with last week was shown, but the total remained much under the figures a year ago. Oats followed corn TS, | rather than wheat. Provisions were firm, influenced by steadiness of hog values. Plants on Full Time. CHICAGO, January 26 (#)—Presi- dent R. C. ‘Stirton_of the Associated rel Industries, Ine., reported today manufacturing divisions were oper- ating capacity and that a new plant at cm—y, nd., would begin oper- lt.lmll next month. Other p nts al lelvlm Ill.; Elkhart and Logans- JANUARY 26 1.31. GRAIN TRADERS FINANCIAL. ON SIDELINES PENDING CHANGE IN SITUATION BY FRANK I. WELLER, Associated Press Farm Editor. Grain traders apparently have come to the conclusion that until there is & decided chxn{. in general conditions they should close to shore. An outstanding u-wre in all grains of late has been refusal of the markets to re- spond to the news and the failure of small receipts of corn and oats to stim- ulate the demand. ‘The corn market is weaker, and prices have declined 2 to 3 cents at most points. Some responsibility may laced on reduced feeding demand, due' to an unusually mild Winter in the Central West. Too, been relatively hl(h compared with other feed grains. W-Iher Favorable. Good rains in the Winter wheat belt of Kansas and surroundi States, w— gether with mild weather, ?&n vorable for the new crop and perhaps exerted a weakening influence upon the market. Further declines in foreign markets have helped the ure. Competition between Russian, Canadian and Argentine shippers has forced Liv- erpool prices sharply downward. Some _traders believa the situation cannot be remedied until the United States enters the export column, which is impossible until domestic prices de- | 2,000, cline to alout 50 cents a bushel, which would be in line with Winnipeg and Buenos Aires. They fear the lack of export business will be felt severely and that pressure on the market will be- come greater. Others, without being able to find a legitimate reason for it, see a happler and more comfortable feeling in grain. They say Government agencies have restored confidence to a large degree by a marginal arrangement protecting banks and brokers with the deposit of securities at Federal Reserve Banks. The plan for loaning old wheat to millers on a basis that will permit them to engage in export trade is considered a psychol mll elp to July wheat. ‘While t is being freely marketed 'hel’ever lt '.‘ln be found, undoubtedly of the movement is over, mmlre should be less on old crop de- Pverlex and nothing, of course, on the new. deliveries. CITIES SERVICE CO. IN RICHFIELD OFFER Exchange of Shares on One-for- Four Basis Is Suggested by Doherty. By the Associated Press. NEW YORK, January 26-=Cities Service Co. common stock will be ex- changed fer Richfleld Oil Co. of Cali- fornia common on & basis of one share of Citles Service for four of Richfield, Henry L, Doherty & Co. have an- nounced. The statement said Citles Service holds a substantial amount of Richfield stock which will be accepted and sets Flebl'ulry 25 as the date the offer ex- pires. Cities Service has had no extensive operations on the Pacific Coast. LOS ANGELES. January 26 (#).— Willlam C. McDuffle, recently appointed receiver of the Richfield Oil Co. of Cali- fornia, expressed surprise today at the announcement in New York by President Hemg L. Doherty that Citles Service would offer to ‘acquire Richfield stock on a trade basis. “This is the first I have heudegl it,” McDuffle sald when inform Doherty’s announcement. Several months , when Cities Serv- ice first was revealed as planning ex- pansion to the Pacific Coast, Richfield offiéials denied sale of their properties medfin New York concern was consids ert NEW YORK COTTON NEW YORK, January 26 rspecun — Opening cotton prices today steady, 1 point lower to 1 point hl‘ber In most cases renewed liquidation was offset by profit covering by shorts and | 1¥ by purchases by the trade. Southern houses and overseas connections of- fered contracts. operunl prices were: March, 10.32, oft May, 1057, up 1; July, 10.78, October, 11.00, up 1; De- corn prices have | the Severe weather would very readily cause a severe scare in July wheat, even thfg it ultimately my sell at & ma- ter healthier lower figu! : site uation in wheat d help corn Dd heavily fed. WW- corn having been trading way, there should be tunities on the long side of corn. Board’s Policy. ‘The Farm Board has said it will leave July wheat alone unless conditions change very m-terhlly Tha Australian Commonwealth Bank lecided to make available unmedhuly to meet v.h- Queensland pool, advances equaling 56 cents & bushel on wheat. Tt is indicated )¢ Argentine government will not come to the aid of the grain trade. So far Argentine shippers have sold far below their usual amount n this time of the year and, regarldess rice, it is in- timated that ofleflnn will increase from dump attention. lt is not known how much grain Russia has and movements will be_watched closely. ‘The King's Bench Court in Winnipeg has sustqined the wheat pool contracts, which means that 148,000 Canadian farmers still are d by their pool affiliations. The estfmate of Canada's wheat yield has been increased about 000 bushels. Holding is in evi- dence in Manitoba and Alberta. The increase leads some to believe Canada will be faced with another large carry- over, France Quits Market. France has withdrawn from the wheat market for the time being. There some that acreages in several countries will be reduced next season and that exporting countries will come to some price agreement. Under these circumstances Russia is likely to regain . | her place as the world’s largest shipper. A record corn crop is nnrded as as- sured in Argentina, givini e crop an exportable surplus of 140, ooo 000 bushels in excess of the average. The United States is an exporter of corn by-prod- ucts and if Europe can get corn cheaper than from this country, it affect the cxmn market. The Argentine sur- plus otherwise affects domestic corn prices but sentimentally. MORATORIUM SHOULD Financial Students Point Out Ad- vantage to German Credit if Action Is Taken. While the possibility of a German | moratorium has been denied by re- }‘spon.nble government officials at the outbreak of every fresh batch of rumors, it remains a fact that German bonds have sold off at every appear- ance of these rumors. This unfavorable” reaction provides an incongruous situation, as close.stu- dents of international financial affairs declare that if Germany should resort to such procedure the effect on Ger- mnn bonds lhpuld k quite the m the action should strengthen the Gemun currency and act as & gubr insurance to Germany's -bum principal and interest on tions privately contracted a The Alexander Hnmllton Institute believes the action of the bond market in this respect indicates a lack of un- derstanding as to just what a mora- torium would involve. It points out that the term, as it relates to Ger- many, applies only to the canfllfleo;l part of the lnnul'a whk service of the urm loan of 1930 ('.he Young bonds) is met out c;: the unconditional part of the annuf ‘The nnnnmel to be Germany lra dlvlded into two w“mmm :n amounting nlchmar , which must be paid foreign exchange in monthly huh.ll- ments under any circumstances, and, secondly, the conditional part, consist- ing of the difference between the total annuity and the unconditional part, which, although also payable in month- installments and in Imlg currency, !s subject to pos upon three mont — An Alsatian dof neenfly lt'ended the funeral at Sheffield, his mas- ter and almost cons c wmpnnlcn for 10 years, William Mabe. New York City, TO THE HOLDERS OF COMMON STOCK OF RICHFIELD OIL COMPANY OF CALIFORNIA: Cities Service Company is a holder of a sub- stantial amount of common stock of the Richfield 0il Company of California. We are prepared to offer to holders of com- mon stock of Richfield Oil Company of Cali- fornia common stock of Cities Service Company in exchange therefor, on the basis of one share of Cities Service Company common stock for four shares of the common stock of Richfield Oil Company of California. The shares of the Rich- field Oil Company of California should be for- warded, duly endorsed, witnessed and guaranteed for transfer, through your banker or broker, to the undersigned. The undersigned shall not be required to accept a total of more than five hundred thousand shares of the stock of said Richfield Oil Com- pany under this offer (same to be accepted in the order of its receipt), nor to accept such stock after thirty days from the date hereof. Omaha, smount STRENGTHEN BONDS DECREASE N BANK CLEARINGS SHOWN «|Drop of More Than 20 Per Cent Revealed During Last Week. BY CHARLES F. SPEARE. Special Dispateh to The Star. NEW YORK, January 26.—In the past the volume of bank cléarings throughout the country has been regarded as one of the most active measuremients of cur- rent business activity. Their value dur- ing the pmnd of great lation in ncufluu and in commodi however, centers * vhen stock exchanges ‘markets for grain and cetton existed. threw those lo.tn“m Test of the country out of bal- Now that normal conditions have been established in tion, the bank fl"llnl are n looked to as an index of what is actually place in busi- ness throughout the United States, Decrease Last Week. ‘The clearings last week showed a de- crease for the eountry of luchuy more than 20 per cent. The decline has been in 3 ver, only about half the amount of the November loss. does not mean a great de-.l as Jan\llry clearings normally are the highest of the year. While the average for the United States was down 20.3 per cent this week, the decrease was much than this in different localities. instance, it was over 40 Minneapolis a little Kansas City I‘A w”:n;‘ e New York Figures. The decrease in New York Cil L PH g o i in the uary, 1920, when -pen:kun markets were extremely active, bank here were in excess of $10,000,000, or over 70 per cent of the total for that week for entire United States. (Copyright, 1931.) DEMAND FOR PREFERRED' STOCKS HOLDS STEADY Special Dispateh to The Star. NEW YORK, January 26.—Houses that maintain a uuflo\u attitude toward common stocks, on the that they have discounted the Imvmvemt in sentiment that Construction Budget. ";VIIW YOngJlnl\::ry 26 ;’l—'l'he construction budget of Middle West Utilitles System provides for ex- penditure of mpmxlmluly $63,000, of which it is estimated $6,000,000 be carried over into nen for pletion. cotmnf.hn veay ® January 26, 1931. HENRY L. DOHERTY & COMPANY, 60 Wall Street, New York City.