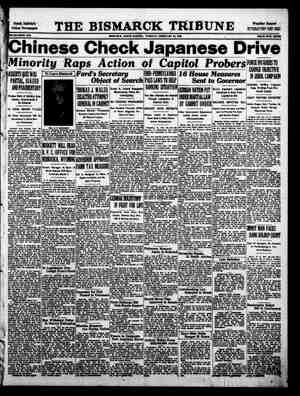

The Bismarck Tribune Newspaper, February 28, 1933, Page 3

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

qlty il! til lg ‘| rll Bs baat i Ui aay: ut ih il i HF gag itl | CAPIT OL al! Hl size of the regulatory department.” i Paid full amount of con- Makers Lose Bill &k> 3s aes State has for the inference” that close relation- tract interests of state. i 8 EE m7 H in Dally at 2:30-7-9 ADMISSION 25¢ Last Day Showing John Barrymore hart, which the line formerly handled now goes to trucks and busses, the ap- Plication said, - 13-mile years old lesday in the tery after funeral her home, where she Ye 11, will be buried Wedn He facts”) “There is absolutely no foundation ar present i] gs * Hi i oS i il minority fi 1 i to tiing of which have ered eon appear- Helena, Mont., Feb. as wate hi ge costs” have i ant Tot s Er THE BISMARCK TRIBUNE, TUESDAY, FEBRUARY 28, 1983 of Trying Senate By Wells County Senator Intended to Build Agricultural College on Ruins of s Battle signment of Courses Taught To Assist Schools'== { IN TAXES FROMN, P, Grand Forks Herald Accuses ‘Fargo Political Coterie’ to Wreck State University By Proposed Reas- ‘17S A CASE OF JITTERS’ 1S FORUM'S ANSWE port of Public ; E i Railroads Must Have Sup-| RECEIVES $70,707 BURLEIGH COUNTY ae aiad th ie ahh . HHH 1 Late it tey [2 ga i Grand Forks Institution Is Claim McCrary, tax com- railway company, irgest taxpayer” un- .71 from the North- ern Pacific Railway company in full ‘ payment of that firm’s 1932 taxes. firm “cannot maintain its Of this amount, $36,328.25 or 51.4 per cent will go toward maintenance Of schools while $6,229.58 will be used position as the la: for road purposes. In a statement issued at the time Jess it is accorded “equality of treat- ment and public support.” missioner for the check for $70,707. of payment, E. A. said his tpl «3 i plot lid 3s aint: sf z ah i Fy Says Support Necessary “Since a railway company which provides and maintains its own road- way is required to pay taxes for the acceptable bond| would have been 100 beyond |Oak Grove cemet ven | services from Details et to the state. T. Jahr the board “we do not believe that | died Sunda; Ronee no loss to trees a Sis A gy ig 2 it facts ital ab Hag! Es" e2 ail a8 8 ii baie if 4 pant the role he chose above in all others “Topaze” a rid te E BE ga | Hl Coming Laurel-Hardy Comedy Don’ stake the clean brightness of teeth on chance. Don's rely on guesswork in choosing your dentifrice, for teeth chance-taking is poor business in caring iking It’s the most amazing bright- ener of teeth you’ve ever found. Cleanses and doubly polishes. Does not scratch. Get some to- difference in results.‘Note the special introductory offer —to- day and observe the str: thoroughness, and (2) ‘k. Gives exact, advance SAFETY...NO SCRATCHING! Dr. West's new tooth paste ends leans: proofof the safety and thorough- ness with which it will brighten your teeth. A report of labora- tory tests comes with each tube —showing its (1) outstanding day, gt your favorite store. Don's . guessing games about your teeth, 4 TH v ap al Tn F ert ee inp sete hi Hit F: E : i A | Ess ae és i 2. id ti of motor , “it seems per= why these agencies should not be required to pay taxes for the sup- Port of the schoool and other ernmental activities.” support of public highways and roads that are used by its bus and truck competitors,” he said, tinent to inquire transportation evening, lems of state. To illustrate: Herald becomes some dark, Bove McCrary said he believes taxes now paid by his company are “ Fargo back cessive” in proportion to present val- ues and earnings. Agricultural of courses of study at/| less it is defeated in day, calling for elimination | very future of ity of North Dakota luplication the other of ai the North Dakota lege. And the Universit Purposes, times that addition to several amount for county and local subdivi- sion taxes. More than half a million dollars taxes will be due from railroads Wednesday as their share of the levy for state governmental in esa aebgs 32 gees ¥2 22 Ey in 8s rr UI H iy : 5 is Hath oS Ea 55e2 283 deus ej 1 ag? ad 8 2 4 g i a8 HE Blt Ha 1" Hl due aii 8 ailaaidedla! iu ie i BE HITE siees afi aa FE ig G $68,155. in $24,286 state tax, Morton county, railroads will state tax of $22,946, tax and oe 1, Burleigh county railroad In Cass county, the railroads ie state levy totals $15,547 pay state taxes of $44,313, while The state taxes on railroad erty in Ward county totals county tax, exclusive of local sul 2 for the county tax; division taxes within the county, valuation of $85,575,317, which is totals $100,694.28, of the assessed valuation. and the county ‘the county, county; 01: é uli ss Publication | ¢! the capitol but in other departments| guesswor! $s! aa ef 2S bass Bin sabes g ett ge a att: Begee ag fal itl eg geet: F is g a5 isl: ai 3s 8 Be. Rage 2 (By The Associated Press) SENATE o aaj’ Passed ie ir } 2 ee iE i te the if ih a a hs j disposi H. B. 17—Makes nepotism unla' Bias B. 34—Provides for oe estates of less i i & Ay ar Hii i ede i its ae ie tH qaaea 28 aplit ys a EEC ESS ual ante i reve ij! i Hilti ats ine spared 8 & : m 4 i aH if sete |i an i “s bat a i | bagel £8 i eli & i if i & i i cl a D. aad NTINUE from page one? co i aegis sae i d aE lasts Tena? of the: world, both here and overseas, You'll enjoy their mellow-mildness ...appreciate their character Ta every comer because'lt’s toasted” besediianssneaeetennatemnatitenaanandgptestanetinentheEensn. umes a i tee hie i ili Hic i ial L iin an ‘ie fl ie ie li i f pin ih tn Ea cr r F - i id lia ita fii te ot sue Lee coming » 1982, long ila HH | before ag coed: et tet as Tt i sles oe cme ee oe iif “itl i pile ihe if ie i its . He en a 8. B. 127—Clarifies law on building |». and loans relating to withdrawals. 6.8. 139—Provides any number of | ontion’ j i