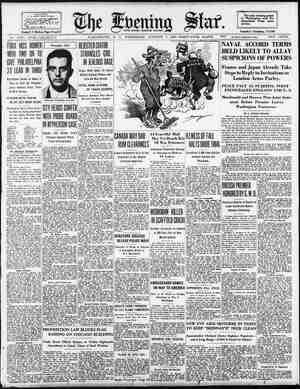

Evening Star Newspaper, October 9, 1929, Page 13

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

FINANCIAL. NEW YORK COTTON. First Mortgage Loans NEW YORK, October 9 (#).—The | Lowest Ratesof Interest and Commission cotton market opened steady at an ad- vance of 2 to 5 points on covering or | Thomas J. Fisher & Company, Inc. rebuying by some of yesterday's sellers | ————————————————————— who were probably influenced by the steady showing of Liverpool and pros- pects of showery weather. December contracts sold up to 18.54 at the start or about 14 points sbove the low level of yesterday, but the ad- 'vance met some Southern selling and some further liquidation which sent prices off a few points during the early trading. By the end of the first hall hour the market was about net un- FIRST TRUST NOTES sufels Sad"Seckity for our sevines: Call for particulars. Thos. E. Jarrell Co. Realtors 721 10h Street N.W. National 0765 Received by Private Wire Direct to The Star Office CIRBSHARESDROP INHEAVY SELLNG U*llities Are Under Pressure Alum Co Amer 55"’2? 100% 9 9 9 " H jed P & L o 4 24 4 Uni P 4 5 { and 0l Issues Show 1 o i h:;z:ee TN % ottt 1 NEW YORK CURB MARKE Triplex Safe Gl Ltd. Transit . l§ gm‘:m ‘Tobacco . h Penn Ol n! Sales in an penn o INDUSTRIALS. hundreds. High. Low, Noon. 3 Acetol Prod A .. 19 " 18% 19 29 Adams Exp n_wi 54 Sup Mf B 16 29% Reserve District No. 5. REPORT OF CONDITION Of the Northeast Savings Bank 7 ©Of Washington, D. C.. at the close of busi- ness on October 4, 1929. PROPERTY MANAGEMENT For nearly thirty years we have maintained a thor- 0. 1000 Vacuum Oli RESOURCES. . Loans and discounts $790,927.69 5 130227 1,000.00 " Strength. BY JOHN A. CRONE. 8pecial Dispatch to the Star. NEW YORK, October 9.—Reversing the upward trend of the preceding ses- slon, curb prices moved irregular lower today at the opening, rallied somewhat, then encountered further selling. Util- ities were subjectted to the most pres- sure. Petroleum shares furnished a contrast by their comparative strength. Mines and motors remained weak, while aviation shares, after opening higher, slipped and investment trusts eased ‘on renewed profit-taking. The }ughsr-prlced industrials were irregu- lar., 7 Amer Gas Amer Investors r Investors war & Trac Ol Group Strong. i B Citics Service common, duplicating its| 1 Boas Ak & B performance of the previous session, opened at a new high record price. Ac- quisition of Seven-Eleven Oil by Lion Oil attracted attention to the latter shares. This advance, however, was short lived. Gulf Oil again was sirong as a result of rumors connecting it with the plans of an oil investment trust. Standard Oil of Kentucky and Humble Oil were among the bright spots in the oil division. Humble brought in several important wells in the last few d: The rapid rise of Standard Oil | nsas was attributed to a pool. Star Gas was the weakest of the natural gas shares, most of which were inclined to heaviness. Opening at +64, Lone Star moved down to 58 In the first two hours, following the announcement that it proposed to sell $8,000,000 of preferred stock for ex- pansion purposes. Baltimore Markets Bpecial Dispatch to The Star. BALTIMORE, Md. October Potatoes, white, barrel, 150a4.00; 100 pounds, 2.50a2.80; sweet potatoes, bar- Tel, 75a3.00; beets, 100, 3.00a4.00; beans, bushel, 50a1.25; cabbage, hamper, 60a90; carrots, 100, 4.0025.00; celery, crate,’ 1.2582.25; corn, dozen, 10a2 eggplant, hamper, 20a40; _lettuce, bushel, ,75a1.25; lima beans, hamper, B 1.25a1.75; onions, 100 pounds, 1.75a2.10; Eas 3 & B Assil peppers, hamper, 20a30; peas, 4.2524.50" 8 squash, hamper, hamper, 25a60 30a85; apples, monw & S op 166 Comunercial Solv. 6 Cons Afrcrafs 3 Corroon & R 10 Grocker, Wheeler 5. 9 15a35; tomatoes, canners stock, bushel, bushel, 1.0022.00; can- taloupes, 5a1.75: grapes, basket, bushel, 1.25a 3.25; pears, bushel, 2.7524.00; quinces, bushel, 1.00a2.00. Dairy Market. Poultry, alive—Spring chickens, pound, 25a30; Leghorns, 24a25; old hens, 25a 19a21; old Toosters, 18a20; guinea fowls, each, 40a65; pigeons, pair, 2: Eggs—Receipts, 1,929 cases; native and nearby firsts, 45a46: current receipts, 39a40; hennery, whites, 52a53. Butter—Good to fancy creamer: pound, 42a48; ladles, 35a36: rolls, 31a3: P e butter, 40a41; store packed, 231, Live Stock Market. Cattle—Receipts, 75 head; light sup- ply; market dull. Steers, choice to prime, none; good to choice, none; medium to good, 11.25 to 12.25; fair to medium, 10.00 to 11.00; plain to fair, 9.00 to 10.00; common to plain, 7.50 to 9.00. Bulls, choice to prime, none; good to choice, none; medium ta good, 8.50 to 9.50; fair to _medium, 750, to 8.50; plain to fair, 6.50 to 7.50; common to plain, 6.00 to 6.50. Cows, choice to prime, none; good to_choice, 8.00 o 9.00; medium to good, 7.50 to 8.00; fair to_medium, 6.50 to 7.50; plain to fair, 5.50 to 6.50; common to plain, 4.50" to 5.50. Heifers, choice to prime, none; good to choice, none; medium to good, 9.00 to 9.50; fair to medium, 8.00 to 9.00; plain to fair, 7.00 to 8.00; com- mon to plain, 6.00a7.00. Fresh cows and springers, 60.00 to 150.00. Sheep and lambs—Receipts, 300 head; light suppl; market steady. Sheep, 2.00 to 6.00; lambs, 6.50 to 13.75. Hogs—Receipts, 100 head; light sup- ply: market steady. Lights, 10.80 to 3 11.05; heavies, 10.65 to 10.90: medium, 3 Living Alr Chute 10.90 to 11.10; .roughs, 7.55 to 9.25; ngm| I Rarstatlt B O pigs, 8.00 to 10.25; pigs, 10.60 to 10.80. Calves—Receipts, 50_head; light sup- ply; market steady. Calves, 7.00 to 16.50. Ten e n Pennroad Offers “Rights.” NEW_YORK, October 9.—The Penn- road Corporation, holding company affiliated with: the Pennsylvania Rail- road. proposes to raise $49,900,000 through the issmance of 3,025,000 ad- ditional common shares in the form of voting trust certificates at $16.50 each. Present certificte holders will be en- titled to purchased new ones in the ratio of one for each two held. The rights, on the basis of yesterday's clos- ing price of $24.50 for Pennroad stock, are worth in the aggregate about $15, 000,000. In announcing the offering, the company made known that it had purchased the Canton Co. a strategic plece of railroad property in Baltimore. 5 Marc Wire Lon 68 erlnoe Mm}: dp.ld wer 11 Memphis. Natl 1 Mesab] ron 6 Metal & Min i t 1Mid West Util 7 Missouri Kans Estimated Coal Output. NEW YORK, October 9 (#).—The weekly estimate of _bituminous coal production in the United States for the period ending October 5, is placed by the National Coal Association at 11,200,000 net tons, a decline of about 250,000 tons from the total for the preceding week: A w ud P B wa Niagara Shares 8 Niles Bem Pnd. . 2Noma Elec ........ 1Nor Amer Aviation.. Sta P A SHORT-TERM SECURITIES. (Reported by J. & W. Seligman & Co.) . of Canada 55 1957, California Pet. Corp, 5%s 1938. Glan’ Nat. Ry. 4lis 1930... 1Pick Barth 4 Pilot Radio 29 Pitney Bowes 1Pitts" & L E Del. & Hudso: Edison Elec. Il Bost. 43 Gen. Mot. Accep. Cofp. 65 1937. General Pet. Gofp, 58 1940 , 85 Phillips Petroleun - 5%s 19 % s 369 ] orp 5%8 Shell Union ON 65 1947, Binclair Crude OIl 5%s 163 Co SchutterJohns ‘G’ 12 Schulte Un 5c-31 FOREIGN EXCHANGE. d by W. B. Hibbs & Co.) (Quotatiens urnignes BY 1 ¥o1a Seliing chec value (or pan).” " tod London, pound. $4.806 e dsa3s 1931% Oslo, crown Stockholm, erown TREASURY CERTIFICATES. c. 15, 1 . ;; an 1844 e 10 9%, 4 319 Sales MINING STOCKS. in hundreds. 2 Carnegie Metals 1 Cons Cop Mines 12 Falcon Lead Min . hio Cop " 21 Roan Antelope Cop'.. hattuck Denn .. don Cop 1t 1% ) INDEFENDENT STOCKS. s, 62 3 Nat Fuel Gas. 38 36% foNew Mex At 'iad 4l 4 : Lo 2 8alt. Creek Pror 19% 13% 13% Sales in _ STANDARD OIL ISSUES AND units, FORMER SUBSIDIARIES—STOCKS. “ | comparativel 4 | that t G Pip 6 9 Ser Pow 5138 '62. G&E 55 A '58.. B Hr () 2 Det Intl 6%s, 7 Det Intl 78 2. 2 Georgla Pow 55 5 Gulf Oil Pen 5s *47.. 9914 1Gulf Sta Ut s A 58 023 H Wald Ast ww 7s '84 103 6s 37, 9915 31Ind Ofl & Gas 6 39 10514 2Indiana BAL 03 A 57 9614 50 Tllinois P L. 300%4 300% Imp O Can 1 s 36 ' 36 1300 Inter Pet Lt e 214 By the Associated Press. The year of 1929 should go down in history as a period of notable prosperity for American business, in the opinion of Secretary of Commerce Lamont. There is no obstacle on the business horizon which will disrupt the present high level of industry in the United States, according to the Commerce De- partment head, who has become recog- nized as one of the Government’s keen- est analysts of economic conditions, if not the most able in surveying as a whole the structure of business and in- dustry. Recognizing that there are at present certain indications of slacken- ing of business activity in several in- dustries, he expressed the opinion today that none of these signs was sufficient potency to upset the presperity level of the Nation. There is no mneed for alarm over slackening signs during this Fall in the belief of Mr. Lamont, who feels the recessions are merely that business is going through a “breathing” period after the tremendous and unprecedented activity of the past Summer. He cited that the steel mill opera- tions have diminished during the past month, but pointed out that the trend of building construction has been down- ward and the production of automobiles had slowed up. The latter two factors, he said, accounted in part of the steel decrease, adding that steel production during the Summer reached unusual high levels and now is receding to its normal stage of output. In regard to automobiles Mr. Lamont asserted that this industry’s production by the end of September had exceeded the entire output for last year so the present slackening would not destroy its record of prosperity for 1929. Bitu- minous coal production, too, according to reports reaching him, is likely to ex- ceed last year’s output by the end of 1929, but anthracite coal is behind 1928. The apparent certainty of a peak rec- ord for all time in raflroad freight movements, as forecast in reports of the American Railway Association, is view- ed by the secretary as one of the best indices of the year's “prosperity.” This .is a reflection, in his opinion, of the likely continuance of wholesale and re- tail trade activity at about the same “high speed” rate during the Fall as during the past Summer. Agriculture, Mr. Lamont says, also is in a firm posi- tion. Better prices making up for what- ever production deficiencies have oc- curred in certain crops. ‘While no public views on the outlook emanated from members of the Federal Reserve Board, it was pointed out that during recent weeks the seasonal in- crease in the demand for currency, a concommittant rise in the demand for reserve bank credit &nd a continued firmness of money rates were factors here in the credit situation. The troubles of the tight credit market are expected by_officials to unraveled through natural causes and factors of economic readjustment. These natural factors also undoubtedly will play a major role in the correction of the brokers loans problem. A new high record in the financing of government loans of Latin American nations in the United States was es- tablished last year, with a total of of- ferings of $344,508,000, an increase ol $13,000,000 over the 1927 financing. Experts of the Commerce Department reported that, in general, 1928 was a year of financial progress -for the Southern Hemisphere, despite the exist- ence of unfavorable economic condi- tions in certain nations. With but few exceptions, the revenues of Latin Amer- ican governments increased and at- tained record proportions in a great many instances, according to Eugene W. Chevraux of the department's finance and investment division. “Banking and currency systems of the Latin American nations, as a rule, were strengthened during 1928, Mr. Chevraux said. “Exchange rates were relatively stable, although in the lat- ter part of the year a declining tendency occurred in a number of South Ameri- can currencies, and this became more noticeable in 1929, with a rather se- vere decline occurring in Uruguayan exchange.” While a record was set during the year, the department’s advices said that at the end of 1928 there was an almost complete cessation of Latin American borrowings, due largely to the high money rates prevailing in the New York money market. Important developments in South American governmental finances dur- ing the year were listed in the Com- merce Department’s reports as follows: “Enactment of legislation by Bolivia providing for extensive changes in the country’s financial organization; the provisional stabilization of Peruvian ex- ; the successful maintenance for the second full year of the Brazlian stabilization p m; the continued increase in the fiotation of Colombian ental 1oans in the United States for the construction of transportation facilities and other public works; the arrangement effected by Cuba with American bankers for the financing of the public works program through the issuance of public works serial certi- ficates, and the negotiations between Mexico and the international bankers' committee looking forward to a new debt agreement.” ‘The United States is Procud.lnl to paint the world red, white, blue and other colors, according to statistics just issued by the chemical division of the bureau of foreign and domestic com- meérce on the exports of American paint products. The paint industry has one of the most startling rises of any enterprise in* \n_business his tory, more than tripling its output value in the past decade and taking the ex- 2 T 0o 63 44 23Ul P s 02 3 West Pow 5'zs A '57 160 FOREIGN BONDS. ands. uerios Alres 7148 47 101% 1Cauca valley 7548, 88, 88 c 2C &P 18 Free St Prus €: 2 Free St Prus 6lis 9 Ger Cons Mun 65 1 Hamburg E 75 '35 1Hamburg E 5155 2 Hano! 2 Ital 2 Ital erp sid. 1 Mansfeld M&S 7 1 Mor Bk Borota REGULAR. Pe- riod. Q N Pay- Hldrs. of record Oct. 18 Rate. able. 5 0 o Castle (A M tn States 0. ! Hunts Brs. Pack. A Knickerbocker Ins. 3 Lucky_ Tiger Comb, G M 2 55 Mengel Co pf T s = Do. pf. Ryerson (J T1 | Term El Pr 5% bf. Do. 67 pI. Do. 7% D o B D U S & British Inter, Ltd, $3 f.........75 Utah 'Radio_Prod. Westn Air_Expres: Zenith Radio. Castle (A M) & Co. { Knickerbocker Ins. N Y Fire Ins B 000D DOODOODODOOIHO0 OF DODODO OO Durant Motors of Calif. . Mengel Co. Thermoid Davega, Inc. grant (w ) co. % o Seleesas ort Ter BEOIAT: .. ov e 8ep. 30 Schlage Lock 1077 OMITTED, Houseman Spitzley.A..75¢ Q Due Oct. 1 Kern River Oil Fieid: of Calif, Ltd. Uited British. O Fields of Trini- dad, Ltd 71 West Am Fi *Payment “Due Gct. 15 PARIS BOURSE PRICES. PARIS, October 9 (#).—Prices were weak on the Bourse today. Three per |cent rentes, 79 francs 65 centimes. Five per cent loan, 105 francs 20 centimes. Exchange on London, 123 francs, 89%; centimes. The dollar was quoted at 25 francs 48 centimes. CHICAGO DAIRY MARKET. CHICAGO, October 9 (#)—Butter, steady; receipts, 6,209 tubs; creamery, extras, 44%; standards, 44%; extra firsts, 42 to 43; firsts, 39), to 4 seconds, 37 to 3812 Eggs, steady; ceipts, 5,847 cases; prices unchanged. Poultry—Alive, firm; receipts, 3 ca! fowls, 21 to 27; Springs, 22 to 2! ;| roosters, 19; turkeys, 20 to 30; ducks, 16 to 19; geese, 20. REAL ESTATE LOANS Made at Low Interest Rate: TYLER & RUTHERFORD ineldent to direct fevrescntation 1520 K St. N.W. National 0478 Buy Bonds at Present Prices for 6% Returnand Possibility of Profit Mom'fls of high money rater have forced bond prices to levels where it is now possible to select a well diversified list, on which the yield averages over 6%. Our current lists of bond and short term note investment sug: gestions include 90 issues on which the average return i over 6%. Send for copies THe EQUITABLE SECURITIES ! COMPANY NG kA v StawLy Canr, Representative ' changed to 3 pm?tts lower, with trading uiet. ‘The week] yqreport of the Weather Bureau read favorably as to Western conditions, bu tunfavorable as to the East and appeared to be without much effect on the immediate market. Liverpool cables reported continental and Bombay huylng‘ in the market there and said e cotton goods situation at Man- chester was unsettled with the decline in silver checking business with China. GRAIN MARKET. CHICAGO, October 9 (#).—Wheat rices scored an early advance today, gelped by material fresh upturns in quotations at Liverpool. Official an- nouncement that the Federal Farm Board might resort to purchase and withdrawal from commerce of consider- able tonnage of grain tended also to strengthen values. Opening 53 to 1% higher, Chicago wheat later held nL‘Bl" initial figures. Corn and oats were also firm, with corn starting Ysals to 4 up, but subsequently receding a little. Pro- visions tended downward. | Indications that continued active transatlantic demand for wheat from North America accompanied fresh up- | turns in Liverpool quotations did much | to encourage speculative buying at times today in the wheat market here. | Much attention also was given to word | that under ext:aordinary circumstances | the Federal Farm Board was prepared to purchase a large surplus of any agri- cultural commodity and carry the prod- uct until & more favorable opportunity of disposal was brought about. General trade comment here today on the announcement of the plans of the Federal Farm Board for emergency purchases of grain when necessary was to the effect that the market influence of this intention appeared to be dis- tinctly in favor of friends of hlxher‘ prices. On the consequent bulges in price, however, free selling to realize | profits was in evidence. On the other hand, foreigners were credited with having done a good deal of buying to- day of wheat future deliveries here, e e R ‘There are indications of great de- posits of oil in Argentina. ENTERPRISE SERIAL BUILDING ASSOCIATION 7th St. & La. Ave. N.W. 63rd Issue ot Stock Nov. Open for Subscription Shares of Stock, $1.00 Each Payable Monthly JamesE. Connelly James F. Shea President Secretary 809 15th St. N.W. Assets . . Overdrafts ... oughly equipped rental de- ot o partment and we actually retain some of the original accounts. Extracts from a letter of a property owner recently received—"“1 certainly do thank you for the excel- lent and prompt manner you manage my rent busi- ness, even in trifling de- tails, y o u r viligance, courtesy and sympathy are unparalleled, etc.” Try this service. Moore & Hill, Inc. (Since 1900) 730 17th Street N.W. HEALTH the Business Man's best investment. RASSAIDOR: W o W OE L HEALTH CLUB Descriptive Booklet on Request FOURTEENTH AND K STREETS AN For a Safe Investment REAL ESTATE NOTES Secured by High-Class Improved Properties Competent Appraisals 6% « Interest Consult JEAVER BRO REALTORS District 9486 Equitable Co-operat;ve Bldg. Ass'n JOHN JOY EDSON, President Organized 1879 ..$5,675,890.10 Subscription for the 97th Issue of Stock Being Received WALTER S. PRATT, Jr, Sec 49th YEAR COMPLETED Surplus & Profits. .....$1,695,894,08 SAVE AS - YOU EARN HE Equitable’s plan of sys- tematic savings encourages thrift in a manner that if con- sistently folloywed will even- tually lead to financial inde- pendence. Start now while you have a steady income. Come in and let us explain about our systematic plan. 915 F St. N.W. o INTEREST COMPOUNDED TWICE A YEAR AND FREE FROM ALL TAXES THE CHILDREN There is no such thing as chance success; the first step must_be in the direction of thrift. Start a thrift account for the kiddies and encourage them to add to it regularly and you will have instilled in them that Spirit of Thrift which will Tater in life lead them to success. THE ADULT The successful investors do not allow the pronyse of big speculative profits or exorbitant rates of interest to influence them; they seek absolute safety for their principal with a fair rate of interest, SECURITY All deposits with this Association are secured by first mort| s on improved real estate in this city and on the bqs‘ils of about $204.00 valuation for every $100.00 on deposit with us, Columbia Building Association 716 11th St. N.W. UNDER GOVERNMENT SUPERVISION. 120.000. Complete Investment g ST Service & ue_to bank: %3, Demand deposti 3. Time deposits . $100.000.00, 3550050 17,571.30 00,93 404.143.24 1,204,973 Total . . .$1,808,! GreLeT & Co. nated ‘batik. o solomply swear chat the B8ANKERS above statement is true to the best of m}'l knowledge and b!llsfll R. LEWIS, Cashi INVESTMENT BUILDING Ottt ¥ 1EW er. WASHINGTON, D.C. TF & S I TEWART, Telehone National 2460 iEQ. BISHOP. GEO. F. HOOVER. Subscribed and sworn to before me this 9th_day of October, 1929. (Seal)) C. D. RATCLIFFE, ary Public. For Bigger Business This Fall ‘When you go out for big business this Fal! be sure that your office can take care of it. Be sure that you are equipped with the newer, more modern type of office furniture. Furniture fashioned to facili tate modern methods of business. Furni- ture you are proud to have your clients see. Economical, solid, permanent, hand- some, serviceable furniture—the kind you observe impressively displayed in our spacious show rooms. THE W.D. CAMPBELL COMPANY == BUSINESS FURNITURE AND EQUIPMENT Decorators of Commercial Interiors 1018 15th Street 1506 L Street SHAYE'E EERGSTT MORTGAGES THERE’S NO ARGUMENT NEEDED TO CONVINCE It’s perfectly plain on their face that these 6% FIRST MORTGAGES Over a Third of a Century Without a Loss of ours are especially desirable for investment because the prin- cipal is amply secured by con- servative values; and the inter- est notably liberal where the protection is so secure. May be purchased in amounts from $250 up. B. F. SAUL CO. National 2100 925 15th St. N.W. THERE. IS NO SUBSTITUTE FOR SAFETY 120.245.00 174,685.63° r_of the sboves: Not (My commission expires July 23, 1931.7" STOCKS that land on a cushion EMPORARY breaks are merely the indenta- tions in the ever ascending curve of Amer- scan prosperity. When they come, individ- ual stocks, even those of the most successful companies, go down with the general list. But Incorporated Investors lands on a cushion of the “average of selective diversification.” The price decline of Incorporated Investors during general market recessions is retarded by the use of resources to take advantage of lowered or lowering prices and the rebound is accelerated. Remember, Incorporated Investors buys only CHOIG companies Who!e field! are 'he most prom- ising; whose surpluses are more than ample; whose directorates have again and again demon- strated their ability, and whose earning records are impressive. Last Friday, the low point in the current market break, liquidating value of Incorporated Investors (and therefore its price) was 25% higher than on January 2nd, this year. An investment in Incorporated Investors shares will give you a reward commensurate with the best profit attainments in American business. Quarterly Report Upon Request * k% INCORPORATED INVESTORS HOBSON & CO., INVESTMENT BLDG.