Casper Daily Tribune Newspaper, February 18, 1923, Page 21

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

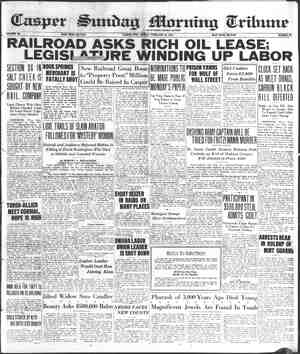

SUNDAY, FEBRUARY 18, 1923. WYOMING’S LEADING OIL LOWER TAXES NOT YET IN SIGHT THOUGH EXPENSES ARE REDUCED Roger W. Babson Analyses Situation at Washing- ton, for Busiriess Men and Investors—Figures for Past Year Prove Hopeful, Is His Testimony. WELLESLEY HILLS, Mass., Feb. 17.—“When will taxes be reduced?” _ The problem Is uppermost in the mind of the American business man and investor as he figures his report for 1922. To get the answer Roger W. Babson, statistician, has spent a week in Washington studying the tax situation. His first hand findings and unbiased report is of vital interest. “Future taxes.” says Ms Babson, depend, in part, upon future expen- ditures. The figures fer the past year on this score, at least. are very hopeful. Whatever criticism may be made of the present administration it must be admitted that it has ex- erted a continuous effort to reduce expenditures. An honest attempt is being made to introduce and operate a budget system. At the conference of bureau chiefs, held recently at the Continental Memorial Hall some 600 men met to affect further economy in the operation of the government business. “Fixed charges, interest rates, and previous obligations, of course, can- not be changed, and in spite of the splendid work done to cut down cur- rent expenditures the expenses of the government for 1922 reached a total of $3,795,302 80. Nearly one billion of this amount was paid out as interest on the public debta such as Liberty, bonds and other outstand- ing securities in the United States; $253,800,000 was used in pensions to soldiers, or their dependents of the war of 1812. Mexican war, Indian wars, civil war, and Spanish-Ameri- can war, while $450,000,000 was paid for compensations, care and training of veterans of the world war. Ap- proximately $455,000,000 went for the army, and $475.000.000 for the navy, About 50 per cent of our total expen- ditures go to the payment of interest, sinking funds, pensions and the re lief to veterans. “During the fiscal year of 1922, the xovernment collected $4,109,104). 150.94. Prosent prospects, however, indicate that no such amount will be collected in 1923. The excess prsofits tax has been removed and general business is not as prosperous , and therefore will not yleld as much in taxes as in previous years. To mect this situation, President Harding has earnestly requested that expenditures be. cut by $92,000,000 more. *if-we look at the United States government as we would a corpora- tion there is no cause for alarm. Ex- penses have increased, to be sure, but expenses have increased in all businesses. On January 1, 1923. we had in the Untted States, in gold $3,; 933,475,615, about 45 per cent of all the gold in the world. Of this, over three and one-quarter billion is held in the treasury, mostly in the form of bullion. If we look at the ledgers, we find that 3,600,000 taxpayers and 7°101,300 corporations contributed $2,- 068,128,192.68 in 1922. While only $356,443,387.18 was received from cus- toms and duties, “Further study indicates that the problem during the next few years is not one of trying to decrease the Present budget, but rather of trying to hold it where It is and keep it from geing much higher. "Unless a miracle happens, some sort of a bonus bill will be passed in 1924. If not passed with the pre: dent's consent it will be passed over his veto. This will call for a huge additional sum of money. Then there is @ tremendous road building pro- gram, the proposed nationalization of coal mines and the demands upon the treasury by the Farmer Bloc. “When I talked with financiers re- warding possible measures of taxation to meet these additional expendi- tures and proposed increase in our national budget, the suggestions are as follows: 1—A eales tax, 2.—A tax on light beer and wines.- 3.—Further customs and internal revenues. 4— Collecting from the Europe the 310,000,000,000 owed us, and 6.— ‘The restoration of the excess prot- its tax, “The keener stucents of taxes al- most universally recommend the sales tax, but politically there seems little chance of the new congress put- tng it through. A tax on light beers and wines at the present time is cer- tainly out of the questidn. Both cus- tom and internal revenue taxes are as high as the public can stand. Hence, by the process of elimination the political leaders strenuously re- fuse to cancel the European debt for fear of the re-enactment of the excess profits tax. “Their fear in this regard is well founded’ not from a. purely selfish point af view on the business man who must pay such a tax, but be- cause of its effect on the prosperity of the whole country. The re-enact: ment of such a tax would be a dis- Unct setback to every one, Natural resources, available labor, nor even capital, is sufficient to make @ coun: try prosperous. Russia is rich in natural resources. Africa abounds nm available labor, and in every coun: try where money is cheapest busi- ness is at its worst. Prosperity !s really the result of initiative cour age and hopefulness. These intan- gible but all-important forces are the result of encouraging business. We cannot get prosperity by putting a ball and chain cn the interpreter. “Inheritance taxes may be in- creased without affecting business. Congress can even increase the tax on incomes from stocks and bonds without hurting the farmer, but a re- enactment of the excess profits tax, which paralyzes efficiency, enterprise and the {nitlative would be Cistinctly narmful to all sections of the country and to farmers, businessmen, wage workers alike, “These igures on government re. celpts and expenditures have a direct relation to investors, They mean that the present demand for non-taxable bonds will continue. A good many People who have their money in tax able securities have ‘continued to hold theese securities and pay a tax on them with a sub-conscious hope that some time, some day, somehow, somewhere, their taxes would and re: duced. A statistical study of the situation leads one td believe that higher taxes are here to stay, and that it will be a real feat to keep them down to present figure. “An interest in tax-exempt securi- tles may also be increased by a con- stitutional amendment preventing the sale of any more ‘tax-exempt: A resolution to this effect is before congross at the present time. If it passed it will go before the states for ratification. It will be a long time, howeverg before such a bill will get the necessary two-thirds of the states to sign it, that it may be- come a constitutional amendment Even if enacted it, of course, could not be ertroactive, and cannot affect the tax-exempt securities already is sued. The very agitation may tend to bring out a rush of new issues which will have a depressing effect on the municipal bond market in spite of the strengthening tendency which many people expect. “All this means.” concluded Mr. Babson, “that the very large inves- turs will continue to hold tax-exempt Securities but there is no reason why the average investor should stam- pede to secure such issues. The bone crop is one crop that has never yet been known to fail. Many people be- eve that owing to the improved con ditions, money will be much higher and that all bonds will dectine in price during the next few months This may be true, but T seriously doubt it. Althouvh the Babson chart stands today at § per cent above nor- mal, which would ordinarily signify that we are entering another period of inflation, a statistical study strong ly stuggests that this present optim- istic figure is only temporary. The great readjustment which started over two years ago is only about 60 per cent complete. My prediction Is that bond prices in 1923 wil average about the same as the bond prices in 1922, and the ‘taxexempts’ will fol- low the genera] market. “It will be the safest for investors to count on present high taxes con- tinuing, even if congress has sense enough not td reenact an exce profits tax."" IARESULARITY IN STOCK MART Main Trend Upward During Short Session of New York Exchange. NEW YORK, Feb. 17.~An_irreg- ular trend was apparent in today’s brief but active session of the stock market caused by profit taking of speculators together, with a resump. tlon of pool operations in other quar- ters. California Petroleum, Pan. American and Baldwin were heavy at intervals, the last named sagging to 140% after creating a new high rec- ord for the year at 141. Steel and Tube preferred, Columbia Gas, Amer. jean Brake Shoe, Nash Motors, New Haven and American Linseed prefer- red, also were under pressure. Buying continued, however, in the coppers, foods, motor accessories, tobaccos and low priced olls, several of which made substantial gains and established new high prices for the year. The closing was irregula: Sales approximated 700,000 shar NEW YORK, Feb. 17.—Peak prices were made in the brief session today by Dupont and General Motors with Railway Steel Spring, Royal Dutch and American Beet Sugar heavy. United States Steel and Studebaker moved upward with a fractional loss in Baldwin. Kennecott reached 42 a new high for the year as a result of the interest dispiayed in coppers. Although the main tendency of the market was to higher ground, prices as a whole wero irregular. Realizing sales caused recessions of approximately a point in California Petroleum. United States Alcohol and Atlantic Gulf but the genera! list continued upward. Ba'dwin recovered its early loss and duplicated yester- day's high of 141%. Good buying power was noted in the merchandis- ing, motor, motor accessory and equipment groups, gains of a point or more being recorded by May Depart- ment Stores, Brown Shoe, Lima Loco. motive, New York Air Brake, Inapir- ation Copper, and Crucible Steel, Rails also were in better demand, Louisville and Nashville and Ann Arbor preferred gaining a point each and New York Central, Reading and Norfolk and Western recording large fractional gains Foreign exchanges [ §2.97% asked; May $2.11; July Casper Sunday Worning Cribune EDITED BY-L. C. BAILEY New York Stocks Oil Securities (By Wilson. Cranmer & Company) Allled Chemica! & Dye mde Allg Chalmers ._.. aaa WASHINGTON, Feb. 17.—Applica-|the best wild cat prospects being! American 46% PE cre OIL STOCKS tion of the Roxana Petroleum com-| drilled by the company. The Ohio ts | American ar 96 | pameemer 1 s21_ | pany, American subsidiary of the|rushing the work in Oregon Basin and American Car & Foundry _ 185 Dai indian 21 +23 | Royal Dutch Shell company, for otl|expects to complete the first well | American Hide & Leather pfa. 71 ston Wyoming --. 1.00 1,10 | development rights on-the locations|there by the middle of March. The | American International Corp _ 28B +18 | on reservations of the Creek Indians|}company ‘s also finishing another American Locomotive _. 128% +32. | in Oklahoma, will be heard by Secre-| well in Hidden Dome, C. M. Gingrich American Smelting & Refg. .- 64% 18 -20 | tary Fall on February 23. The hear-|coming here from Salt Creek his American Sugar --.-- Chappell --.. 43 -50 | ing next week, it {s said, is to be do-| week to have charge of operations. American Sumatra Tobacco =. . ae +18 | voted to oral argument covering the| A number of oll companies are American’ T, and. ‘onsolidated Royalty. 1.36 1.38 | question of the effect of the iaw upon| ready to start operations here as soon American Tobacco Cow Gulch -..... 0s 08 an American sitbsidiary and the ex-|as the weather will perm!t and more American Woolen 06 08 | tent to which Great Britain and the] wildcat drilling is promised the com. Anaconda. 104 :06 | Netherlands allow American of! com-| ‘ng summer than ever before in th Atchison 85 87 | panies the privilege’ of acquiring | section The wild cat people ire Atl, Gulf and West Indles -._. 5.00 6.50 | holding In their territories. watching both the Mercer and Netber Baldwin Locomotive 09 a ain, me wells and should either bring In Baltimore and Ohio - ee! = tos ot Business Slows Up Slightly Production it will open up thuosands | Bethi_.ehem Steel B Tatoe Crock ssaligc act : NEW YORK, Feb. 17.—Bradstreet's | Of ®cres of simlar lands for develop:| Canadian Pacific -.---- Tak ‘Royals pane says: “The most severe and widely |™°"* } Central Leather -.... ite Hoary Sat 2 | oxtended storm of the winter has had mie i ‘ Chandler Motors _—.. Mtsintain @ Gule 332. 1.a4 | 9 Fetarding effect on many lines of| _Cotton and Steel Business Big. Chesapeake and Ohio --. Red, Bank Sergtr) “3g | trade, tending epecially to reduce re-| Dun's Review says: “No month Chicago Mil and St. Paul — 28 | picdray Ps Jog. (| tail trade, and even measurably af-|¢ven in war times, saw as he Sot Chicago, R. I. Pac. ~ - 38% aay 3 ’ fected jobbing trade 7s own |ton spindles running as was the case Chino Copper - = 26 | ROSS: Producers. Jae 8 Totnevellth et Led ocr ee cone | this, January -and the steel industry Colorado Fuel and Iron 81 | rom Bell Royalty ‘01% og | Product receipts in the west and coal] 8" attained the highest rate of op Corn Products - Weatérn Exploration 2.75 2.85 |" raw material deliveries to Satur-| ‘ration possible under existing cir Ceuclbie Steel - ‘WyoKan.. 4 38 "30 | @ay have been checked, and carload. | CUMmstances rle ohana Ot = ‘75 | ings have fallen off. Collections have oe pee: are Lasky Western eased Lee ae slowed a trifle also. General Electric a2. bit ordhagg od Ml caniaea es ee ee ; k General Motors NEW YORK CUBR CLOSING “These more or less temporary tn- Livestoc Goodrich Co, ------- Motntale Producers .$ ioe 3 12.87 | cuences, however, have mot prevented Great Northern pfd. 17 = “go | % Sood volume of seasonal jobbing Ullnois Central —. - 112% egies ee oe 1.62 | trade, which has felt and still feels Chicago Prices Inspiration Copper - - 40 Salt pad ies cake fa the stimulating effects of numerous| CHICAGO, Feb. 17.—(U. 8. Depart: International Harvester - 96 ‘and Refrs. = 10.00 11.00 shows, conventions and expositions. | ment Agriculture. —Hogs receipts Int, Mer. Marine pfd. - ~ 43%] ee pained 500 600} The larger markets generally are] 10,000: market weak throughout International Paper - 53% | ited 1500 15,12 | Teported full of buyers who are oper-| closed 15 to 20¢ lower than Friday's Invinelble. Oil ---. - 17% Cities Beccles Com 188.00 190.00 | 2t!ns confidentially for nearby wants, | close: hulk 150 to 200 pound averages Kelly Springfield Tire -. ~ 84% | sland or “at's7 "95 | but conservatively as to the future,|3.15@8.40; bu'k to 300 pound Kennecott Copper --. ~ 48) New York Oli 15.00 owing to price uncertainties butchers 7.85@8.00; few. packing sows Loutsvitie and Nashville ~. 1000 [ee on 5126 61.63 | _Week'y bank clearings, $6,405.107,-| 6.75@7.25: pigs mostly 7.00@7.7.; est! Mexican Petro‘eum -. bet LIBERTY BONDS. 000.56 mated holdover 5,000; heavyweight saaie Stace On sine 3%s -- ae one hogs 7.75@8.0 medium 7 80@8.20 Midvale Steet . 30 | First 4s = Demand for Wool Irregular light -8.00@8.40; Mght light 7.75@ M 1 fic = 1s%] Second 4s BOSTON, Feb. 17.—The Commer.| 8.30; packing sows smooth 6.90@7.30 Miseours Facile » nx 7 ora | Firet 40 cial Bulletin says: packing sows rough 6.50@7.00; kill NOY. NH. anc Hartford 2a. 19% Second due “The demand for wool has been| ing pigs 7.00@8.00. Ne ee ~ a16 7 | Thine 4yere. rather irregular and on the whole} Cattle receipts 1,000; compared with By! a7 Gg | Fourth 4X8. hardly so heavy as a week ago.| week ago: beef steers and yearlings picbecpad lt ekee allege 2% | Victory 4%5 Prices, however, keep very firm as] mostly 15 to 26c lower; better grades Oklahoma Prod and Ref. - an 4%5 = ea they ought, in view of the fact that] matured steers showing most decline; Pacific Ol --. 2% this is still the cheapest market in the| quality largely medium to good; Pan American Petroleum --.- Gee world, Foreign wools have comprised| week's top matured steers 11.00; Pennsytvania oid the bulk of the business, although} weight 1,432 pounds; best yearlings People's’ Gas mart domestic territory and bright fieeces| 10.50 in load lots; few herd 11.25; re 15% been moved also at firm prices.| beef cows and heifers Iarsely 25 te Ray Consolidated 20% F Contracting in the west is still] 40c higher; canners, cutters and Reading - - rag evidently very desultory and at last | bologna butls largely 26c higher; veal Rep. Iron and os - fry week's high prices do not appear to| calves unevenly 50 to 1.00 higher, Royal Dutow N=: ase. have been topped. In fact. it would] medium light vealers showing most Src: con ot - 35% seem as if leas buying had been done | advancr:- better, Sraitee stnskers: § ne s - = Fe : this week than last. feeders steady; lover grades ° Southern ‘Pacific - - ae Weather Conditions in Wheat} ‘rhe goods market Is healthy, but| lower: week's bulk prices follow: beef veo elated ~ any Belt Handicap Bears on not especially active. ntears 8,009.60: siockers and feed aaa sion T ai9y Exchange. “Foreign wool markets are all firm] ors 6.50@7.75; fat she stock 4.850 Btudebaker Corporation . aise ee with some tendency to reaction from canners and cutters .3.15@4.25 wenneases’ ‘Copper 51% | CHICAGO, Feb. 17—With an ab-|the easier tone at the cose in Lon-| veal calves 11.75@13.00. epaey acd: Pasitie 25% | Bence of heavy selling coupled with| don last week. Sheep receipts 1,000; moatly direct Tobaseg’ Products a4 weather conditions in the winter _ohale is sather slow but firm tony Competed with sore Seo * = “4 while iM i d a) lambs strong Oo 2 ‘Transcontinental Ol 12% | Wheat belt prices today took a fresir le notls have nm in good demand Shelce” hagiawalents wool" aking. Up . 141 upturn especially during the early}and very strong.” f Union Pacific 78% | dealings. ni ail Stores United Ret Pipe Line Runs. 4 = 70%] Commission houses were the prin- Urd eacee enboae = go% | cipal buyers, The opening which} Pipe tine runs for the week ended United States Steel ---~ - 107%] ranged from % to %@%c_ higher.| February 10 showed a decided slump Utah Copper .-. 17 | with May $1.20% to $1.20% and July|from the figures for the previous Westinghouse Electric ---. 65 | $1.16% to $1.16, was followed by a}week. A loss of approximately 10,000 7% | slight reaction, but then the market 18% | rallied again. 33% | Subsequently, resumption of selling 84%] 0n the part of houses with eastern . 71%] Connections led to a temporary down- ~ 9% B] ward swing in prices. Demand broad- 3 ened on the decline, however, and the 84% | market recovered, bulls putting stress 16% | on the British debt settlement and on 65% | asserted cheapness of wheat com: barrels da!'y was manifested in the Salt Creek outnut and a smaller de- crease in most of the fields of this dis- trict. The lessening in output, how- ever, is on'y temporary. The following table shows the aver- age daily pipe I'ne runs from the fields of Wyoming and Montana for the weeks ending February 10 and February 3: Willys Overland --. American Zine, Lead and Sm. ~ Butte and Superior Cala Petroleum Montana Power Shattuack Arizona Great Northern Ore --. Chicago and Northwestern --. Maxwell Motors B - Consolidated Gas most higher; week's extreme top fat Inambs 1 to shippers; closing packer top 15.2 bulk @16.25; clipped kinds mostly 12 12.50; , BUSINESS AND FINANCIAL DEPART MARKET GOSSIP AND FIELD NEWS ; fed yearling wethers 25 to 50¢ fat she stock 15 to 25¢ up desirable fat wooled lambs 14.50 a week's fatl shorn up to 12.90; extreme top fed yearlings 13.75 to shippers; others mostly 12.60@13.25; choice fat ewes up to 8.40; bulk de. sirable Ight weights 7.2508. best feeding and shearing lambs 15.40 to yard traders. Omaha Quotations. OMAHA, Noeb., Feb. 17.—(United a aa 25% | pared with tne general commodity} Fields. Feb.10 Feb. 3/states Department of Agriculture.)— Amurjean: Taqseed (OH = SS lst. The close was unsettled, 34 net/Salt Creck - - 73.570 82,540 Hogs—Recelpts 15,500; mostly 15@20c lower to % advance, May 1.19% to|Big Muddy -.-.-.- 3.370 3.450 lower; packing grades $6.85@7; bulk were trregu‘ar, demand sterling bold. 1.20 and July 1.16% to 1.15%. Lance Creek annie 685 690] of sales $7.75@7.85: top $7.85. ng steady aroud $4 the year's! ‘Gorn and oats were firmer with| Pilot Butte 110 115] Cattle—Receipts 350; compared with best price and the French francs 4rop-| wicat after opening %c to %c ad-| Lander -~ 735 710) week ago, beef steers 15@25c lower ping five points to 5.95 cents. vance, May 46% to 46% and later held| Lost So'dier 1.520 4.750| she stock steady; spots strong: bull near to the initial range. Rock River ~ 4,780 4.225} 15@250 higher; veals steady; stockers 7 Speculative buying upheld the corn} Grass Creek 3.909 3,850] and feeders weak to 25c lower; steer narket when wheat displayed weak-| Hamilton Dome ~ 350 410]top $9.60; yearlings $9. veal top 0 i ness. Corn closed unsettled %@% to| Elk Basin 2.97 2.060] 811.50; stockers and feeders top $8.30 Foreign Exchange %@% net higher, with May 75% to|Greybull 205 195] Sheep—Receipts none; compared 15% @%. Osage .. ~. 750 with week ago, lambs and yearlings = T | Provisions showed a litte strength|Ferria -- —. 715 720 |15@25c highe: sheep steady: feedes 25c NEW FORE: ze. poate bye with grata, despite lowee huotations Cat Creek 6630 6,950|highe; tof yealings $12.75; wethes chaneee eat Britain demand 4.69%, (on hogs. Kevin Sunburst 1,090 860] 88 ewe top $7.50; feeding lambr Great Britain dem: etal Miscellaneous .. 425 400 | $14.25@15.15. 4.69%, 60 day bills on banks cand , cables | Wheat— Open High Low Close —_—_ Ages Preis rath, cables 4.79; | May - 0% 1.21% 1.10% 1,19%| Totals -. 101,850 114,710 Denver Prices. Belgium demand 5.28, cables 6.23%;| July - 64m 1.16% 1.15% 1.15% — DENVER, Colo., Feb. 17.—Cattle— Germany demand .0052%, cables |Sept. ---1.14% 1.14% 1.13% 1.1444 Much Drilling Predicted. Recetpts 270; market steady; | beef 0052%; Holland demand 39.52, cables | Corn— BASIN, Wyo., Feb. 17.—The Ohio] steers $7.00@8.50; cows and_helfers 29.85; Norway demand 18.63; Sweden | May --.- .75% .76 .75% | drilling at Mercer dome is now around | $3.50@7.50; calves $4.60@10.50; stock demand 26.63; Denmark demand 19.20; | July 178% 76% -76% | 1,800 feet and drilling in the hard Ton: ers and feeders $3.50@7.0. vvecrland demand 18.80; Spain de-|Sept. -.. .77% 7% -77% | sleep formation, which {s expected to] Hogs+-Receipts 92; market steady Swe es; Greece demand 1.18%;| Oate— continue hard drilling for another 100} top $8.00; bulk 87.85@8.00 mand demand 0022; Czecho-Slovakia | May F 46% 48 46%] {eet when better time is expected.| Sheep — Receipts 3,900: market hry) 286 teu! tne demand 37.26; | July ---- .45 dM AG 46 | ‘This well is expected in at around] steady; lambs $12.50@14.25: feede eit ? 98%. | Sent. --- 48% .43% 435% 434%] 2.500 feet, and is considered one of lambs $12.50@14.25; ewes $4.50@7.25. Brazil demand 11.62; Montreal 98%. {7 May ---- 11.32 1145 11.82 11.40 July ---- 11.50 11.60 11.50 11.55 . Ribs— Silver May 10.82 . ““! EUROPE RULE IN GRAIN MARKET NEW YORK, Feb. 17.—Foretgn bar Cash Grains. aor silver 63%; Mexican dollars 48%. penTRAe. ‘eb. 17.—Wheat—No. 2 rd $1.22%. ee, 7 Corn—No. 2 mixed 72%@73%c; No.|. CHICAGO, Feb. 17.—July and Sep-) cording to some authorities the ex LONDON, Feb. it-—Ber sfiver: 0 pone tember wheat advanced during the| isting further conditions of lee cov Money % per 11-16 pence per ounce. 2 Papal T4%e. ts—No. 2 white 46% @47%c; No.| week with extreme weather condl-|ering and previous insufficient mots cent. bate} 3 white 45% @46%c. tions furnishing a bullish factor on| ture tend decidedly to make the out of Rye—No. 2, : prices for the new crop. May wheat,! let Cublous Price of Texas Crude Up Barley—64 760. representing the supply on hand, took! Corn and oats rivaled wheat in at FORT WORTH, Texas, Feb. 17—] Tmothy seed—$5.90@6.50. a recession due to the heavy selling of | taining ne whigh price records for *he Mexia and Currie crude ofl prices} Clover seed—$13.5020.50. eastern owners who had bene holding| season, with demand active and offer: were advanced ten cents a barrel to-| pork—Nominnl. the supply in the hope that favorable| ings light, Subsequently, rains in day by the Texas company. The! gard—$i1.15. credit enactments would be made at | Argentina had a bearish effect on the price is now $2.20 for Mexia and $2.60) Ribs—$10.50@11.25. Washington. corn market for Currie. | —s———— Compared with a week ago,| Provisions were without notable Debt Bul Passes Senate. ‘The British debt funding bill, limit- ing ratification to British indebted- ness, passed the senate Saturday. a Steel Plants to Increase Capacity. It 1s announced that starting next week, the iron and steel mills in the Youngstown district will operate at Sugar | @%; oats %@% to 1% and provis fons down five to ten cents. Abrupt selling of May wheat in NEW YORK, Feb. 17. — Sugar | amounts that were estimated as to: closed firm; approximate sales 29,000 | tating millions af bushels gave the tons. There were no changes in re-| wheat market as a who'e a decided /fined but a good inquiry was reported | jolt on one occasion, but rallies fol-| with fine granulated Mated at $8.25@ | iowed when the selling of May was, 90 per cent of capacity. 8.30. - restricted later to an unimpressive Ser SRE | Volume. Bulls, especially in the May Car Shortage WIll Not Bo Investigated Celivery, continued to be handicapped An announcement from the White) however because of prolonged slow.) House atates that the president will Potatoes ness of export demand. not ask for a commission to invest!- | New high price records for the sea. gate the car shortage on raflroads, |son were reached by July and Sep —_—— CHICAGO, Feb. 17. — Potatoes) tember whi inasmuch aa both DULUTH, Minn., Feb, 11.—Flax) stronger; receipts 22 cars; total| would be directly affected by any seed close on track $3.00@3.0: $2.97%; February $3.00 bi arrive| United States shipments 354; Minne.) extensive injury to the new crop. Or. March | sota sacked Red river Ohfos 1.10 c~t;| dinartly, coid weather 1s of itself no 2.70. | Minnesota sacked russets 1.05 cwt. | creat danger to winter wheat, but ac-| try wheat this morntng ranged from 11 | *uPport aside from lard buying asso decline to 2%; corn was off % to 1|Ciated with tho cottonseed oll indus- SWAN UNDERREAMERS AT YOUR *- SUPPLY ‘STORE ORTH JAGE FIVE. MENT Duminion of Canada, 5% per cent notes 19: French Republic, 88 - French Republic, 7%s — Kingdom of Belgium, 74s — Kingodm of Belgium, 68 ~ Kingdom of Norway, 8s U K, of G. B. & I, 54s, 1929 _ U.K. of G. B. & 1, 5% American Sugar, 6s American Telephone an American Telephone and Telegraph Armour and Co.. 4448 ~ Baltimore and Ohio c Bethlehem el ret., Bethlehem Steel p.m. Canacian Pacific deb.. 6s Ohicago, Burlington & Qu Chicago, Milwaukee and St. Paul yoodyear Tire, 8s, 1931 _ odyear Tire, Ss, 1941 and Trunk Ry of Can.. 78 — and Trunk Ry. of Can., eat Northern 7s A Great Northern 5 13s B - 109% Mo. Kan. and Texas new, adj. 6s A — 10134 M'ssour! Pacific gen., 48 -~ 62% Montana Power, 6s A - 61% New York Central deb., 68 Northern Pacific pr. lien, 4s _ Oregon Short Line gtd., 5s ctfs — Oregon Short Line ref., Pacific Gas and Electric 58 — Penn. R. R. gen, 68 Penn. R. R. gen., 5s Reading gen., 48 - Sinclair Oil Go, 7%s ndard Oil of Cal, deb Union Pacific first S. Rubber, 74s S. Rubber, os tah Power and Ligh 109% Western Union, 64s 108% STOCK PRICES CLIMB HIGHER IN WEEK AS DEMAND INCREASES NEW YORK, Feb. 17.—New high} records for the year were made dur- ing the week with sales averaging | attention to that group. more than 1,250,000 shares daily, | , caused by renewed interest in public! buying and pool operations. higher prices for zinc again ing the sixth consecutive exes, commodity Prices, more|vania product, resulted in extensive ara Mend disbursements and | speculation in the oll shares, partic. publication of several unusually | ularly fornia Petroleum, Cced favorable earning statements furnish.| and n-Amertean tssues, With ed the impetus for the advance, for-| automobile production ands: ies olen rs cevelopments again being} mounting to new high records, the de- hag ota ie mand for gasoline this summer was nd ¢ was most oxnected to reac r - effective in the ofl, steel and copper | portion net tie ee eee aps, each of which were influen > © Public utilities stocks we ‘ . ; x , re taken ed by ‘Mgher commodity prices while| in hand upon publication of the pre. runar shares enjoyed a brief period| liminary 1922 report af the Nocen i strength in response to a sensa-) American company, which showed onal rise in raw sugar futures. Vir-[net income of $19.422.448 as neninat tually all the important steel atocks| $7,360,514 the preceding year. Sev ral Tet tears levels on reports | specialties also made excellent gains. that manufecturera bain paving} one of the features being American » ‘0 _obtain§ prompt! Can which showed a net gain of ap shipment. Copper shares also broke proximately through their previous tops when the ten points red metal was quoted at 15% cents a pound, the highest price since 1920, in reflection of the marked increase In the demand for that product. Oth- ages of 20 standard Standard Oil Stocks ——— EW YORK CURB. Ol] leases, reat estate, owners of Anglo 18 18% | Teapot townsite. — Kepresentatives: Buckeye ~. 90 92 wanted. Call or write us. Teapot Continental 47 4714 | Development Co., 218 Midwest Bldg., Cumberland 115 118 Casper, Wvo. 18-4tt Galena _ 6815 6914 - Ml. Pipe — 168 170 | We offer Original Wntryman's fut Ind. Pipe 96% 97%] Oneelghth royalty on six quarter Nat'l Transit _. 28% 29 «| Sections in sections 12, 13 and 24, N. ¥. Tranait 195 137.—-| 33-37 in the Big Muddy field. Biggest ‘orth. Pipe 108 119 | bargain in Casper today, Will sub- Ohio oll a say | aivide to sult. Teapot-Salt Creek 4 y 83% | acreage, also leases in Bly Creek and Prairie Oil 114% = 115% J other Wyoming and Montana fields. Solar Ry. ~ 183 18T Deal direct with Wyoming's largest Southern Pipe — 109 110 lease Cealing firm. Correspondence Ss. O, Ind 66% 66% | solicited. 0, S. Kane 47% 48 TEAPOT DEVELOPMENT CO., 0. 8. KY: 10713 108 Suite 218 Midwest Bldg, 8. O. Neb, 22 7 Casper, Wyoming 8. 0. N.Y. 46% © 46% Ady. S. 0. Ohio . 300 305 Vacuum - 48% 49 > S. Penn Ol 193 196 é WAN UNDERREAMERS Crude Market » Hamilton — -$1.65 Cat Creek - 2.15 Mulo Creek -. = 1.50 Re Ainimlib os Big Muddy — ~°1.68 ~ Salt Creek — 21.65 AT YOUR Rock Creek 1.15 SUPPLY: STORE Osago . 2.10 Lance Creek - 2.10 Grass Creek 2.10 Torchiight - 2.10 Elk Basin 2.10 Greybull 2.10 - Sunburs' ~ 1.30-1.50 Surveying aud Locations Geologists Oil Experts emer, || Oil Field Maps, Blue Prints C Z WYOMING MAP AND ‘otton BLUE PRINT CO, P. O. Box 325 Room 10, Daly Bldg. NE quiet; W YORK, Feb. middling 28.60 17.—Cotton spot NOTICE Chains are as strong as their weakest link. Are you the WEAK LINK? We must know to keep an unbroken chain. Payments on the Lost Soldier lease aiv due and payable. you desire to keep your place on this lease you must make a payment at ONCE or make satisfactory arrangements at the office. Failing to take care of your obligation on this lease your opportunity will have passed, and your place offered for sale to others. This lease joins large production you can share with It us for $110.00. Opportunity is offered you today that may never return. Wire, write or phone. JI will be in the office Office hours, 9 to 12 a. m. and 1 to 6 p. m. or by appointment Anna Bell Wyoming Oil Company W. E. PATTON, Pres. Room 220 Midwest Bldg. Phone 1956 er metal shares also were in demand, qrawing Higher prices for crude otl, includ- increase | this year in the price of the Pennsyl- on the week, crossing 99 for the first time. Aver railroad shares also established a new peak price but they lagged far behind the industriale Offerings of new comman stock by the Household Products company and Auto Knitter company, which were put out during the week were over bubseribed and the shares traded im at a premium on the curb market.