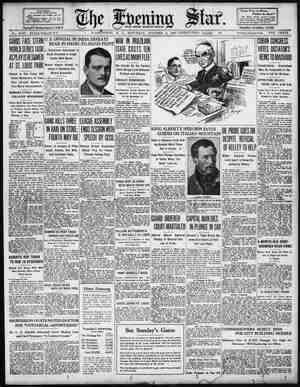

Evening Star Newspaper, October 4, 1930, Page 13

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

ONLEHTTURNOVER Utilities, Natural Gas, Oil and Investment Trust Groups Favored. BY JOHN A. CRONE. Special Dispatch to The Star. NEW YORK, October 4—Public util- fties, especially natural gas shares, oils, | investment trusts and a few indus- trials, furnished the bulk of dealings in today's dull and selective Curb Ex- change session. _ Power and light companies showed relatively little disposition to follow the bulges of their leader, Electric Bond & Share. The same was true of the petroleum shares in relation to the movements of Cities Service. Moderate improvement in some Te- eently depressed stocks, heretofore sponsored by two now insolvent and former curb members, continued. Pep- 1l Manufacturing’s announcement t it was operating at near capacity | served to atiract attention to textile shares. Celanese Participating prefer- red, up nearly a point, was one of the chief beneficiaries in this movement. United Gas New turned active fol- lowing announcement that the com- pany planned to spend about $20,000. 000 on expansions and improvements. Of this amount $8,500,000 will be for improvements on transmission and dis- tribution facilities, $7.250,000 for 35 miles of new lines and $3,360,000 for improving natural gas service in Hous- ton and vicinity. Southwest Gas Utilities was in de- mand on persistent, but unconfirmed, rumors that some of its oil properties’ ‘were being sought by Standard Oil Co. of Indiana. Alleghany Gas, likewise, stirred, following Newark dispatches cetailing the discovery of natural gas at Tioga, Pa. This spot is just across the New York State line, 225 miles from this city, and within a short dis- tance of Olean, N. Y., where the first natural gas was struck in this country mearly a century ago. Swift International was a feature of the food group as it rose a point on rumors that & development favorable to stockholders would be announced Monday. General Baking preferred re- imed its advance mm‘llfllln Light & Traction softenec | somewhat as cables told of dismrbmces‘ in Brazil, Newmont Mining, lfl‘:"; dropping to 64, a record low price, ral- lied more than 3 points on the next two sales. ‘Ungerlider Financial Corporation was & weak t in investment company dealings, as it opened down 3% points. Comparative steadiness of United Founcers reflected dividend forecasts of the company’s subsidiaries. Invest- ment Trust Associates and United States & British International, Ltd., have just announced initial dividends, and it is now predicted that a thir¢ United Founders' subsidiary, American & Gen- eral Securities Corporation, will be placed on a dividend basis next month. BONDS ON THE CURB MARKET. DOMESTI NDS. ousands. O B on: Low. Close. Pw 4las '6T100 99% 99 Alabama Fow''ss 6105 108 108 b 108 *52108% 10w 103t Vil wiis ¥lie 1003 }0«:’4 iaj. 10844 108! s 10053 100% i Efl 97 1 105% 1053 105% 1014 100% 10:%e 103 103Y [o] ggx '60 1007 1067s 1007 4135 D '571017s 1017 10178 Con Gas Balt 41zs H102}s 10214 10214 Con G Bal 5%s E 52 10712 1071; 10732 nsum Pow 4128 '58 102 ° 1013, 102 & E 55 A 138 92% 3 k) i 162 i t 3 Gatineau Pw 6s B 2Gen Bronze 6s Wk 65 B 100 m 55 47102 1Inter Nat 65 '36 xw_. 55 5’ o | ferrous metals and textiles, t P & L 65 A 2026. 1 Okla Gas & El 55 '3 Quwego B Pow iedm't El 6 60 867, Portland G E 60 931, 9 Bub 8 Nor 1l 101 TPug § P & 4%a8 18haw W, 3 Shemeld 2 South 4 3 03 0% 1 04, 7% 92 alif Ed 55 '52 04°3 1 P 6 o Tex Ut 55 A '57 96% FOREIGN BONDS. 3 Ger Con Mun ambury Elec 75 75 4 2 fas. a2% warrants. out Warrants. tszued. | pression of 1920. Siace 1926 there has | been a general declinz of practically 25 : menths have been steadily discounting Note—All stocks are sold in one hundred-share lots excepting those designated by the hug 8 (80s) (250) Sal Aflm Open, 16% which shows v.hosel!tockl to be sold —Prev. 1030.~ Stock and gy Dividend Rate. 20% 16 Afliliated Prod 1.60. . 914 3 Alr Investors vtc. 11% Air Investors cv pf. 3 Allegheny Gas. 7 Allied Mitls (60c) 1051 Alu Co of Am pf (6).. 12% Am CP&L B (10%).. 17% Am Com P A (b10%) Am Cyanamid (B) o EXTE TN YT ers Am Gas & El (31) Am Lt & Trac (2% Am Maize Prod (2). 4 Am Marlcabo. .. Am Mathis (B) w. 4« Am Natural Gas Am Superpow (1)... Am Superpwr 1st(6) Am U &G B vtc 40c.. Anchor PF (b10%) 4 Appalachian Gas. Arkansas Nat Gas Ark Nat Gas (A).... Ark N G cu pf (60c). Art Metal Works (1) Asso Dyelng & Ptg.. Asso Gas & Elec Asso GRE A (at2. Ass0G & E pf (5) Asso Rayon... Atlantic Fr & Sug. Atlas Plywood (2).., Auto Vot M ev pf pt.. Aviation Cor of Am.. Axton-I' Tob A 3.20. Bliss (E W) Co (1).. 4 Blue Ridge Cp (40c). Blue Ridge cv pf a3 Brazil Tr & Lt (h2). Buft N&EP pf (1.60). Cable Radio T vtc... Cable & Wire B rets. Canada Marconi Ceco Mfg Co (b8%).. Celanese 18t pf (7% ) 175 Cent Pub Svo A al75 Cent St El (k40c: Chain Store Deve! Chain Stores Stock. . Cittes Serv (g30c) Citles Serv pf (6) 4 Colombia Syndicate. Col Oil & Gas vte Col Pict vtc (£1%) 4 Com & Sou war. Com Wat Sv (b6% ). Consol Afreraft..... Consol Auto Merch. . Consol Copper-.... § Consol Retall Stores. . Contl Share cv pf (6) Copeland Pr Inc A Cord Corp. Cosden Of1. Creole Petroleum, Crocker Wheeler... . Crown Cork pf(2.70) Cuneo Press (2%). .., Curtiss Wright war. % Dayton Alr & Eng. .. Deere & Co (m1.20).., i De Forest Radio Derby Oil Refinin, Detroit Alrcraft. Diamond Match new. Dia Match cu pf (n). Draper Corp (15). Dresser M{g (B) (2). Dubilier Cond & Rad Duquesne Gas Cp wi. Durant Motors. " East C & F Ass % East St Pow B Pt Eisler Electric Corp. El Bond & Sh (b6)... El Bond & Sh cu pf 5. El Bond & Sh pf (6). Elec Pow Asso (1)..: Elec Pow Asso A (1) El Pow & Lt op war.. % Emp P Ser A (a1.80) Employ Reins (1%4). Europ Elec deb rts. . Evans Wallow Lead. Fabrics Finfshing. .. Fairchild Aviation. .. Ford Mot Can A 1% Ford Mot Ltd'37%e.. Fox Theater Cl (A).. General Baking... 10215 15% 143 14% 16% 16% 814 27% 31y 514 461y | PP OO OIS - 8 3 S e R Globe Underwriters. Golden Center. .. Goldman Sach TC .. Gorham Inc pf (3) GrA&P T n-v (5) GrA&PTpt (7). Gulf Ofl of Fa (1%). Hall Lamp (60¢) 4« Houston O of T Hudson Bay M & Humble Of1 (2). Hygrade Food Prod. “Imp O1l of Can (50¢) Ind Fin ctfs (b10%). 4 Insull Ut (1b1015 %) “InsCo N Am (13). Insurance See (1. Intercontinent Petn. Int Petroleum (1)... Internat Super (f1).. Italian Superp (A). . Johnson Motor...... 9% 16% 304 5 1% ~Prev. 1930.— High. Loy odd lots only. . High, Low. Close. 16% 16% 16% Lion O11 3 3 Met & M Midvale Mo Kan 2 Mo Kan Nat Pub NYP& Niagara Nor P L Fac Pub Pandem Philip M. Polymet Premier Pure Oil Selected 25 2259 4% S W Gas Spanish Stand Of Taggart Tri Utill Utd Gas U S Elec U S Foil Vacuum 1% 613 284 6 % % Wenden payment. * Ex dividend. cash or stoc 5% In stock. 2% in stock. 8% in stock. 34 6% | fo [ Stock and Dividend Rate. Kirby Perroleum % Lane Bryant (2) Leonard Ofl... Nor St Pow A (§). 4 Pac Western Oil. Pantepec O Pennroad Corp Peop L& P A a2.40 Pepperell Mfg (8). Pratt & Lamb (15) Reliance Int Cor (B), Repetti Candy . Heynolds Invest. Rossia Int Corp. St Regis Paper (1).. Salt Creek Prod (2).. h Saxet Co........ Schletter & Zander Schulte Un 5c-31 St. . Seaboard Util (50¢)., Sec Corp Gen (40c).. Seg Lock & H (50c).. Seiberling Rubbes. Sel Ind all ctfs(4%). Shenandoah Corp. ... Shenandoah Cp ( Sing Mfg Ltd (23¢c) Sou Penn Oil (12%). SoCal Ed pf C (1%). Southern Corp. Standard Motors. . Stand Oil Ind (2%).. 1Partly extra ayable in stoch Received by Private Wire Direct to The Star Office Sales— Add 00. Open. High. Low. Close. 1% 1% 1% 1% Ref (2). 4 Lone Star Gasn (1). Louisiana Lan & Ex.. MacMarr Stores (1), Mavis Bottling. Memphis Nat G in Inc (1.20). Mid West Ut (b8%).. Mid West Ut A war.. 4 Midld Nat Gas A 1.20 Mid Roy c¥ pf (2)... Co(4)....0s PL(b10%). PLvte. Nat Aviation 4 Nat Investors. Nat Pow & Lt p! « BO: Sv A (1.60). Nat Rubber Mach (1) Nat Sugar N J (2)... Nat Trade Journal Nevada Cal Elec. ... 130 Newberry (JJ) 1.10.. Newmont Min (£4).. Ltpt (6). N Y Rio & Bu Alres.. N Y Tel pf (614).... Niag-Hud Pow (40c) Niag-Hud Pow A w. Sh, Md(40c) Noranda Mines (2) Nordon Mines, Ltd Nor Europ 01l Corp.. (t5).. . SV (1.30).... o1l 206y orris Inc Plymouth Ol (2) Mfg (b4%). Gold (24¢).. Prince & Whit (25¢). Prudential Invest. Pub Ut Hold (50c) pr6).. » NI o 10 R 0 1 R 00 e RN RS b Indvstries. ). Utilities. ... & Genrets. . 6 24 1Ky, (t1180) 3 Stand Ofl Ohio (234). 50s Stand O Ohio pf (3). Stein Cosmetics Stutz Motor Car. Sunray Oil (40c) Swift & Co new (2).. Swift Internat (233), 90s 1 10 Corp (1) Technicolor Inc..... % Texon Oil&Land (t4). Tish Realty & Con. ., Tran Con Air Tran. ties (31.20).; Tri Utilities pf (3).. Triplex Safety Glass Twin St NG A pt (1), Ungerleider F Corp. . Un N G of Can 11.60., Utd Chem pf (3). Utd Corp (war) Jtd Found b2-35 sh, ot (7). Utd Lt & Pow A (1). Utd Milk Products. . Unit Mollasses Ltd Pow ww (B) (1). U S Lines pf (1)... U S & Overseas ctfs.. Util Pow & Lt (a1).. Util P&L B ctfs (a1) Utility & Ind. Utllity Equit, Ofl (4) Venezuela Petrol Vie Finan Cor (40c| Walgreen Co. ... Walker (H) (1) Copper. Worth Ine (A). Dividend rates in dollars based on last aquarterly or semi-annual 1Plus 4% ke Adju e in stock. ) 10% in stock. in stock. a Payable in stment dividend. £ Plus % In st 3 Plus lus 1 ock m Plus 3% in stock. n Plus McGILL, - Editor McGill Commodity Service. AUBURNDALE, Mass, October 4 (#).—Commodity prices, after several weeks of stabilization, renewed the downward trend during the week just closed. The decline was almost entirely attributable to the sharp break in non- accom- panied by somewhat lower prices for ferrous metals, paint materials, coarse textiles and vegetable oils. Out of 15 individual indices during the past week, 1 advanced, 2 remained unchanged and | 12 declined, The Fall period has not advanced sufficiently to outline any definite in- dication as to the extent of the seasonal improvement in business. Much em- phasis is placed on the low stocks held by retailers and wholesalers. In order 1o meet actual requirements there must be some speeding up in production schedules from the low levels reached during the third quarter. It is also im- | portant to note President Hoover's | statement to the effect that the country can pull out of the depression without | the aid of foreign countries. The facts | show that this Nation, due to its great | wealth, producing capacity and natural | resources, is the leader in’ world affairs. | As soon as this country improves other | Nations will follow. | All Commodities. For the first week in October all| commodities established a new low | point in the declining price trend which | has been going on since the great de- per cent, which means one of the most substantial price readjustments in economic history. Many groups are critically low, with many individusl commodities under pre-wa: quotations. Agricultural Prices. The only group which showed a mod crate price upturn was the agricultural. Bearish statements no longer have a forceful effect, as prices in recent versupply. Industrial Commodities. Due to the sharp. break in building materials, hides and leather, metals, paint materfals, paper, textiles and veg- étable oils, industrial prices were lower. ' Non-Ferrous Metals, The most substantial decline during the past week was recorded by non- ferrous metals. Copper broke to 10 cents and lead prices were revised downward to 5.35 cents. Tin and quick- silver were also weaker. Textiles. ‘These u’de novl‘ l,l_, the levelt ;:Ich resents a drop of per cen! ce Cotton, both spot and futures, is around 10!, cents, while both wool and silk were moderately weak. Ovepsupply of . rvin Manufac New York United Westchest Company. Baldwin & Katz Do. pf.. British _Amer Am_ Dej by Corn_ Exchange Bk & Tr (N Y) East Dair Federated _ Publica 30c Fi Great Nor Fij Mastag_Co . enm Oahii Sug, Oilstocks Ltd A Do. B Stearns (F) Triplex. Safely ‘Glass (Am De rots! Trl Utilities 13 Investors’ Mutual A.50c Q Holly Sug 77 Hupp Motor C; Pantex Pr Mch pt Bally Procks Inc.. Pickent 126, | A NEW YORK BANK STOCKS | NEW YORK, October 4 (#).—Over- ' the-counter market: ‘Bankers D Chelsea Bank & Trisi. Chemical Kk s st Corn Exchange 163 167 48, turers £31; ) - | ate B0 er Tite & Tris s | DIVIDENDS DECLARED NEW YORK, October 4 (#).— Regular. Pr. Pay- Rate. riod. abl 78c Q Dec. % Q Hidrs. ot | record. | Dec. 1§ e Dec. 15 Tob | Record. 19, .5:00c bearer) 45 og 16 15-10¢ Do ord r Do. 87 | Ltd ' p.31.75 nancial Inst: pf.$1.50 irst Nat Corp of Portland (Ore.) A.50c Do. B s 50 nee 87 partic A, .32 1st’ b’ $1.50 BE....... 950 Co " Ltd . 10c L 12hc Ppupes £ 171 &' Co 16%¢ ord.57% 2. T8¢ Uniy Pipe & R pi.51.75 Redyeed. ©p: 200000 0D POOD PO ! Omitted. reat Lakes Pij Due Oct. Due Nov. Oct. ar. . 50c e X Due Oct. Ml Due Oct. Soviet Hit by Christians. VEVEY, Switzerland (#).—The Gen- cral Council of Practical Christianity while in session here denounced alleged | Soviet persecution of believers and asked all Christians to fight such vio- lations of liberty of conscience. all textiles is rapidly being discounted in the price level. . Most Important Price Changes. revious First Thig week. week. of 13 5.9 ot 0, BY GEORGE T. HUGHES. (This is the ninth of a series of studies in preferred stocks by Mr. Hughes for . the benefit of Juis readers. He analyzes the technical provisions of the stocks discussed and gives facts about the cor- porations behind the securities. The chief purpose is to explain the analyti- cal process. certain sécurities of high grade being used for the illustrations.) General Electric Special. From 1922 to 1926, inclusive, General Electric Co. issued to owners of its common stock as a stock dividend, shares in General Electric Special which | is in fact, if not in name, a preferred | issue. There are now outstanding $42,- 932,480 of this special stock which has several unique features. In the first place its par value is $10, an unusual figure in preferred stocks. The divi- dend rate is 6 per cent or 60 cents a chare annually and this dividend is cumulative. The special stock has pri- ority over the common stock as to divi- dends, but enjoys no other preferential rights. Holders have no voting rights nor have they any right to subscribe to new stock that may be issued from time to time by the. corporation. The special stock is redeemable on any dividend day, provided at least 90 days' notice be given, at $11 per share and accrued dividends. ‘The market price as this is written is around $12 a share, so that investors who buy at this level take the chance of having their stock called at $1 per share less than they paid. The reason they are willing to take this risk, if it may be called such, is Because of the high yield relative to the extraordinary degree cf safety General Electric Spe- cial gives. At $12 a share, the return is exactly 5 per cent and it would be diffi- cult to find any other industrial se- curity of comparable quality to give so much. The stock has no speculative attraction whatever. It will never be bought with the idea of market price appreciation in mind, but always only for income. Lef us see how well this dividend is protected. General Electric has what is for so large and so strong a corporation only a negligible amount of funded debt. There is outstanding to the amount of $2,047,000 a debenture bond maturing in 1942 and carrying a 3!2 per cent coupon. Except for small bond issue the special stock is the first capital liability of the com- pany. Now during the year 1929 earn- ings available for dividend on this spe- cial stock were $15.67 a_share, against thes60 cents required. In other words the dizbursement was earned more than 26 times in that year. As of December 31, last, General Electric had cash on hand cof $64,371,069, or 50 per cent more u!ntku\e total par value of the special stock. An automobile factory at Birming- ham, England, recently increased its | number of employes from 3,000 to 7,000. England has ‘just rted steel shafts for golf : marked. witiy the country ruled that all im- clubs shall of origin. the |GROWTH OF BRANCH BANKING IS NOTED Association at Cleveland Finally Gives Approval to New Method. BY PRESTON S. KRECKER. Specicl Dispatch to The Star. NEW YORK, October 4.—Sentiment of bankers, long opposed to branch way, as proved by the adoption by the American Bankers' Association this week of a resolution favoring the crea- tion of branch systems. The associa- tion, while adhering to the view that unit banking has its place in the com- munity, at last recognizes the economic benefits of the branch system. There is no doubt that the series of catastrophic failures of small unit banks throughout the West, Northwest and South in the last few years was largely responsible for this change of heart. Many reasons have been &d- vanced for those failures, which cost the public hundreds of millions of dol- lars’ loss in rural communities, but it is realized more and more that at the bottom of the trouble was the fact that country banks made bad loans to farm- ers with the money of farmers, with the result that entire communities suf- fered almost irreparable damage. Had the business of the country banks been diversified and had there been at their disposal resources of a strong mother institution, the financial de- bacle would not have occurred. Busi- ness men are beginning to realize that such diversification would have been | provided by a branch system: and that combined resources of the branch banks would have saved individual members of the system which had be- come embarrassed. Too Many Small Banks. One of the defects of our present banking system is that during periods of prosperity too many small banks are created, often by men of limited bank- ing experience. Banking resources are spread out thinly instead of being con- centrated. What is more unfortunate is that inept management is apt to cp- erate such banks. All may go well until a time of stress comes, but then the weak and poorly managed institu- tions go to the wall. The country has State and Federal bank supervision, but_experience has proved that neither suffices to prevent disastrous bank fail- ures. The advantage of combining numer- our small unit banks into branches of a soundly managed large institution are quite obvious, The branch system thus created has the benefit of the com- bined resources of all the member branches of the system, as well as of the broader vision and experience of the central management. Such a com- bination makes for stability, which, of course, is the end desired. It has been objected that branci banks in small rural communities, operated by ysome large institution re- moved some distance from the seat of the small bank, cannot serve the needs of the small community because of lack of understanding and sympathy. That objection could be overcome by creation of local advisory boards which under- stand the needs of the small town and the rural community surrounding it. Probably the largest branch banik sys- tem in the country is operated in Cali- fornia by the Gianinni interests. The practice of those bankers, when they absorb local banks into their system, ic to place local men in charge of the branch and create local advisory boards of directors, who actually represent community business. The plan is said to work perfectly, giving each com- munity the benefits of a strong banking organization but without the disad- vantages of absentee ownership. Unit Bank Dominates. While branch banking has been mak- ing notable progress in the last decade the unit bank still dominates the bank- ing business of the country. The latést authoritative statistics available show that approximately 21824 banks, or about three-fourths of the entire num- ber in the country, are operated as units, independently of chains, grouys and branch systems. Groups and chains embrace 2,103 banks, while 822 large banks operate 3,547 branches. (Copyright, 1930.) NEW YORK COTTON NEW YORK., October 4 (Special).— as was the case yesterday, hedging op- erations influenced cotton prices today, and a decline of about 15 points oc- curred. December new ended around 10.42, the same level prevailing at the close & week ago. After the market had held compara- tively steady the first hour, weakness in the stock market and selling for spotinterests brought lowest prices of the day in closing dealings. Spots were | reduced 15 points to 10.35. Cotton range: Open. { i i } October, | October, | December, i December. ne January, old High. Low. Close old EEEEE I 19 21 14 2 0 50 40 05 CHICAGO, October 4 (Special).— The wheat market was firm today un- der buying influenced by strength _in Liverpool, but profit-taking sales caused some reaction. December opened 83% to 831; March, 88 to 87%; May, 91 to 90%. After the first half hour December, 83%;; March, 87%; May, 90%. ., Corn followed the action of wheat. December opened 86 to 85%; March, 87Y; to 87%: May, 89 to 89';. After the first half , hour, December 85%; March, 867;; May, 88',. Oats had an easier tone. December opened, 40 to 40ls; March, 42%: May, 4317 10 43%. After the first half hour December, 40%; March, 42%; May, 43%. Provisions were higher. African Cotton Increases. DAKAR, French West Africa (/) To encourage cotton growing in th colony, the government has exempt all dealings in raw cotton from business turnover tax. Exports of cot- ton now amount to 5000 tons annu- ally. First Mortgage Loan In Arlington County and Alexandria, Virginia Commonwealth Investment Co., Inc. 800 15th St. N.W. Phone National 2623 Mortgage Loan Correspondent for The "rudenlial Insurance Co. of America Money on Hand to Loan on First Deed of Trust 6% Interest truaubh'(:o-nl-lo‘: and Applications JAMES F. SHEA 643 Louisiana Ave. N.W. banking, is swinging around the other |, I STOC! Today...... Low, 1930 High, 1929 Low, 1929 Previous day..... Week ago. Month ago. Year ago....... Two yeats ago. Three years ago, weekly aver High, 1930 Low, 1930 High, 1929 Low, 1929 90.4 BUSINESS TRENDS | VIEWED BY GROUPS Outlook in Important Lines| Shows Varied Prospects in Fourth Quarter. Current indications of the trend in various divisions of industry and trade are summarized by the Standard Statis- tics Co., from its first of October resume of the outlook for important lines, as| follows: Agriculture machinery—Manufactur- ers, detrimentally affected by continued unsettlement in the agricultural com- modity price situation, are facing an un- favorable final quarter. | Alrcraft—The industry will have to| { e reorganized and narrowed down to a | few cutstanding strong companies before any satisfactory headway will be in prospect. Apparel—1930 earnings of practically | all companies in the group will be much | below those of last year. Automobiles—It is now fairly certain | that any material increase in retail de- | mand for motor cars is improbable be- fore next Spring at the earliest. ! Automobile parts—Unfavorable sales | prospeats for the final quarter point to | but small improvement in earnings. | Automebile tires—Consumption ~ de- | mand for the balance of the year does ' not proimise to be any better than m the | | 1929 Fal' period of drastic decline. ’ Building—There is nothing to indicate | material near term improvement in resi- dential building or in any other major divisin of the industry. i Chemicals—Profits for the full 1930 | year will probably decline from 15 per | cent to 20 per cent under those of the | preceding year. | Coal—Earnings of bituminous pro- ducers for the balance of the 1930 vear, | will leave much to be desired. | Copper—Purchases to cover imme- | | diate niceds only, should be made new. | | Cotton goods—There is little prospect | of higher profit margins until excess | productive equipment has been drasti- | cally adjusted to the normal needs of | | the market. | | Electrical equipment—Earnings of rep- | resentative units for the second half | probably will fall slightly below first- | half results. Better Wheat Prices Seen. Farm preducts—Wheat prices should | display more resistance to weakening | influences. Although corn prices are | unlikely to rally materially during the early future, present values should be largely maintained. | Fertilizer:—Prospects are not favora- | e for the full year's volume to equal that of the past’ year. Focd products (other than meat)— Considered as a group, the food indus- try is one of the few to promise larger | profits this year than last. | Household products—Only a few pro- | ducers are registering profits expansion: | Lead—Earnings of | will be decidedly lower in the full year 11930 then in the preceding period. Leather—It is possible that a few shoe manufacturers distributing popu- larly priced merchandise may make relatively satisfactory showings. Genuine sustained real improvement in trade | will be deferred until next Spring, at | least. | Meat packing—Present indications | point to the probability that the Big | Four will enjoy fairly satisfactory re- sults. Office equipment—Profits for most manufacturers will be restricted during the ne:w future and sustained improve- ment_in returns is unlikely until well | into 1931 Paper—Earnings of the leading com- panies this year, under lowered volume, probably will approximate the disap- pointing showings of 1929 Petroleum—The _statistical position of the industry continues the gradual improvement witnessed during the past several months. Radio—Earnings as a whole should show some betterment during the cur- rent half over results experienced dur ing the earlier months of the year. _ Railroads—The persistent reduction in transportation costs and mainte- | nance outlay will be more in evidence | in the remaining months of 1930 and | provide a firm foundation, although at | a greatly reduced level, for distributions to security holders of interest and divi- | dends, | Railroad equipment—Full year earn- | ings will be smaller than those of last | year. ¥ Rayon—Returns for the full 1930 year | in most cases will fall considerably un- | der those of 1929. i | Retail Sales Gains Likely. Retail trade—Further increases in | les'may be seasonably expected as the | scason progresses, but currently re- | consumer purchasing power will | not likely allow greater than seasonal E | | | b he _continued increa: ‘ MONEY AVAILABLE for Purchasz of Notes Desirabl; Secured 2_nd 'i"rusf Improved Real in the District of Colum- bia and Nearby Mary- land and Virginia. PROMPT SERVICE NATL. MORT. & INV. CORP. 1004 Vt. Ave. Nat. 5833 FINANCIAL STOCK AND BOND AVERAGES SATURDAY, OCTOBER 4. By the Associated Press. 20 920 Utilities, Tol 10 Utilities, 100.7 100.8 1008 (Copyright, 1930, Standard Statisties Co.) visible supplies nullifies all hope of ma- terial market improvement in the near term. Shipping—More favorably situated yards are assured of satisfactory profits for the next three years or so. Zarni most silk goods companies for the full year.will w doubtedly be far below those of 1929, Steel—Moderate further enlargemen of output may take place during early succeeding weeks. Sugar—Earnings of producers and refiners alike during the next few months will leave much to be dssired. Theaters—It is expected that the final quarter of 1930 will make a show- ing fairly comparable with results re- ported for the quarter of.1929. Full vear husiness of some leading manu- | facturers should approximate that of a ar ago, Toba ‘The present year will prob- ably witness the largest profits ever enjoyed by the cigarette industry. Sharply smaller 1930 earnings are ex- pected for the cigar division, Utilities—The electric and gas busi- ness has stood up under the adverse cir- cumstances of the past 10 or 12 months far better than other major industries and the chances are still good that the companies in the aggregate will reveal no serious declines in income as a re- sult of 1930 operations. Final results for telephone companies for the year may be only slightly above 1929, CHICAGO STOCK MARKET By the Associated Press. CHICAGO, October 4.—Following 1is| 1 the complete official list of !ransactmnsy in stocks on the Chicago Stock Ex- change today: Sales 50 Acme_Steel 25 Pamer Co Po 50 Art Metal High. Low. Close. 493, 4974 49 acky 200 Bastian-Bless: 1550 Be 6 62, 4942 28 ; lead companies | 88 1150 Midland ‘2 490 Midland a4 50 Midland 112 50 801 4% 20 e Public Serv 230 QRS M Co oard Ui olo Po per-Maid 50 Swift & Co 50 Switt T Feit 100 Vortex Cup “A’ 50Wahl . 100 West “Con 50 Zenith Bond sales t 0 1 ¢ Uil dio. 2, 6s_'40. 2100 99i: 100 5000 Metro WSE Exi '4s''33 507 50% 50% Stock sales today—-71,200 shares. SAFBE FTRST . | the ‘basic str * A—-13 BUSINESS TRENDS HELD CONFLICTING | |Weekly Reviews Find Diffi- | culty in Estimating Sea- | sonal Gains. Special Dispatch to The Star. NEW YORK, October 4.—Conflicting trends in the various markets make |1t difficult to estimate business condi- tions in the past week, according to the reviews of the mercantile agencies. FCooler weather has increased buying, particularly at retail, but because of the Jewish holiday the net result of this is hard to gauge. The sharp down- tward trend of the stock market and some staples, followed by upward fluc- | tuations, are cited as incidents confus- ing the ituation with regard to sea- | sonal gains. Dun’s Review says, in part: | The final quarter of an unsettled |year begins with widespread and | vigorous commercial revival still de~ | ferred, although not without some in- | dications of nal gain. There is |now, as .might be expected after a rather protracted period of uncertainty, much sensitiveness to the conflicting forces in operation, and the extensive | scope and diversity of these factors ac- | centuate their influence, k Commodit, An equilibrium in commodity prices |is “vet to be reached, particularly in | the great agricultural staples; securi- |ties markets have continued to lack isldbllll}' and sentiment has remained confused. Those are among the ma- | jor elements acting as barriers to busf n progress, but they are familiar | phases in" times of readjustment. The point has been frequently stressed that economic recuperation was not likely to otherwise than slowly and un- , and the present absence of a broad ‘advance is not surprising. “More than the ordinary fluctuation in the me of trade appears in in- dividual lines from week to week, giving the composite situation a highly irregu= lar aspect, and there is no general ups ward trend in the various statistical barometers. There is, however, a nat- urally improved status in the retail fleld under the stimulus of Autumn re- quirements, and the increased activity in this channel has been aided recently by cold weather over a considerable area of the country. Conditions in ‘manufacture, as a whole, have not changed in marked de- gree, although buying for replenishment of stocks and some forward purchasing induced by attractive prices has raised the level of production in certain in- stances. In view of the unusual cir- cumstances which have prevailed for many months and which have been | practically world-wide, conservative | opinion does nct minimize the adjust- | Prices. ¢t: | ments yet to be completed, even while | recognizing the importance of the re. | sults already achieved in strengthening ucture of business. Ulti- ’mslcl,\" there will be a fuller response | to the better fundamental position and (it will be facilitated by the abundance |of funds available at exceptionally low | rates. Instead of the growing monetary | tension of a year ago, with abnormally in= flated loans on speculative account, the current trend is toward further ease in both respects. Bradstreet’s says, in part: Weathey Aids Sales. n the strictly constructive side of the account, the advent of much de- sired cooler weather over the greater part of thescountry acted to enlarge buying, both at rei | especially the for | conflicting counter-currents, making for activity or the reverse, render definite measurergent of the net resuits of the week rather difficult. Taken as a whole, it hardly measured Up to anticipations, based on the arrival of real shopping her, and September, as a whole, | while showing undoubted gains over the | Summer mopths of July and August, |left something to be desired in the way |of definite seasonal trade and indus- trial advancement. “The effect of the downward com- modity price movement for September ound registration in a new low level of Bradstreet’s Monthly Index Number, which rather tends to disprove the idea !advanced earlier in the Summer that ° the price decline, beginning in 1929, had definitely culminated. “Among the industries there were igns that the recently reported buy- ng of steel had lost some of its force h the building up of stocks of that metal, this being accompanied by weak~ of pig iron and scrap. In tals the shading of cop- per to 10 cents, the lowest price in 34 | years. was reported to have brought out a good deal of buying. “‘One ‘notable efTect of the recent de- cline in wheat was the sharply accel crated increase in buying of flour, the low price of the raw material being aid to have developed a good deal of in this directio In fact, the ur weeks was said to have set the 1 year definitely ahead of the like | period & year ago in the matter of out- put. OFFICES Hill Building 17th & I Streets Several single offices and suites available at most ‘rea- sonable rentals. Avply to Representative, Roome 300 Moore & Hill, Inc. 730 17th St. N.W. i 1 | | ADD INCOME TO SALARY You can do that easily through investr 6% —and ver @ Third money of a for y« Century Without a throug! with s May be purchased in amounts ment in our FIRST MORTGAGES while so invested your will be making money ou—a definite return hout the entire period— BN afely secured principal, from $250 up. National 2100 A e S AUL. oD 925 15th St. NNW.